Learn The Proven Strategies To Lower Your Monthly Student Loan Payments And Find Loan Forgiveness.

Getting out of student loan debt can be one of the hardest financial tasks of anyone's life. But what most people don't realize is that there are a lot of different options for getting out of student loan debt.

For most people, there are multiple different types of student loan repayment plans to choose from. Even with private student loans, some lenders now offer multiple repayment plan options. Then, there are student loan forgiveness programs: and there are hundreds across the country. There are also ways to get your student loans discharged in special circumstances.

Whether you have Federal loans, private loans, or both - we can help you learn the proven strategies to lower your monthly payments, find loan forgiveness programs, and build a plan that will allow you to get student loan debt free!

Enter your Name and Email Below To Learn More:

Student Loan Facts

Before we dive in to everything student loans, let's cover some basic facts about student loan debt in the United States:

- Average student loan debt: $39,351

- Median student loan debt: $19,281

- Average student loan monthly payment: $393

- Median monthly payment on student loan debt: $222

- Percentage of borrowers with growing loan balances: 47.5%

- Percentage of borrowers who are more than 90 days delinquent: 4.67%

- Average debt load for 2021 graduates: $30,600

Here are some useful links to find out who services your loan or can help you with your student loan debt:

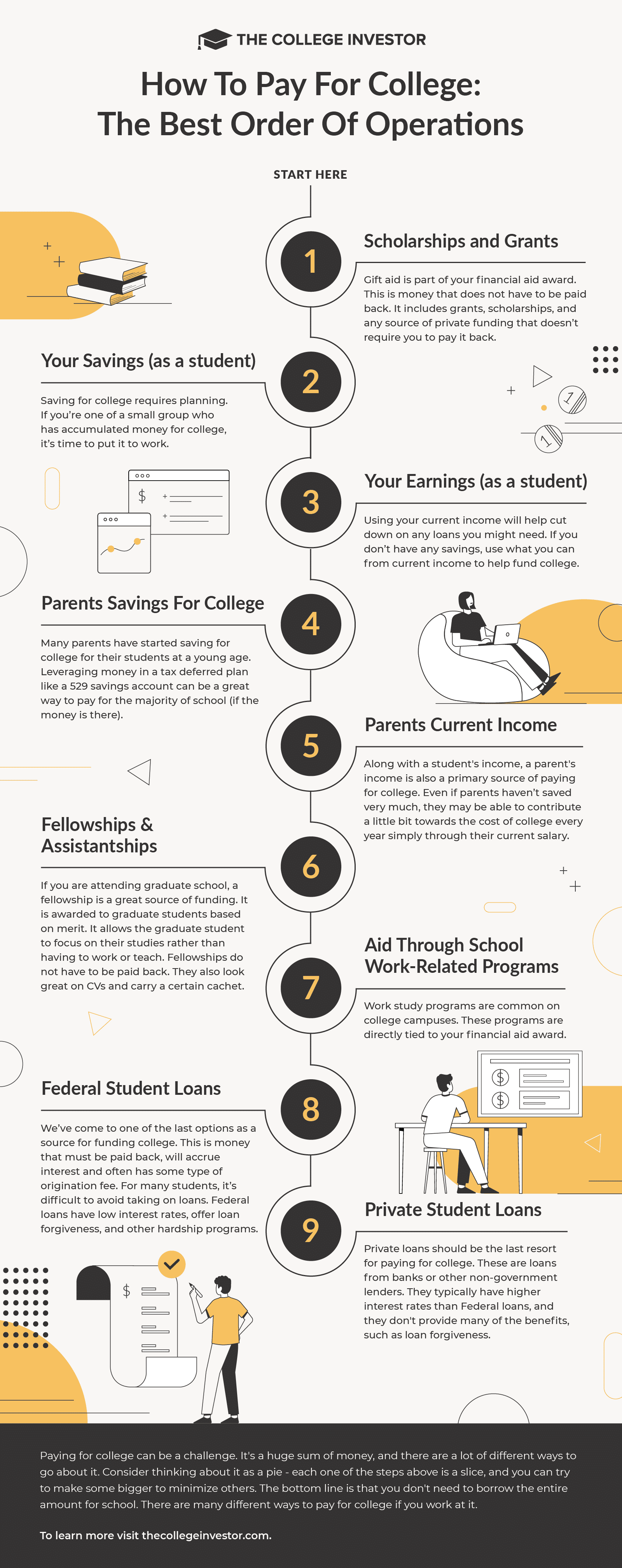

Paying For College

One of the best ways to lower that amount of student loan debt you are borrowing is to navigate paying for college effectively. Effectively paying for college means lowering the cost of attendance, maximizing your financial aid, and borrowing smart.

The simple truth is that college is an investment - one that costs both time and money. The goal of this investment is to earn more over your lifetime than if you didn't go to college. But what if you spend too much, and those future earnings don't outweigh the alternative? That's a problem.

Navigating Repayment

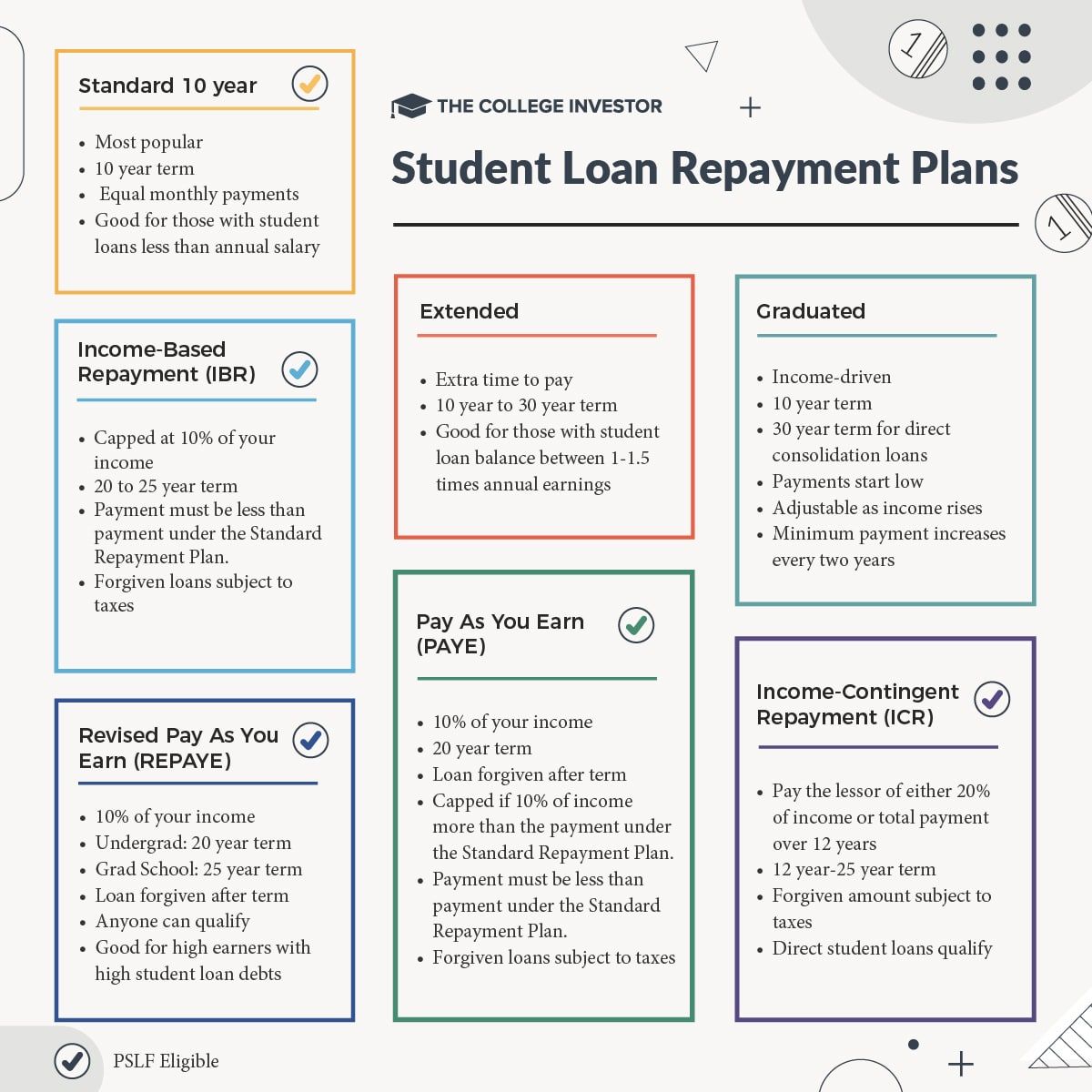

So you have student loans and you want to know what to do next? Let's talk about navigating repayment. This means finding the optimal repayment plan based on both your income and your goals - like maximizing student loan forgiveness or paying them off as quickly as possible.

For most borrowers, an income-driven repayment plan will be the best option.

To start repayment, you should assess your situation to decide if you're going to go for the lowest student loan payment possible (in order to maximize loan forgiveness), or to try any pay off your loans as quickly as possible. A good rule of thumb is this:

- If you're eligible for a broad student loan forgiveness program like Public Service Loan Forgiveness, you should get your payment as low as possible to maximize your loan forgiveness.

- If you owe more in student loan debt than your salary, you likely want to have the lowest payment in order to maximize your future loan forgiveness.

- If you owe more in student loans than your salary, you likely want to maximize debt repayment if you don't qualify for loan forgiveness.

Student Loan Forgiveness

We estimate that roughly 50% of all student loan borrowers qualify for some type of student loan forgiveness program - whether total or partial. Almost every student loan forgiveness program is based on your repayment plan type or employment. However, there are a few state-based programs that provide loan forgiveness for completing a qualifying activity (like buying a house in the state or moving to a certain area).

However, navigating the various student loan forgiveness programs can be tough. The most popular program, Public Service Loan Forgiveness (or PSLF), requires you to meet 3 criteria for 10 years. It can be tough.

Here's some of our most popular guides to student loan forgiveness.

September 24, 2023

Student Loan Forgiveness Programs by StateDid you know that most states have their own “special” student loan forgiveness programs? Forty-seven states, the District of Columbia, and Puerto Rico all have special student loan forgiveness programs for residents of their states. These plans are different than the federal programs you’ve probably heard of – like Public Service

Student Loan Refinancing

Student loan refinancing can make sense in certain circumstances. It's important to understand what student loan refinancing is (especially compared to student loan consolidation). Student loan refinancing is the process of getting a new private loan to replace your existing loans (either Federal or private). Student loan consolidation is the process of getting a new Federal loan to replace your existing Federal loans (and it's free).

It can make sense to refinance your student loans if you already have private loans and can save on interest. It can also make sense if you're going to pay off your Federal loans in less than 3 years and don't qualify for any types of loan forgiveness (which is also why many doctors benefit from refinancing their student loans).

Here are some of our guides to student loan refinancing:

Read More Student Loan Content

We have hundreds of articles related to student loans. Check out our full student loan archive here:

Page [tcb_pagination_current_page] of [tcb_pagination_total_pages]

Student Loan Terms And Definitions

Learn more about what these student loan terms mean, from A to Z:

A

B

C

- Capitalization

- Cohort Default Rate

- Collateral

- Collections

- Collection Agency

- Consolidation

- Cost of Attendance

- Cosigner

- Credit Bureau

- Credit History

- Credit Report

- Credit Risk

- Credit Score

D

- Debt-to-Income Ratio

- Default

- Default Rate

- Delinquency

- Deferment

- Direct Loans

- Disbursement

- Double Consolidation

E

F

- FAFSA (Free Application for Federal Student Aid)

- Federal Family Education Loan Program (FFELP)

- Federal Reserve

- Federal Student Aid

- FICO Score

- Financial Aid

- Financial Counselor

- Financial Hardship

- Financial Literacy

- Fixed Interest Rate

- Fixed Rate Loan

- For-Profit College

- Forbearance

G

- Garnishment

- Grace Period

- Graduated Repayment

- Grant

- Guarantor

I

- Income Contingent Repayment (ICR)

- Income Share Agreement

- Income-Driven Repayment Plan

- Income-Sensitive Repayment (ISR)

- Income-Based Repayment (IBR)

- Interest Capitalization

- Interest Rate

L

- Lender

- Lifetime Learning Credit

- Loan Agreement

- Loan Balance

- Loan Forgiveness

- Loan Origination

- Loan Portfolio

- Loan Provision

- Loan Rehabilitation

- Loan Servicer

- Loan Terms

M

- Master Promissory Note

- Monthly Payment

N

- National Student Loan Data System (NSLDS)

- Net Price Calculator

- Non-Performing Loan (NPL)

- Non-Profit Lender

O

- Ombudsman

- Origination Fee

- Overpayment

P

- Parent PLUS Loan

- PAYE (Pay As You Earn)

- Pell Grant

- Perkins Loans

- Predatory Lending

- Prepayment

- Primary Borrower

- Principal

- Private Lender

- Public Service Loan Forgiveness (PSLF)

Q

- Qualifying Payments

R

- Refinancing

- Repayment Plan

- Repayment Schedule

- Repayment Terms

S

- Sallie Mae

- Scholarship

- Securitization

- Simple Interest

- Stafford Loans

- Standard Repayment Plan

- Saving on a Valuable Education (SAVE)

- Statute of Limitations

- StudentAid.gov

- Student Aid Index

- Student Aid Report

- Student Debt

- Student Debt Crisis

- Student Loan

- Student Loan Ombudsman

- Student Loan Trust

- Subsidized Loans

T

- Tax Deductible Interest

- Tax Offset

- Temporary Expanded Public Service Loan Forgiveness (TEPSLF)

- Title IV Loans

- Total and Permanent Disability Discharge

- Tuition Fees

U

- Unaccredited Institution

- Unsecured Loan

- Unsubsidized Loans

W

Editor: Clint Proctor Reviewed by: Chris Muller