Compared to the mid-twentieth century, employees no longer stay at a job their entire life. Where a pension and one company used to be common, now switching jobs every year or so is the norm. Such job-hopping creates a more dynamic situation for your retirement.

Pensions have faded away and been replaced by self-managed retirement. When employees switch jobs, they have a few options of what they can do with their retirement. Rolling it over into another account is one option available to them.

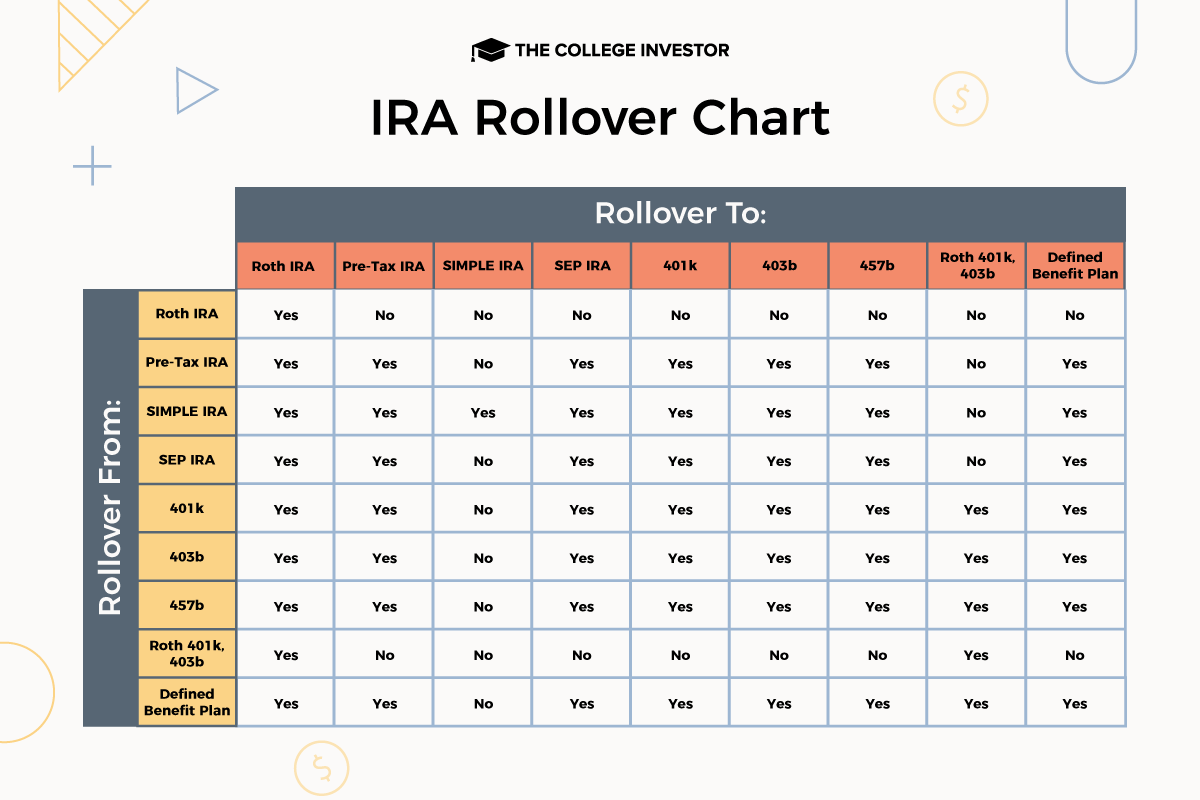

In this article, we’ll talk about where you can roll your retirement to when you leave your job. Plus, we have a handy IRA rollover chart that lays it all out for you.

Why Rollovers Are Important

One of the most common reasons for rolling over a retirement account is to move it out of a former employer’s plan. In that case, a 401(k) is rolled into an IRA at another brokerage of your choosing. There are a few benefits to doing this:

- More diversification: Employer retirement plans generally have just a few funds available, which translates into insufficient diversification. Maybe there is an all-world index, an S&P 500 fund, and some bond funds. There may be a handful or so of such offerings. Want to invest in oil, real estate, emerging markets, a specific country, high tech, etc.? You’ll often be out of luck.

- Lower fees: Most employer plan funds also have high fees. While fund fees have come down greatly in recent years, rolling your 401(k) into an IRA will often save you a few tenths of a percentage point in fund fees. Fund fees aren’t the only fees to consider. There are also employer plan administrative fees as well. Most IRA plans only have fund fees.

- More control: Not only do you have more diversification in an IRA, you control when money goes into the account and how. There can also be some benefits when it comes time to pull money out during retirement, depending on what you roll into.

In addition to leaving an employer, there are other reasons to roll over. You might have two or more retirement plans at your previous employer. A rollover offers the chance to consolidate them into one plan, which will provide easier management of those funds.

Finally, you might not have any reason to roll funds over into another account. If your previous employer’s plan offers great diversification and low fees, it might be difficult to compete with that. You could even do an IRA to 401k reverse rollover.

Rolling Your Retirement

Let’s answer the question of where you can roll your retirement account to. Depending on the account type, you can roll into a number of retirement account types. The IRS has very specific rollover guidelines.

The most restrictive rollovers are the Roth IRA, which can only be rolled into another Roth IRA, and the designated Roth account, which can only roll into another designated Roth account and a Roth IRA.

Note that each plan listed below can be rolled to the same plan at a different brokerage. For example, a Roth IRA can be rolled into another Roth IRA.

- Roth IRA: Can’t be rolled into any other account type.

- Traditional IRA: Can be rolled to Roth IRA, SEP-IRA, 457(b), pre-tax qualified plan, and pre-tax 403(b).

- SIMPLE IRA: Can be rolled to the following after two years: Roth IRA, traditional IRA, SEP-IRA, 457(b), pre-tax qualified plan, and pre-tax 403(b). The two-year wait doesn’t apply if rolling into another SIMPLE IRA.

- SEP-IRA: Can be rolled to Roth IRA, traditional IRA, 457(b), pre-tax qualified plan, and pre-tax 403(b).

- 457(b): Can be rolled to Roth IRA, traditional IRA, SEP-IRA, pre-tax qualified plan, pre-tax 403(b), and a designated Roth account.

- Pre-tax qualified plan: Can be rolled to Roth IRA, traditional IRA, SEP-IRA, 457(b), pre-tax 403(b), and a designated Roth account.

- Pre-tax 403(b): Can be rolled to Roth IRA, traditional IRA, SEP-IRA, 457(b), pre-tax qualified plan, and a designated Roth account.

- Designated Roth account: Can only be rolled to Roth IRA.

Note, rolling from a pre-tax account to a Roth account may have tax implications. Also, to roll into some plans (such as a 401k or defined benefit plan, the plan must allow it).

IRA Rollover Chart

Here's a handy IRA rollover chart that could help make things clear:

Restrictions to Be Aware of When Rolling Over

Once the rollover process starts, you’ll have 60 days to complete it. Otherwise, the money is considered a withdrawal and subject to income taxes. Also, if you are under 59.5 years of age, those funds will incur a 10% early withdrawal penalty.

Have any check made out to the new plan and not you. Send the check directly to the new plan. Don’t forget to report the rollover on your income taxes as a non-taxable distribution.

Which Brokerages to Open Your Account At

If you aren’t sure which brokerage to roll your new plan to, we’ve identified the top brokerages in our article, The Best Traditional and Roth IRA Accounts. Some of the names listed you’ll already be familiar with, such as Vanguard, Fidelity, Schwab, and Betterment. Some names you may not have heard of. You really can’t go wrong with any of them.

Rolling over a retirement plan is not difficult or time-consuming. Just follow both plan administrators’ instructions and you should have a hassle-free rollover experience.

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller