Sometimes the early choices we make with money come back to bite us in the ass. Say you get a credit card at 18, and then don't pay your bills. This can damage your credit score early on, and make it difficult to get other loans later. And while you've learned the error of your ways, this small infraction can haunt you for a long time.

So, what happens if this is you and you need to get a student loan? Can you still get a student loan with bad credit?

Before you dive in, make sure you look at the best student loans to pay for college.

Let's explore your options!

Need-Based Federal Student Loans

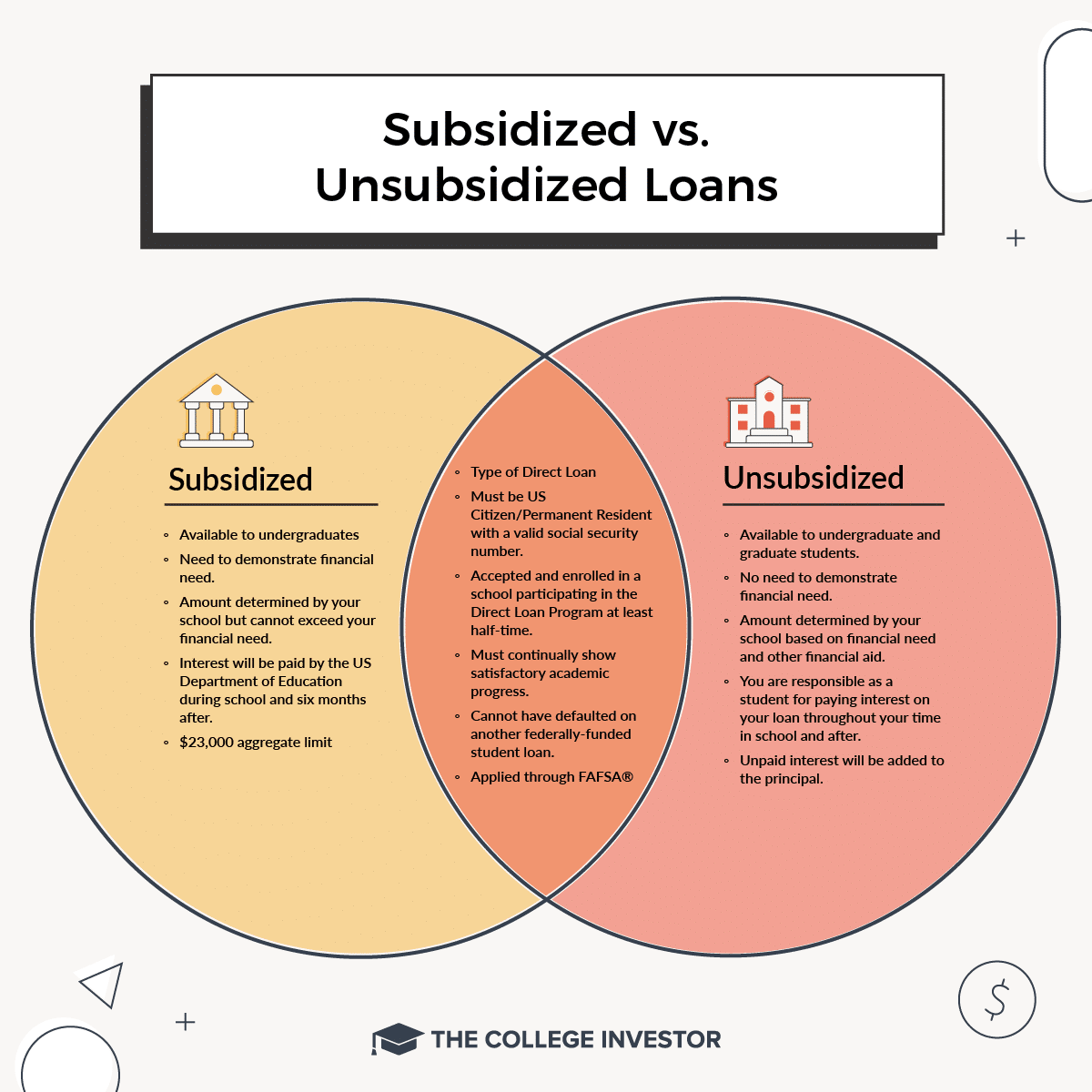

The best option for student loans, whether you have good credit or bad credit, are need-based Federal student loans. Need-based student loans are based on eligibility requirements that are calculated when you fill out the FAFSA. The FAFSA takes a lot of information from your taxes (and your parents' taxes), and it runs it through a formula that calculates what's known as your Expected Family Contribution (or basically how much you can theoretically afford to pay for college).

Once that's calculated, you can see if you're eligible for need-based student loans. Right now, that means getting a:

These loans are great for students with bad credit because your credit score isn't a factor that's used for calculating eligibility. So even if you have bad credit, you can possibly qualify for these types of loans.

Non-Need-Based Federal Student Loans

If you don't have a need based on the Expected Family Contribution equation, you may still be able to get Federal student loans that don't require a credit check.

You can get one of the following:

- Federal Direct Unsubsidized Loans

- Federal Grad PLUS Loans

These loans typically allow you to borrow higher amounts, and they also aren't based on your credit score. So, even if you have poor credit, you could still qualify for these. Your school's financial aid office can help with that.

Check out the best student loan rates here >>

Federal Loans That Do Require A Credit Check

The one notable exception to Federal loans are parent PLUS loans. We've talked in-depth before how we don't believe that parents should borrow money to pay for their children's education, but the fact is, many parents still do.

Parent PLUS loans don't rely on credit scores like traditional loans — and they don't base your qualifications on your credit score. However, in order to qualify for a parent PLUS loan, you must not have an adverse credit history. This means specifically you must not have:

- A current deliquincy

- More than $2,085 in default or charged off in the last two years

- Any default, bankruptcy, foreclosure, repossession, tax lien, wage garnishment, or write-off of Federal student loan debt in the past five years

Sometimes you can get around these requirements by filing an appeal (rare) or by getting a cosigner that has a positive credit history (more common).

However, remember, at the end of the day, we NEVER recommend that parents take out a loan to pay for their child's education.

Private Student Loans

Finally, there are private student loans. Most borrowers should avoid these loans, unless you have a very specific reason to take them out (such as medical school).

If you have bad credit, it can be tough to get a private student loan. Unlike Federal student loans, private student loans do look at your credit score. If your credit score is low, the bank may require you to have a cosigner for your student loans. You can see no-cosigner student loan options here.

If you don't have someone able to cosign for you, you probably won't be able to get a private student loan if you have bad credit.

Make sure you check out our list of the best in-school private student loans for more information.

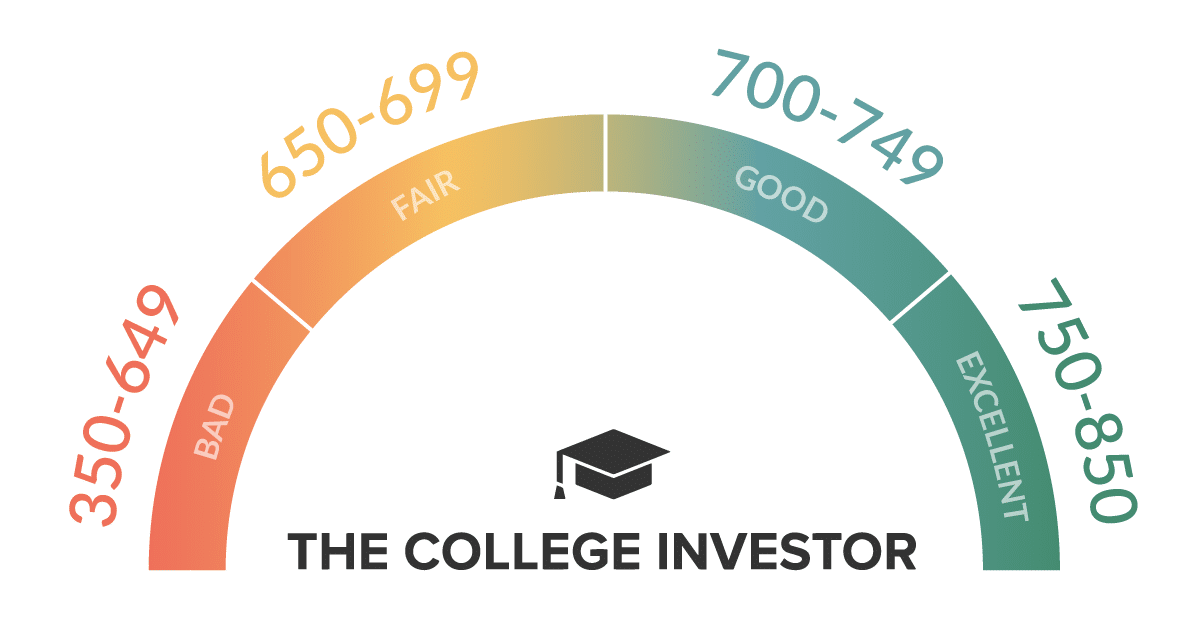

Know Your Credit Score

The key to all of this is to simply make sure that you know your credit score at all times. If you need to take out a loan, you should know what you may or may not qualify for based on your score. Plus, you definitely need to know your credit score if you're looking to take out other loans with poor credit.

That's why I recommend that everyone use a free service like Credit Karma to check your credit score. Credit Karma is truly free, and they don't require a credit card or anything to sign up. When you do sign up, you can view your score and other tools that will help you improve your score. You've probably seen their commercials on TV, and I use them myself.

What are your thoughts on getting a student loan with bad credit?

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller