Are you trying to figure out what student loan repayment plan makes sense for you?

The myriad of options can be confusing, but figuring out the right option is critical to your financial health. There are over 150 different options for your student loans - from Federal loans, private loans, loan forgiveness plans, and more.

It's important to remember the best student loan repayment plan is the one that you can afford to pay each month, on time, without missing payments. The absolute worst thing you can do is go into default on your student loans.

Below we outline resources and options to help you figure out what makes sense for you.

Resources for Deciding on a Plan

Your Loan Servicer

Loan servicers aren’t known for the best customer service. However, a loan servicer can provide you with information about your current loans including your current repayment plan.

Chipper

Chipper is a tool that will help you understand your loan repayment options. It has a database of loan repayment options, and it helps you optimize based on your personal circumstances. Unlike lots of tools, it doesn’t automatically push users to refinance loans.

This tool is especially useful for people just getting started with debt repayment, and those who may qualify for Public Service Loan Forgiveness.

Refinancing Marketplaces

Can you easily afford your loan payment on a 10-year repayment plan? If so, refinancing your debt could make sense. Use a marketplace like Credible to find student loan refinancing options.

You can also look at our list of the best student loan refinance lenders here.

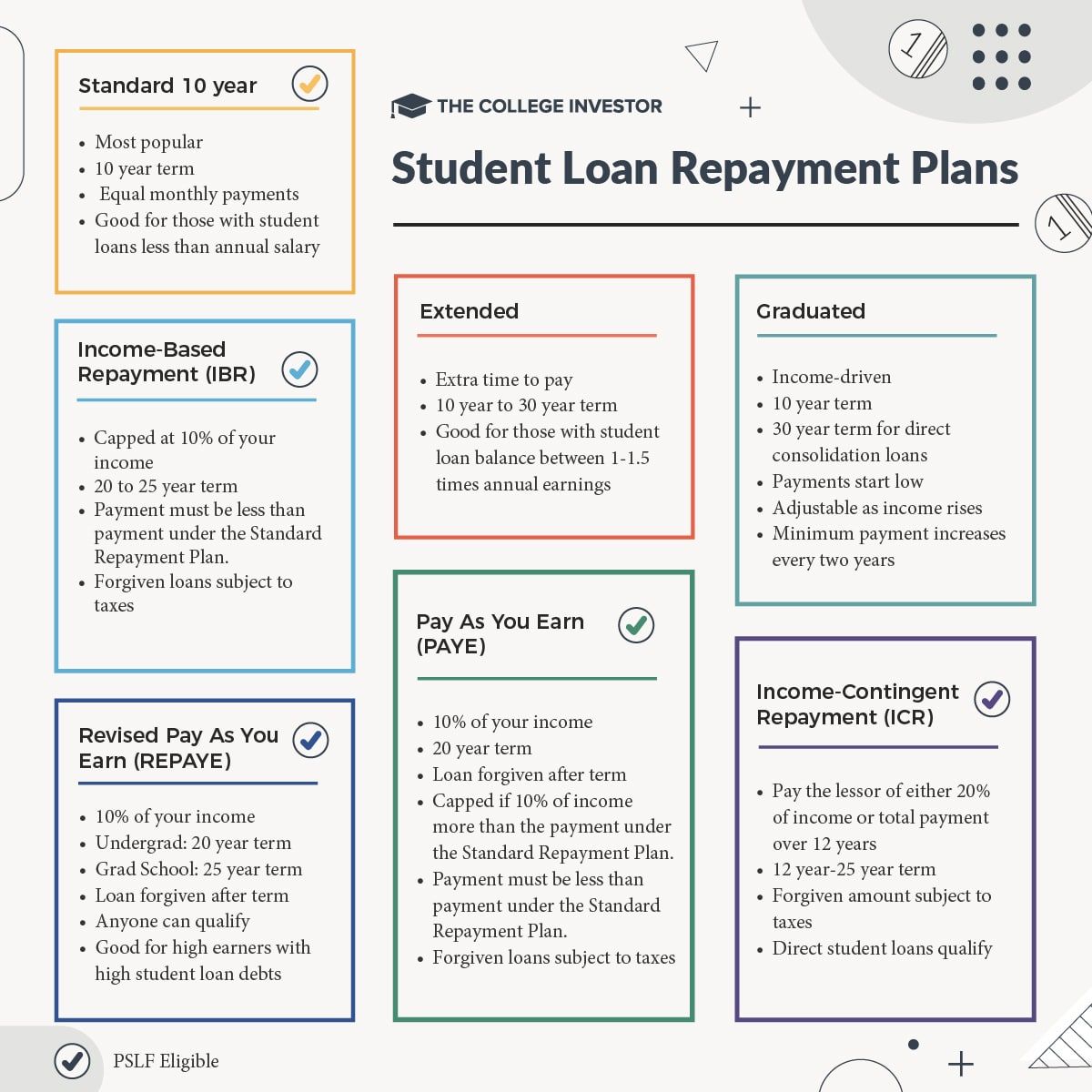

Standard Repayment Plan

When you take out Federal student loans, your loan servicer will automatically opt you into the Standard Repayment Plan. Under this plan, you’ll make equal monthly payments for 10 years, and then your loans will be paid off!

The Standard Repayment Plan is the most popular student loan repayment plan, although that is probably because it is a default repayment plan.

In most cases, if your annual salary is more than you owe in student loans, the Standard Repayment Plan makes sense for you. For example, if you earn $47,000 per year, and you owe $33,000 in student loans, in most cases, you can afford to repay the loans.

If you owe more in student loans than you earn each year, you’ll want to avoid this plan (at least for now).

Extended Repayment Option

When you do a direct consolidation of Federal student loans, you can opt into the extended repayment option.

Technically, there are two versions of this program. If your loan repayment started between October 7, 1998 and July 1, 2006, you’ll have 25 years to repay your loans. The payments will be level monthly payments over the 25 years, and you’ll have a minimum of a $50 monthly payment.

For those who started loan repayment after July 1, 2006, the repayment term depends on the loan balance. Repayment terms range from 10 to 30 years.

If you do not plan to apply for Public Service Loan Forgiveness, and you need some extra time to pay back your loans, this plan could make sense. It can be particularly helpful if your total loan balance is between 1 and 1.5 times your annual earnings. For example, if you earn $200,000 per year, and you owe $250,000 in student loans, this could make sense for you.

Loan Balance | Repayment Term |

|---|---|

Less than $7,500 | 10 years |

$7,500 to $9,999 | 12 years |

$10,000 to $19,999 | 15 years |

$20,000 to $39,999 | 20 years |

$40,000 to $59,999 | 25 years |

$60,000+ | 30 years |

Graduated Repayment Option

A graduated repayment plan is a payment program that allows borrowers to pay off loans over a 10-year period. If you’ve taken a Direct Consolidation Loan, the repayment period may last up to 30 years depending on the balance.

Under the Graduated Repayment Plan, payments start low. But your minimum payment increases every two years. Ostensibly, this gives borrowers the ability to adjust their payments as their income rises.

However, this is a plan that seems like the worst of all possible worlds. In many cases, payments under this plan triple over the course of 10 years. Plus, a ton of your payment goes towards servicing interest in the early years, so you’re unlikely to see real progress until your last few years.

In most cases, if you can’t afford your payments right now, an income-driven repayment plan makes the most sense.

Income-Driven Repayment Plans

If you’re pursuing Public Service Loan Forgiveness, you definitely want to be on one of the income-driven repayment plans. However, there are four options, and it isn’t always obvious which one makes the most sense.

SAVE (REPAYE)

The REPAYE Plan was recently rebranded as SAVE (Saving on a Valuable Education) Plan. The Biden Administration basically revised the rules on the REPAYE Plan to help more borrowers.

This plan update happens in two phases. Some features are available right now, others roll out in 2024.

Right now, this plan offers the following:

- The change in the income threshold from 150% of the poverty line to 225% of the poverty line. Check out our updated discretionary income calculator to see how this changes.

- The waiver of interest beyond the required payment will also be implemented.

- Borrowers who file federal income tax returns as married filing separately will have their loan payments calculated based on just their own income. Spouses will no longer have to cosign the SAVE repayment plan application.

Starting in 2024, this plan will also have:

- The change in the percentage of discretionary income, from 10% to 5%.

- The forgiveness of the remaining debt after 10 years for borrowers with low initial loan balances.

- Consolidation will no longer reset the qualifying payment count for forgiveness. More deferments and forbearances will count toward forgiveness.

- The automatic use of tax information to calculate the monthly payment under the SAVE plan. Automatic recertification of income and family size.

- Borrowers who are 75 days late will be automatically enrolled in an income-driven repayment plan.

When the SAVE plan is fully implemented, borrowers will see the lowest monthly student loan payment of any individual repayment plan.

Income-Based Repayment (IBR)

If you started borrowing after July 1, 2014, your payment is capped at 10% of your income, and you will make payments for 20 years. If you borrowed before July 1, 2014, your term will be 25 years. After 20 or 25 years, your loans will be forgiven, but you need to watch out for the tax bomb the year the loans are forgiven.

To qualify for IBR, your payment under IBR must be less than the payment under the Standard Repayment Plan.

Borrowers can combine IBR with Public Service Loan Forgiveness. When you do this, you’ll make qualified payments for 10 years, then the loan will be forgiven.

Pay As You Earn (PAYE)

Under PAYE plans, your payment is 10% of your income, and your repayment term is 20 years. If 10% of your income is more than the payment under a standard repayment plan, then your payment is capped. After 20 years of payments, your loan is forgiven, but you have to watch out for the tax bomb.

To qualify for IBR, your payment under IBR must be less than the payment under the Standard Repayment Plan.

You may use PAYE in conjunction with Public Service Loan Forgiveness.

Related: IBR vs. PAYE

Income-Contingent Repayment (ICR)

Anyone with Direct student loans can opt for an Income-Contingent Repayment Plan.

On an ICR plan, you pay the lesser of either 20% of your discretionary income or what you would pay with a fixed plan over 12 years.

When you use the 20% option, your payments can stretch out up to 25 years. After a maximum of 25 years, your loans will either be paid off or they will be forgiven. The forgiven amount is subject to income taxes.

You may use PAYE in conjunction with Public Service Loan Forgiveness.

Private Loan Repayment Options

Private student loans don't have the same repayment plan options that are offered by the Department of Education. Rather, the loan terms are set by your lender when you take out the loan.

Private loans have terms ranging from 1 year to 20 years, and the interest rate can be fixed or variable. We break down the best private loans here so you can see how yours compares.

Most lenders offer some or all of the following types of plans:

- Immediate Repayment - This is where you start making monthly payments immediately

- Deferment In School - This is where your payment is deferred while you're in school, and typically for 6 months after you graduate

- Set Monthly Payment In School - This is where you have a small, set monthly payment (such as $25) while in school

- Interest Only In School - This is where you pay only your accrued interest each month while in school

If you already have private loans, the typical way to change your repayment plan is to simply refinance your student loan into another student loan with better rates or terms. You can find our guide to Student Loan Refinancing here.

Final Thoughts

Once again, the best student loan repayment plan is the one that you can afford to make every month. If you fail to make your monthly payments, not only will your credit be hurt, but you can see your wages garnished and more. Plus, going into default will see your loan balance automatically rise by about 25% due to accrued interest and collection costs.

So, find the student loan repayment plan that works for you. If you don't know where to start, look at using a service like Chipper to figure it out.

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Claire Tak Reviewed by: Chris Muller