I'm a big fan of methods and orders of operations for doing things. I think that it is essential to have a set plan for executing tasks, especially long term tasks like saving for retirement. But what's the best way to go about funding retirement? What is the proper order to save?

Remember back in elementary school the order of operations for math - "Please Excuse My Dear Aunt Sally"? I always found that useful - parenthesis, exponents, multiplication/division, addition/subtraction.

Its rules and order that make things easy to remember, just like PEMDAS from elementary school.

So, what is the best order of operations for saving for retirement? Let me break it down for you, and show you the exact strategy I'm using as well.

The Order Of Operations For Saving

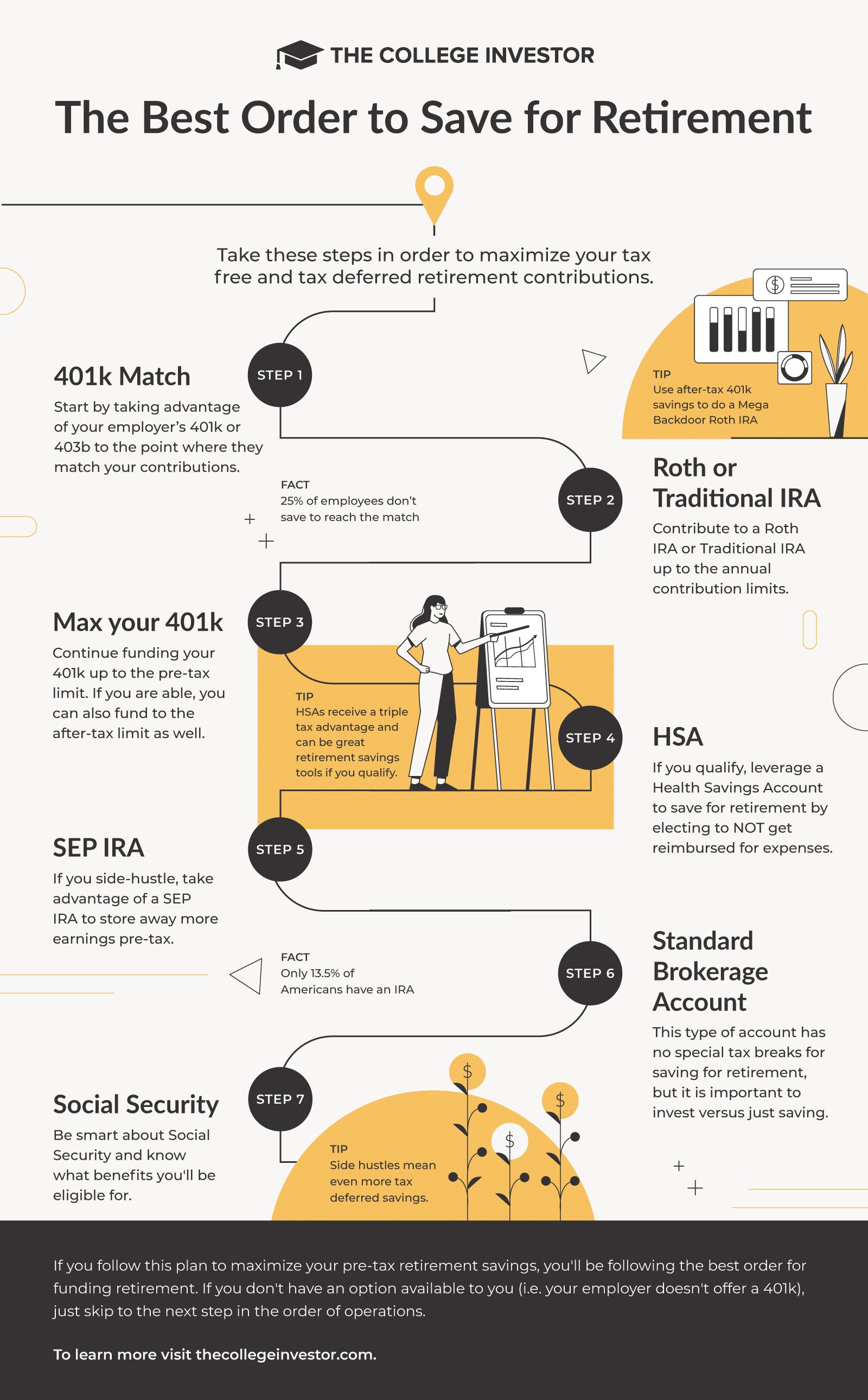

Let's start with a chart breaking down the best order of operations for saving for retirement.

Step 1 - Save in Your 401k (Up To The Match)

The first step in saving for retirement is to take advantage of your for 401k or 403b, up to your employer match. These are great plans that every eligible person needs to participate in, and when your employer matches your contributions, it's free money! Funding your retirement in a 401k is a great way to save because it gives you a tax savings when you contribute, your investments grow tax deferred, and in many places, your company matches your contribution up to a certain percentage.

If your company matches your contribution, and you don't contribute, you're leaving free money on the table, which is crazy! It's essentially giving up a percentage of your pay!

Plus, saving for retirement in a 401k is easy. All you have to do is sign up. Check out more of the best 401k moves you can make as well.

Step 2 - Save The Max In Your IRA

If you've invested in your 401k to at least to get your company match, it's time to start looking for what comes next for funding retirement savings. The next step in the order of operations for funding retirement is your IRA. There are a lot of resources out there to help you decide if a Roth IRA or Traditional IRA is better, but regardless of which you choose, investing in an IRA is a great way to save for retirement after you've maxed your 401k.

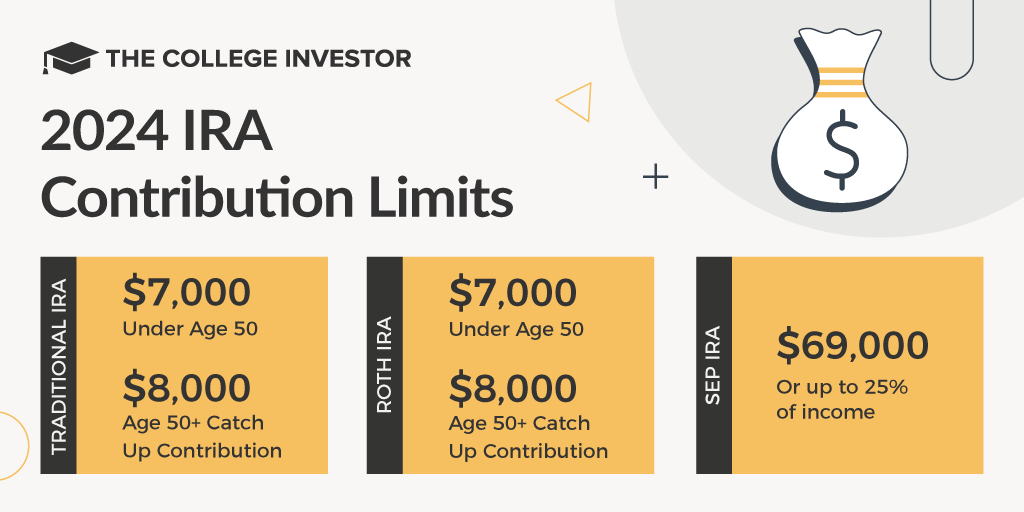

There are a lot of IRA misconceptions, but you should know the following - you can invest up to $7,000 per year (in 2024), and if you're older than 50, you get a catch-up contribution of $1,000 extra. All of the money in your IRA grows tax free. Depending on the type of IRA, you may not even have to pay taxes on your withdraws (that's a Roth IRA for you). All of these features make investing in an IRA Step 2 in the Order of Operations for Funding Retirement.

Make sure you check out the IRA Contribution And Income Limits here.

Step 3 - Continue To Max Your 401k Contributions

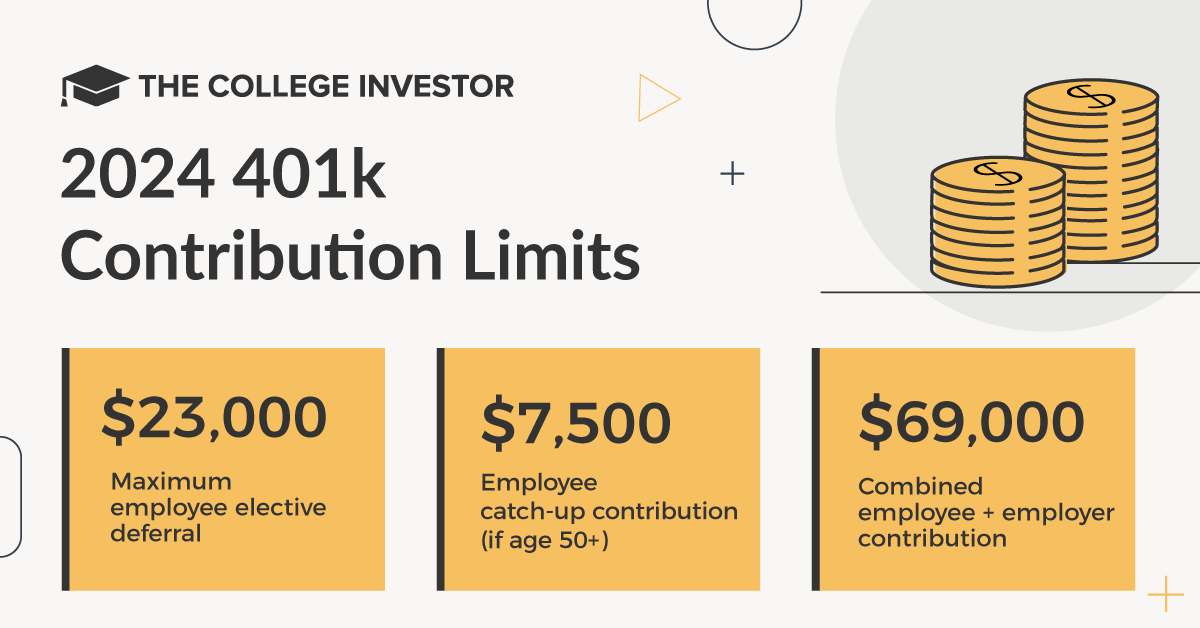

If you've already maxed out your IRA contributions, it's time to look at maxing you your 401k contributions. Remember to check out our guide on how to maximize your retirement contributions. In 2024, you can contribute $23,000 into your 401k pre-tax, and you can have a total contribution to your 401k (employee + employer contributions) of $69,000.

If your employer allows after-tax, non-Roth contributions, and you can afford it, you might consider maxing this out so that you can potentially take advantage of the Mega Backdoor Roth IRA.

Make sure you understand the 401k Contribution Limits here.

Step 4 - Max Your HSA

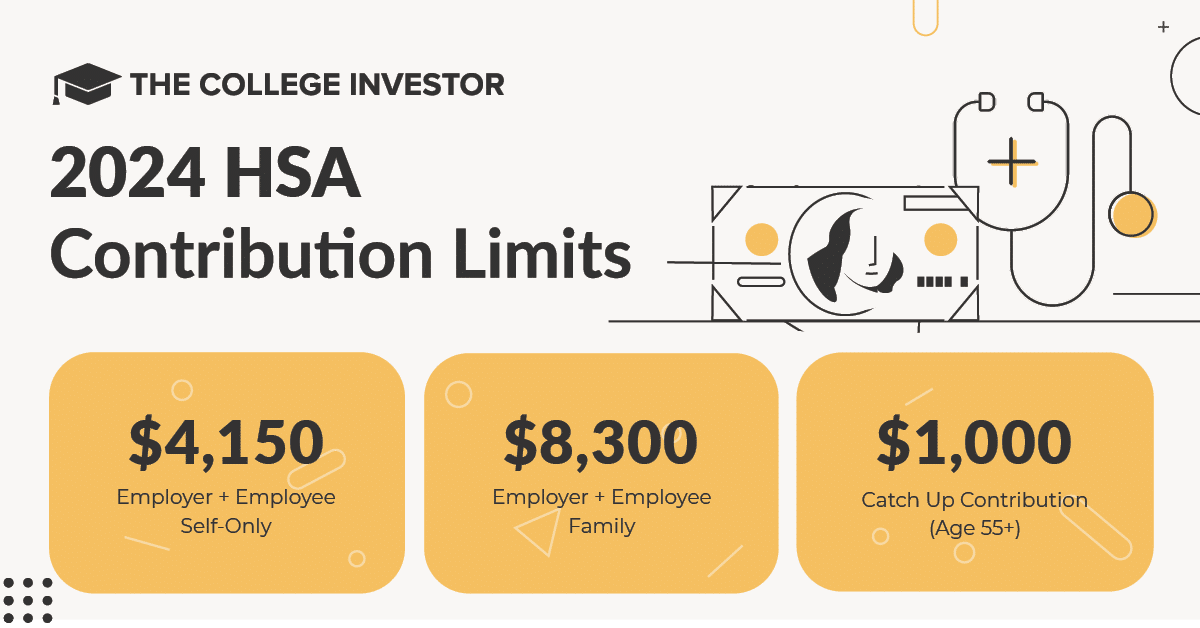

If you are in a high-deductible health plan, and you are eligible for a health savings account (HSA), you'd better be taking advantage of it to the max. I consider the HSA to be the secret IRA nobody is talking about, because it offers triple-tax benefits, and is simply an awesome way to save.

Plus, many employers offer matching contributions into an HSA, and many times the health insurance attached to the HSA is cheaper than other options offered.

The only reason that the HSA is #4 on this list is because many people simply don't qualify for it. However, if you do qualify for it, I'd move it to #2 - right behind taking advantage of your employer's match.

Make sure you check out the HSA contribution limits here.

Step 5 - Side Hustle And Do A SEP IRA

If you're a side hustler, or have any type of freelance income, you should consider doing a SEP IRA. This is another way to save pre-tax money in a retirement account, and lower your total tax bill from your side hustling income activities.

With a SEP IRA, you can contribute 25% of your earnings, or $69,000, whichever is lower.

Note: You can substitute a Solo 401k here if you are good about balancing contribution limits with an employer plan. A SEP IRA is usually easier for side hustlers with a 401k they max at their day job.

Step 6 - Save in a Standard Brokerage Account

After you've invested in both your IRA and 401k, you may not know what to do next. The best thing you can do after maxing out all the "traditional" retirement accounts is to just invest in a standard brokerage. This type of account has no special tax breaks for saving for retirement, but it comes in as Step 5 in our order of operations for funding retirement because it is important to invest versus just saving.

The key is to protect against inflation from eating your returns as you fund your retirement. If you just save the remainder in a savings account, you don't grow your money or keep up with inflation. While saving is important, it is more important to grow your money over the long run by investing.

Check out our list of the best brokerage accounts here.

Step 7 - Be Smart About Social Security

Step 7 in the Order of Operations for Saving For Retirement is Social Security. As I've mentioned before, Social Security isn't going anywhere, even for young workers. However, one thing that young workers should plan for is that the benefits will be less, and the retirement age will be much higher. I wouldn't be surprised if today's college graduates have a Social Security retirement age of 70 or even 75 before they can take benefits. The reason is that people are just living longer.

As such, you have to be smart about your Social Security benefits, even at a young age. The reason is that there are many factors that may, or may not, allow you to get benefits.

For example, if you work for a State or Local government, your organization may choose to opt-out of Social Security in lieu of their own retirement program. This could be beneficial to you (as the program may be better) or it could be worse. The bottom line is that you need to be smart about it and know what benefits you'll be eligible for.

Conclusion

So, if you follow this plan to maximize your pre-tax retirement savings, you'll be following the best order for funding retirement. If you don't have an option available to you (i.e. your employer doesn't offer a 401k), then just skip to the next step in the order of operations, just like PEMDAS above.

What's your thought on the right order of operations for funding retirement?

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller