Investing apps are making it easier than ever to invest commission-free. But there are a lot of apps out there? Which are the best free investing apps?

But investing is risky. It comes with few guarantees. The only investing guarantee I can offer is this: everything held equal, the less you pay in fees, the better your returns.

Fees don’t have to stop you from making wise and lucrative investments. Thankfully, we live in the 21st century, and there’s never been a better time to be a small investor.

And now, in today's mobile world, investing is becoming easier and cheaper than ever. Plus, with the investing price war that's been going on, it's cheaper than ever to invest!

Here are the best investing apps that let you invest for free (yes, free). You might also check out our list on the best brokers to invest.

Note: The investing offers that appear on this site are from companies from which The College Investor receives compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). The College Investor does not include all investing companies or all investing offers available in the marketplace.

1. Fidelity

Best For: Full Service Investing At $0 Trade Prices

Fidelity is one of our favorite apps that allows you to invest for free. This surprises most people, because most people don't associate Fidelity with "free". However, Fidelity offers a range of commission-free ETFs that would allow the majority of investors to build a balanced portfolio. Plus, they now offer $0 commission stock, option, and ETF trades!

The also offer fractional share investing, meaning that you can invest dollar-based, not just share-based. This is a big win for people starting with low dollar amounts.

Fidelity IRAs also have no minimum to open, and no account maintenance fees. That means you could deposit just $5, and invest it for free. That makes this a much better deal compared to companies like Stash Invest.

Furthermore, Fidelity just announced that it now has two 0.00% expense ratio funds - yes free. So, you can not only invest commission free, but these funds don't charge any management fees. Truly free investing.

But to make it a top app, it has to have a great app, and Fidelity does. Their app is the cleanest and easiest to use out of all of the investing apps we've tested. They have a ton of features, but it all works well together.

Plus, you get the benefit of having a full service investing broker should you need more than just free. Check out Fidelity's app and open an account here.

Fidelity | |

|---|---|

Minimum Investment | $0 |

Commission | $0 for stocks, ETFs, options |

Monthly Fees | $0 |

Account Type | Taxable, IRA, HSA, 401k, Trust |

Promotions | Varies by account type |

2. Robinhood

Best For: 100% Free Stock Trades & Limited Crypto

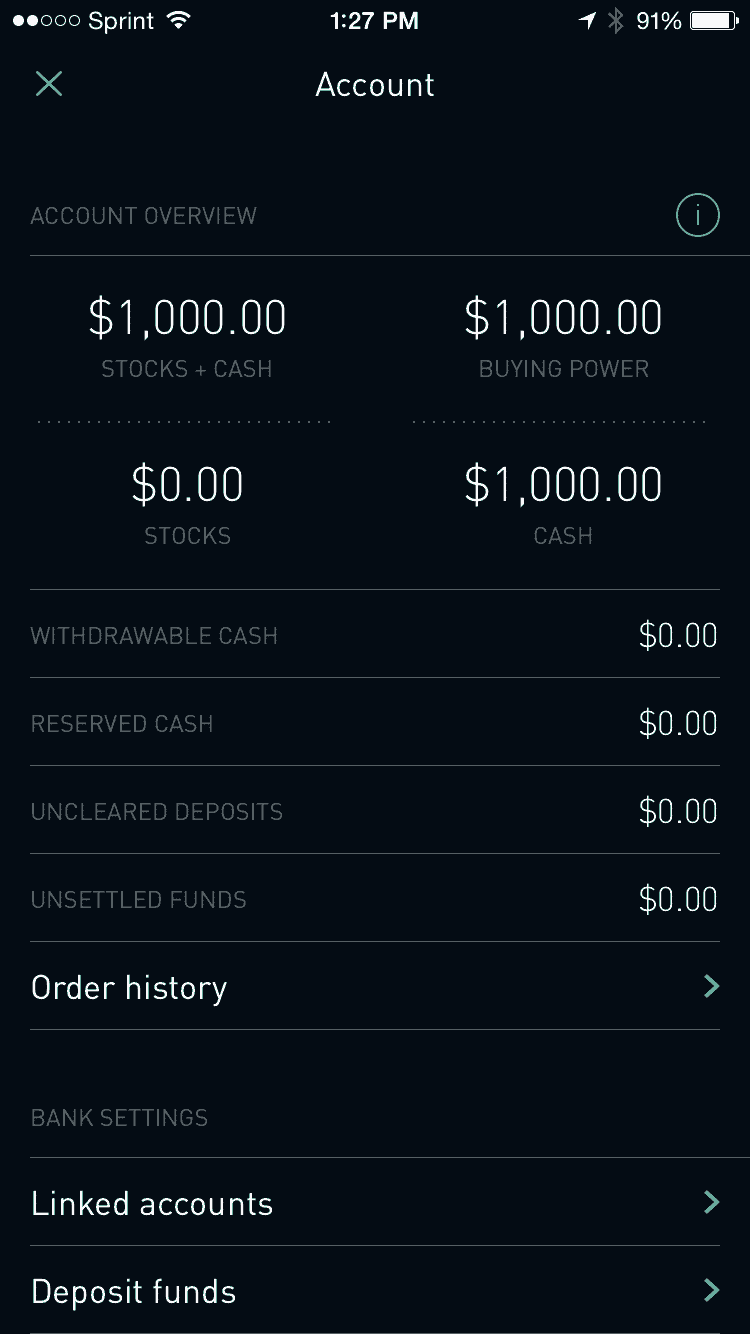

Robinhood is an app lets you buy and sell stocks for free. Users can buy or sell stocks at market price. The app allows you to make limit orders and stop loss orders too. Unless you’re an active trader, this is plenty of functionality. Plus, the app comes with a clean user interface and basic research tools.

Most serious investors should pair Robinhood with one or more free research tools. This will help them develop a more systematic approach to investing. That said, you can’t beat Robinhood’s free trades, but its shortcomings here make it third.

They also allow options, fractional shares, and cryptocurrency investing, but these are limited as well.

The drawbacks are really limited, but one of the biggest is that the platform has become unreliable in recent months with large outages impacting investors.

If you’re curious how Robinhood makes money, it’s through Robinhood Gold. Robinhood Gold is a margin account that allows you to buy and sell after hours. Buying on margin means you double your expected returns. It also means you double your expected losses. The result (based on the magic of compounding) means that trading on margin tends to eat into your principal.

Check out the other options for trading stocks for free.

Open a Robinhood account here and get a free share of stock >>

Robinhood | |

|---|---|

Minimum Investment | $0 |

Commission | $0 for stocks, ETFs, options, crypto |

Monthly Fees | $0 |

Account Type | Taxable |

Promotions | Free share of stock |

Get a free share of stock!

3. E*TRADE by Morgan Stanley

E*TRADE also offers a large selection of commission free ETFs. We are actually big fans of E*TRADE for our solo 401k account, but they don't make the top 5 when it comes to investing apps and free investing.

They just recently announced $0 stock, ETF, and options trades, but we'll see how they compete with others on this list.

While they do offer IRAs with no minimums, and charge no transaction fees, we didn't find their app as user friendly as the rest. Similar to their website, it's just a bit harder to use. However, we still really like E*TRADE and they are definitely a runner up.

Right now, you can get up to $1,000 when you open and fund an account with E*TRADE.

E*TRADE | |

|---|---|

Minimum Investment | $0 |

Commission | $0 for Stock, Options, ETF trades |

Monthly Fees | $0 |

Account Type | Traditional, Roth, Solo 401k, and More |

Promotions | Up To A $1,000 Bonus! |

Earn up to a $1,000 bonus!

4. Schwab

Best For: Investing and Banking Combined

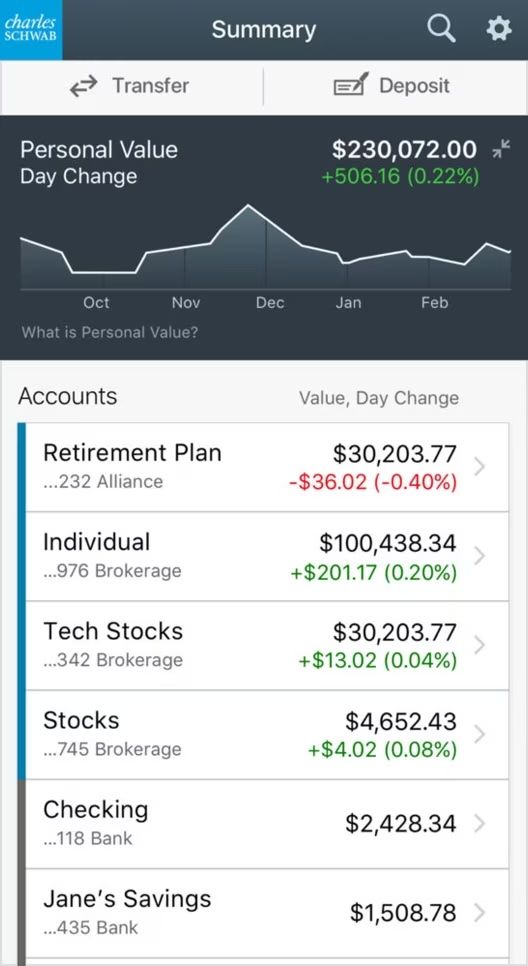

Schwab is one of the best brokers, and it has been gaining ground significantly over the last few years, especially with the acquisition of TD Ameritrade. Plus, it's trading platform thinkorswim is one of the highest rated for traders.

Where Schwab really shines is it's ability to have both commission-free investing, along with a great banking product. The Schwab checking is consistently named a favorite, and you can see in the app how they make investing and banking combined very seamless.

Schwab also has every account type imaginable, and they have a network of offices nationwide if you ever do need in-person support. But again, their investing app is highly rated.

Schwab | |

|---|---|

Minimum Investment | $0 |

Commission | $0 for stocks, ETFs, options |

Monthly Fees | $0 |

Account Type | Taxable, IRA, HSA, 401k, Trust |

Promotions | Varies by account type |

5. Public

Public is another free investing platform that has put a huge focus on the social aspect of investing and education. As a result of using influencers and education, Public has been significantly growing their awareness.

Public has a solid investing app - you can invest in any asset: from stocks, ETFs, crypto, fine art, collectibles, and more - all in one place, including fractional shares and options. They also offer desktop support, which is incredibly useful for things like looking at brokerage statements or tax forms.

They also advertise themselves as being one of the few investment brokerage firms that doesn't do Payment for Order Flow.

Read out full Public review here.

Public | |

|---|---|

Minimum Investment | $0 |

Commission | $0 for stocks, ETFs, options |

Monthly Fees | $0 |

Account Type | Taxable |

Promotions | None |

Runners Up

There are a lot of apps and tools that come close to being in the Top 5. When the competition is so good, it's hard to make the cut.

Vanguard

Vanguard is consistently known as the low cost investment service provider. They were one of the original mutual fund and ETF companies to lower fees, and they continually advocate a low-fee index fund approach to investing.

At Vanguard, you don't pay any commissions when you buy and sell Vanguard ETFs. You also pay no account service fees if you sign up to receive your account documents electronically, or if you're a Voyager, Voyager Select, Flagship, or Flagship Select Services client.

Furthermore, Vanguard recently announced that they won't charge a commission on a huge amount of competitor's funds and ETFs as well!

Vanguard also doesn't have an account minimum, and there is no minimum purchase requirement for mutual funds, but stocks and ETFs it's the cost of 1 share.

What holds Vanguard back is that their app is a little more clunky that the other apps. It feels a little "old school", and it seems to be built for the basics only.

However, it is free, so maybe only the basics are needed?

Vanguard Personal Advisor

If you're looking for professional help with your investments and financial planning, Vanguard offers Personal Advisor to help you build, execute, and continue to manage your financial plan. These are fiduciary advisors and will help you create a plan based on your goals (it's not a robot). It costs 0.30% AUM, which is one of the lowest you'll find.

M1 Finance

Best For: Building A Free Portfolio For The Long Term

M1 has become our favorite investing app and platform over the last year. With commission free investing, the ability to invest in fractional shares, automatic deposits, and more, M1 Finance is top notch.

If you’re looking for a way to create and maintain a free, diversified portfolio of stocks and ETFs, look no further than M1 Finance. They provide a pretty revolutionary tool/investing app that allows you to setup a portfolio and invest into it (correctly allocated) for free.

What do I mean? Well, imagine a portfolio of ETFs - maybe you have 5 ETFs at 20% each. Well, instead of having to do 5 transactions (and commission for each) when you buy, you can now simply invest and M1 Finance takes care of the rest - for free!

If you don't know exactly how to set it up, you're more than welcome to use one of their already setup portfolios as well.

Plus, M1 Finance has a great investing bonus offer right now! You can get up to $500 if you deposit new money by December 31, 2024.

Or, you can simply get $10 for opening a new account and funding it within 30 days!

It doesn't get much better than M1 Finance when it comes to investing for free. Try M1 Finance >>

J.P. Morgan Self Directed Investing

J.P. Morgan Self-Directed Investing is the latest update from Chase when it comes to investing (previously this was known as Chase You Invest). The great thing is that they made their platform truly commission-free. That's what makes it a runner up on our list of free investing apps.

Read our full J.P. Morgan Self-Directed Investing review.

The information about J.P. Morgan Self-Directed Investing has been collected independently by The College Investor. The product details have not been reviewed or approved by the company.

Ally Invest

Ally Invest is a solid choice for free investing. They have a solid app that allows you to invest, and like others on this list, you can invest in stocks, options, and ETFs commission-free.

Ally also offers solid bonus offers if you transfer your account to them. Right now, you can get up to $3,000 when you move your assets over to them.

Read our full Ally Invest review here.

Moomoo

Moomoo is the latest free investing app working to make a splash with US investors. This app has a lot of popularity in the Asian marketplace, and it recently launched in both the United States and Australia. Like most apps here, it offers free stock, ETF, and options trading. It also has robust charting and other information. When you open a new account, you can earn up to 15 free stocks!

Read out full Moomoo review here.

Webull

Webull has been gaining a lot of traction in the last several years as a competitor to Robinhood. It's an investment platform that is app-first, and it focuses on trading. In fact, this year it made our Honorable Mentions list of Best Stock Brokers.

Webull offers powerful in-app investment research tools, with great technical charting. This is a step above what you can find on most other investment apps.

You can find stock, options, and limited crypto trading on the Webull platform. They also offer competitive margin rates. The drawback here is they currently don't support mutual funds, bonds, OTC Bulletin Board or Pink Sheets stocks. Stocks that are under $1 and/or have a market cap of $10 million or less are restricted as well.

Bonus: WeBull is offering a great bonus of 2 free shares of stock!

Read our full Webull review here.

Get a free share of stock!

Other Investing Apps

There are other investing apps that we're including on this, but they aren't free. However, they are popular and may be useful to some investors.

Acorns

Acorns is an extremely popular investing app, but it's not free. Acorns charges anywhere from $1 to $3 per month ($5 for a family), but it does make automating your investments easy!

Acorns allows you to round up your spare change and invest it easily in a portfolio that makes sense for you. However, if you don't have a lot of money invested, that subscription cost can eat up your returns.

Read our full Acorns review here.

Bonus Offer: Right now Acorns is offering a $10 bonus when you open a new account. Start investing with as little as $5 >>

Stash

Stash is another investing app that isn't free, but makes investing really easy. They have turned the investing process into an easy to understand platform, and they don't charge any commissions to invest. However, they do charge a monthly fee that ranges anywhere from $1 to $9 per month.

Stash used to be known for $5 investing, but they have since gone to $0 minimums, and they allow fractional share investing.

Read our full Stash review here.

Who Is This For?

Investing apps are a great way to start investing with the convenience of being able to do everything from your mobile device. It used to be the only way to invest in the stock market was to call a stock broker and make a trade. This was slow, costly (huge commissions to trade), and you had to meet certain minimums.

When I started investing, things had moved online. But it was still not commission-free (I remember paying $9.99 per trade), and there wasn't any ability to do it on mobile.

Fast forward to today, and there are several mobile-first investing platforms (like Robinhood, Webull, and Public). These companies are majority-run on apps, and as a result, they opened up investing to a lot of young people.

If you're looking to get started investing and want to do it on your phone, this list is for you.

Why Should You Trust Us?

This list is based on a survey of 1,000 Americans who identified themselves as investors or interested in investing. The survey was fielded on February 9, 2024.

Furthermore, I have been writing about investing and comparing different investing platforms since 2009. I have reviewed and tested almost every major investing platform and app available, and the analysis is based on that experience.

We believe that our list accurately reflects the best free investing apps in the marketplace for consumers.

Investing App FAQ

Here are some common questions about investing apps.

What makes an investing app different than a brokerage?

Investing apps are mobile first investing platforms. They are brokerages (just like the names you may be used to), but they allow investors to trade and invest in an app.

Are investing apps safe?

Yes, they are just as safe as holding your money at any major brokerage. These apps all are insured by the SIPC and have a variety of investor protections.

Can I invest in anything on an app?

Depends on the app. Some apps significantly limit what you can invest in, while others offer the full ranges of investment options.

Are these apps really free?

Yes. The top apps we list don't charge a monthly fee to use, and don't charge a commission to invest in stocks, ETFs, and options. Of course, these apps may charge service fees for additional services, such as wire transfers, paper statements, and more.

Have you ever heard of any of these investing apps? Which one is your favorite?

Disclaimer:

Vanguard Advice services are provided by Vanguard Advisers, Inc., a registered investment advisor, or by Vanguard National Trust Company, a federally chartered, limited‐purpose trust company

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Ashley Barnett