Laurel Road is an industry leader in private student loan refinancing. It’s got some of the lowest interest rates, and more flexible terms than most private lenders.

That said, you'll need a great credit score and a great job to qualify to refinance with Laurel Road.

Laurel Road has been doing student loan refinancing for a long time, previously under the name DRB or Darian Rowayton Bank.

As a result, Laurel Road is named as one of our best student loan lenders to refinance with. Laurel Road also is one of the best student loan bonus offers we've found.

Will you qualify, and if you do should you refinance with Laurel Road? We explain the basics, so you can decide whether refinancing with Laurel Road makes sense for you.

Quick Summary

- Low student loan refinancing rates⁺

- Great loan options for Parent PLUS Loan borrowers

- High-balance student loan refinancing

- Get a $200 bonus when you refinance (You must apply through www.laurelroad.com/collegeinvestor to receive this bonus.)

Laurel Road Student Loan Refinancing Details | |

|---|---|

Product Name | Laurel Road Student Loan Refinancing |

Min Loan Amount | $5,000 |

Max Loan Amount | Total Loan Amount |

Variable Rate | 5.49% - 10.59% APR |

Fixed Rate | 5.44% - 10.39% APR |

Loan Terms | 5, 7, 10, 15, and 20 years |

Promotions | $200 Bonus |

Who Is Laurel Road?

Laurel Road is an online lending platform that has been originating and refinancing student loans since 2013. In 2019, KeyBank acquired Laurel Road which has allowed the lender to expand its reach and product selection. They also launched a suite of Laurel Road banking products.

Laurel Road is available in all 50 states. In addition to student loan refinancing, the company offers private student loans, mortgages, and personal loans. It also has recently begun offering banking products such as a savings account and a cashback credit card.

Laurel Road Student Loan Refinancing

Laurel Road consistently offers low interest rates, and flexible terms on its student loan refinances. One unique loan that it offers is a Parent PLUS refinancing option. Not only can parents refinance to a lower rate, they may be able to refinance the loan into their child’s name (provided you accept the loan and meet underwriting standards).

To me, it makes a ton of sense for adults with solid incomes to take over payments on Parent PLUS loans, and I love that Laurel Road makes that easy and legally binding.

IMPORTANT INFORMATION: Please note that if you refinance qualifying federal student loans with Laurel Road, you may no longer be eligible for certain federal benefits or programs and waive your right to future benefits or programs offered on those loans. Examples of benefits or programs you may not receive include, but are not limited to, Public Service Loan Forgiveness, Income-driven Repayment plans, forbearance, or loan forgiveness. Please carefully consider your options when refinancing federal student loans and consult StudentAid.gov for the most current information.

Rates And Terms

Laurel Road currently offers the following rates:

- Variable Rate: 5.49% - 10.59% APR

- Fixed Rate: 5.44% - 10.39% APR

Whether you’re refinancing a student loan or a parent plus loan, you’ll need to decide on a repayment term as well as whether you want a variable or fixed interest rate loan. Variable interest rate loans have interest rate maximums ranging from 9-10%.

You must refinance at least $5,000.

Residency Refinancing

In addition to standard refinancing, Laurel Road offers a Medical residency refinancing option. This allows medical residents to pay $100 per month towards their refinanced loans while they are in residency. If $100 doesn’t cover interest, additional interest will be added on following the end of residency. Once your residency is over, your repayment period begins, and ranges from 7 to 20 years. Rates on residency loans are below.

This is a great program, but Splash Financial currently has the best program for medical residency student loans at just $1 per month. Check out Splash Financial here.

Cosigners

Laurel Road does allow cosigners on its refinance loans. It also offers a cosigner release program for borrowers who took out their loans after September 12, 2017. But while some of its competitors will accept release requests after just 24 months, you'll need to make at least 36 consecutive on-time payments with Laurel Road before you can apply for a cosigner release.

Extra Perks

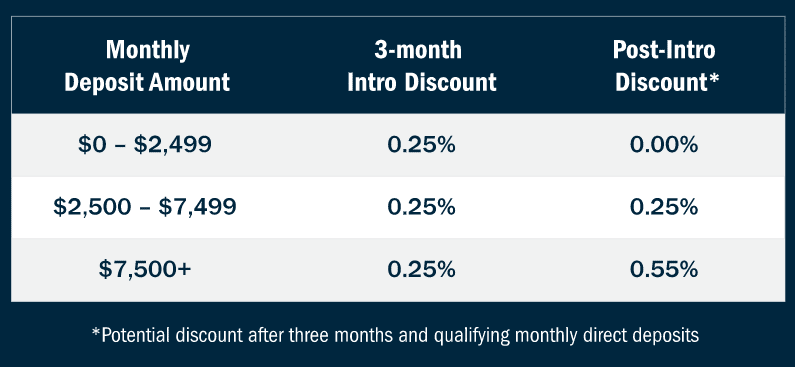

When you switch to Laurel Road Linked Checking during student loan refinancing⁺, you can start saving right away with an introductory 0.25% off your interest rate for the first three months. After that, your interest rate discount will vary based on your total monthly direct deposit amount⁺ – you could lower your student loan refinancing rate by up to 0.55%. Plus, you could get an additional 0.25% rate discount when you set up AutoPay⁺.

Laurel Road Student Loan Cashback® Card

Laurel Road also recently debuted their Student Loan Cashback® Card that pays 2% cashback when you use it make student loan payments and 1% back for everything else⁺. The 2% cashback offer isn't restricted to Laurel Road student loans either -- it says that cashback can be redeemed at 95% of U.S. servicers.

Student Loan Cashback℠ cardholders aren't changed any annual fees or foreign transaction fees. And the card comes with 0% APR for 12 months on purchases and balance transfers⁺.

Bonus Offer: As a new member, you can earn $300 in cashback rewards towards any eligible student loan after you spend $3,000 in the first 90 days with your Laurel Road Student Loan Cashback℠ card⁺.

How Does Laurel Road Compare?

Laurel Road is consistently rated as one of the best places to refinance a student loan. They offer incredibly low rates, and their loan maximum is one of the highest in the industry.

Check out how it compares to two other popular refinance lenders:

Header |  | ||

|---|---|---|---|

Rating | |||

Variable APR | 5.49% - 10.59%⁺ | 5.99% - 9.99% | 5.28% - 8.99% |

Fixed APR | 5.44% - 10.39%⁺ | 3.99% - 9.99% | 5.48% - 8.94% |

Bonus Offer | $200 | Up to $500 | Up to $1,100 |

Cell |

What Borrower Protections Are Available?

Like all private lenders, Laurel Road can't match the robust borrower protections offered by federal student loans. You can’t, for example, get on an income-driven repayment program. Plus, loans from Laurel Road will be ineligible for loan forgiveness programs (such as Public Service Loan Forgiveness).

That said, Laurel Road has an economic hardship option that allows borrowers to have a 3-month deferment (up to 12 months over the life of the loan). This makes it possible for borrowers to remain in good standing if their income takes a dive temporarily⁺.

Additionally, Laurel Road honors federal grace periods. This means that Laurel Road will give you up to six months before you have to make your first payment if you’re still in school or just graduated. This perk is contingent on having accepted an offer of full time employment.

Laurel Road also can forgive your loans if you die or become permanently disabled. This is not guaranteed, but it’s always good to do business with companies that understand that life happens.

Who Qualifies To Apply?

Laurel Road is targeting their refinancing services at students and parents with solid employment, decent incomes, and good to great credit.

While Laurel Road doesn’t specifically disclose its underwriting criteria, it does make a point to mention that to refinance you must be employed in a “professional capacity.” That may mean that entrepreneurs or self-employed people may not be able to qualify for refinancing.

In addition to meeting underwriting criteria, you must be a U.S. Citizen or a Permanent Resident to qualify for refinancing. You must also be a graduate or in your final term of education at a Title-IV accredited school.

Are There Any Fees?

Unlike other companies, Laurel Road doesn’t have much concerning fine print. It doesn’t charge application or origination fees and there are no prepayment penalties. It does, however, have a late fee which is 5% of the amount due of $28 (whichever is less).

Is It Safe And Secure?

Laurel Road uses the latest encryption technology to protect its user data. You can also adjust and limit how Laurel Road shares your information by calling the Privacy Line of its parent company, KeyBank, at 1-800-361-0968.

If you're only planning to apply for pursue student loan refinancing with Laurel Road, you won't need to worry about deposit insurance. But if you also choose to open a savings account, your cash will be protected by FDIC insurance up to $250,000.

How Do I Contact Laurel Road?

Laurel Road's student loan products are serviced by MOHELA. However, it does have its own in-house customer service team. You can get in contact with Laurel by phone at (855) 245-0989, email at help@laurelroad.com, or live chat. Their customer service hours are Mon–Friday, 8:00 AM–9:00 PM (EST).

Why Should You Trust Us

I am America’s Student Loan Debt Expert™ and have been actively writing about and covering student loans since 2009. Myself and the team here at The College Investor have been actively tracking student loan providers since 2015 and have reviewed, tested, and followed almost every provider and lender in the space.

Furthermore, our compliance team reviews the rates and terms on these listing every weekday to ensure they are accurate. That way you can be sure you're looking at an accurate and up-to-date rate when you're comparison shopping.

Who Is This For And Is It Worth It?

Laurel Road has outstanding rates, and its got excellent borrower protections compared to other private lenders. The protections aren’t as good as Federal Student Loans, so you won’t want to refinance until you can comfortably make the payment. Still, someone with a solid income and a large student loan debt can save a lot of interest by refinancing.

Plus, when you refinance with Laurel Road through our link, you'll get a $200 bonus! Check out Laurel Road here.

As always, be sure to compare rates at multiple lenders before choosing one. You’ll never know where you can get the best rate until you apply with a few lenders. We recommend comparison shopping using Credible. You can get up to a $1,000 gift card bonus when you refinance with Credible!

Shop and compare your options at Credible.

Laurel Road FAQ

Here are some of the most common questions we get about Laurel Road:

Is Laurel Road Legit?

Yes! Laurel Road is a bank and student loan lender that offers competitive rates on student loan refinancing.

Who Owns Laurel Road?

Laurel Road is owned by KeyBank, N.A.

Where Are Laurel Road Loans Serviced?

MOHELA is the loan servicing company for Laurel Road student loans.

Is Laurel Road Good For My Student Loans?

It can be! Laurel Road offers highly competitive student loan rates and terms. If you have a large loan balance and are a highly qualified borrower, chances are Laurel Road will be the best fit.

Does Laurel Road Offer Any Bonuses or Incentives?

Yes! Laurel Road offers borrowers $200 if they refinance through our through www.laurelroad.com/collegeinvestor.

Laurel Road Features

Min Loan Amount | $5,000 |

Max Loan Amount | Total loan amount (amounts over $300,000 will require two separate loans) |

Rate Type | Fixed or variable |

APR |

|

Autopay Discount | 0.25% |

Loan Terms | 5,7,10,15, and 20 years |

Origination Fees | None |

Prepayment Penalty | None |

Late Payment Fee | 5% of the amount due of $28 (whichever is less) |

Cosigners Allowed | Yes |

Cosigner Release | Yes, Can be requested after 36 months of consecutive, on-time monthly payments |

Grace Period | 6 months |

Eligible Schools | Title-IV accredited schools |

Associate Degree Refinancing | Yes, for professionals in certain healthcare fields |

Customer Service Phone Number | 855-245-0989 |

Customer Service Hours | Mon–Fri, 8:00 AM–9:00 PM (EST) |

Customer Service Email Address | help@laurelroad.com |

Loan Servicer | MOHELA |

Address For Sending Payments | MOHELA |

Promotions | $200 bonus |

Rates as of 02/20/2024. Rates subject to change. Terms and Conditions apply. All products subject to credit approval.

Laurel Road Student Loan Refinancing

-

Rates and Fees

-

Application Process

-

Customer Service

-

Products and Services

Overall

Summary

Laurel Road is a student loan refinancing company that is a part of KeyBank. It offers competitive rates on student loan refinancing, especially for higher-earning professionals.

Pros

- Competitive refinancing rates

- Can transfer Parent PLUS Loans to students

- Unique options to save more (linked savings account, cashback credit card)

Cons

- Doesn’t offer academic deferment

- Must wait at least 36 months to request a cosigner release

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Ashley Barnett