Did you know that you can start investing with $100 or less? Most people think that you need thousands of dollars to get started investing, but that's simply not true. In fact, I started investing with just $100 when I started working my first job in high school (yes high school).

It's possible to start investing in high school, or in college, or even in your 20s.

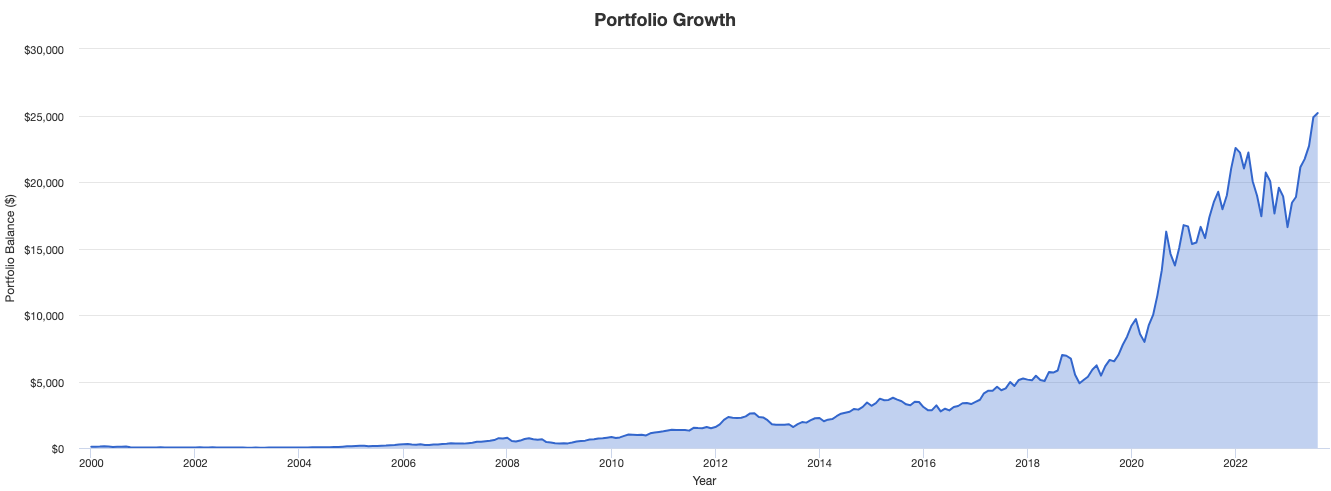

Even more food for thought - if you invested $100 in Apple stock in 2000, it would be worth $25,000 today. Or if you invested in Amazon stock at that same time, it would be work over $3,500 today. And that's just if you invested $100 once.

Imagine if you invested $100 monthly since 2000 in Apple stock? You'd have well over $4,000,000 today. Seriously.

Hopefully that's pretty motivating for you, and proves that you don't need a lot of money to start investing. Just check out this chart:

Remember, the most difficult part of starting to invest is simply getting started. Just because you're starting with $100 doesn't mean you should wait. Start investing now!

Let's break down exactly how you can start investing with just $100.

Where To Start Investing With Just $100

If you want to get started investing, the very first thing you have to do is open an investing account and a brokerage firm. Don't let that scare you - brokers are just like banks, except they focus on holding investments. We even maintain a list of the best brokerage accounts, including where to find the lowest fees and best incentives: Best Online Stock Brokers.

Given that you're only starting with $50 or $100, you will want to open an account with zero or low account minimums, and low fees. Our favorite brokerage for starting out is M1 Finance. The reason? $0 commissions, and you can invest in just about everything you want - for free!

Remember, some brokers charge $5-20 to place an investment (called a commission), so if you don't choose an account with low costs, you could see 5-20% of your first investment disappear to costs. Or other places (like Acorns or Stash) charge monthly fees - up to $9 per month! If you only have $100 - you could be at $0 very quickly just paying fees.

There are also other places that you can invest for free. Here's a list of the best places to invest for free. Just remember, many of these places have "strings attached", where you must invest in their funds, or invest in an IRA, to invest for free.

Bottom Line: Pick a low cost broker like Fidelity or Charles Schwab. You'll be happiest in the long run.

What Type Of Account Should You Open

The next decision you have to make is what type of investment account to open. There are a lot of different account types, so it really depends on why you're investing. If you're investing for the long term, you should focus on retirement accounts. If you're investing for the shorter term, you should keep your money in taxable accounts.

Here's a chart to help make sense of this:

Most people will want to have both an IRA and a taxable brokerage account. But you can start with one.

What To Invest In

The next challenge is what to invest in. $100 can grow a lot over time, but only if you invest wisely. If you gamble on a stock, you could lose all your money. And that would be a terrible way to start investing. However, it's very rare to lose all your money investing.

To get started, you should focus on investing in a low cost index-focused ETF. Wow, that sounds like a mouth-full. But it's pretty simple really. ETFs are just baskets of stocks that follow a certain index - and they make a lot of sense for investors just starting out. Over time, ETFs are the lowest cost ways to invest in the broad stock market, and since most investors cannot beat the market, it makes sense to just mimic it.

For example, the S&P 500 is a common index - it's the largest 500 companies in the United States. If one of them fails (goes bankrupt), company 501 slots into the index. It's what provides safety and diversification. And for growth, as long as the country is growing, the index should also grow over the long run.

Check out this guide on how to invest in the S&P 500 for ideas.

If you don't know where to start, we've put together a great resource in the College Student's Guide To Investing, where we break down several different ETF choices to build a starter portfolio.

Consider Using A Robo-Advisor

If you're still not sure about what to invest in, consider using a robo-advisor like Wealthfront. Wealthfront is an online service that will handle all the "investing stuff" for you. All you have to do is deposit your money (and there is $0 minimum to open an account), and Wealthfront takes care of the rest.

When you first open an account, you answer a series of questions so that Wealthfront gets to know you. It will then create and maintain a portfolio based on what your needs are from that questionnaire. Hence, robo-advisor. It's like a financial advisor managing your money, but the computer takes care of it.

There is a fee to use Wealthfront (and similar services). Wealthfront charges 0.25% of the account balance. This is likely cheaper than what you would pay a traditional financial advisor, especially if you're only getting started with $100. In fact, almost all financial advisors would probably refuse to help you with just $100.

So, if you want a system to help you invest, check out Wealthfront here.

Related: Find out our picks for the best robo-advisors here.

Alternatives to Investing In Stocks

If you're not sure about getting started investing right away with just $100, there are alternatives. Remember, investing simply means putting your money to work for you. There are a lot of ways to make that happen.

Here are some of our favorite alternatives to investing in stocks for just $100.

Savings Account Or Money Market

Savings accounts and money market accounts are safe investments - they are typically insured by the FDIC and are held at a bank.

These accounts earn interest - so they are an investment. However, that interest is typically less than you'd earn investing over the same period of time.

However, you can't lose money in a savings account or money market - so you have that going for you.

The best savings accounts earn upwards of 5.00% interest currently - which is the highest it's been in years!

Investment Options To Avoid

There are two investment options that are pitched all the time that we recommend you avoid.

Subscription Investing Apps

There are several companies out there that advertise getting started investing for just $5. We want to make sure that you have a "buyer beware" mindset when it comes to using these companies and you fully understand what you're getting into.

For example, Stash Investing allows you to invest for as little as $5. However, they charge a $1 per month fee on accounts of less than $5,000. If you're only investing $5 per month - and paying $1 in fees each month, your portfolio return is going to suffer (or even lose) money.

If you only invest $5 per month for a year, you'll have committed $60. However, you'll have paid $12 in fees - leaving you with $48. That's 20% of your money being given up to fees.

Only in 32 of the last 100 years has the stock market returned over 20% in a given year (and that year usually followed a really bad year). The average return has been roughly 11%.

That's why you need to avoid services that charge you huge fees to invest. $1 per month might not seem huge, but it is as a percentage of your $100 investment. That's why we love services like M1 Finance, which offer commission free trading with no annual fees.

Compound Interest Accounts/Insurance Products

If you've been on social media in the last several years, there have been a lot of people pitching "compound interest accounts" or other variations on life insurance products that are sold as investments.

Please don't "invest" or buy into these indexed universal life insurance policies. They may have sexy names, and are pitched by really convincing sales people, but the bottom line is that these products are expensive (lot's of fees), and they typically underperform the stock market. You'll come out way behind in 20 years if you utilize these products - and that's assuming that you don't miss a payment and lose the policy.

Just avoid these things!

Just Get Start Investing

Remember, the reason why you're investing is to grow your money over the long term. That means you're leveraging the power of time and compound interest.

Time works on your side. The earlier you start investing, the better. So, even if you only have $100 to invest, just get started.

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller