Earnest is a student loan lender that offers both student loan refinancing and private student loans.

Qualified borrowers will not only find low interest rates at Earnest, they’ll find a customized student loan product. Earnest is leading the private student loan marketplace in innovation.

This is also why Earnest earned itself a place on our annual list of the Best Places To Refinance Your Student Loans.

Here’s what you need to know about refinancing student loans with Earnest. See how Earnest compares to other top lenders here!

Earnest Student Loans Details | |

|---|---|

Product Name | Earnest Student Loan Refinancing |

Min Loan Amount | $5,000 |

Max Loan Amount | $500,000 |

Variable APR | 5.99% - 9.74% APR |

Fixed APR | 5.19% - 9.74% APR |

Loan Terms | 5 to 20 years |

Promotions | None |

Earnest Student Loan Refinancing

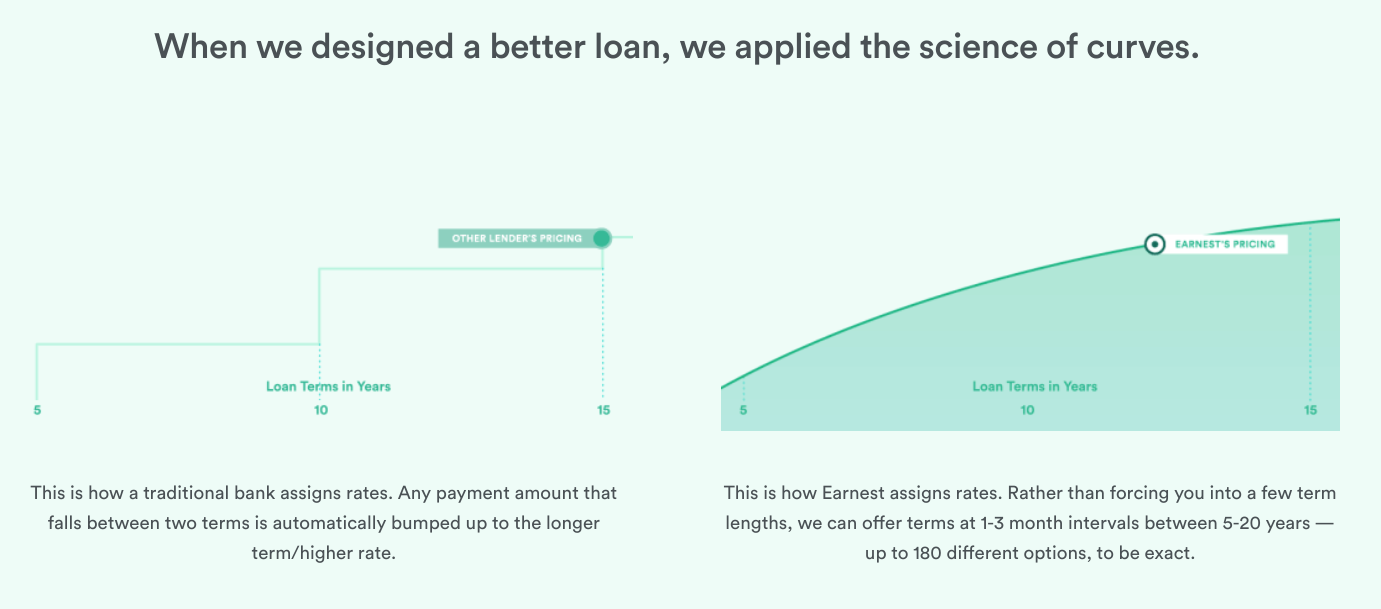

By far, one of the coolest features that Earnest offers borrowers is its “precision pricing” option. Basically this means that you can pick your monthly payment, and Earnest will come up with a term between 5 and 20 years that allows you to hit your exact monthly payment (and pay off your loan as soon as possible).

In total, Earnest is able to offer 180 different repayment terms. This precision pricing model means you could end up with a 7.5 year loan term. That's something you won't likely see at other lenders.

Rates and Terms

Earnest refinances loans ranging from $5,000 to $500,000. Rates on these loans are very competitive. It offers loans with the following rates:

- Variable Rate: 5.99% - 9.74% APR

- Fixed Rate: 5.19% - 9.74% APR

Note that Earnest doesn't currently allow cosigners on its refinance loans. However, Earnest is also one of the few lenders that does allow people with incomplete bachelor's or associate degrees to refinance with them.

How Does Earnest Refinancing Compare?

Earnest is consistently at the top of the pack when it comes to student loan refinancing. They have great rates and terms.

However, the typically don't offer any type of bonus incentive to refinance with them.

Check out this quick comparison:

Header |  | ||

|---|---|---|---|

Rating | |||

Variable APR | 5.99% - 9.74% | 5.99% - 9.99% | 5.28% - 8.99% |

Fixed APR | 5.19% - 9.74% | 3.99% - 9.99% | 5.48% - 8.94% |

Bonus Offer | None | Up to $500 | Up to $1,100 |

Cell |

Earnest Private Student Loans

Earnest is also offering undergraduate and graduate private student loans. They have highly competitive rates and terms for their undergraduate loans, as well as flexible repayment plans.

One of the best features of their private student loans is that they offer a 9 month grace period after you graduate before you have to start making payments. That's one of the longest that we've seen.

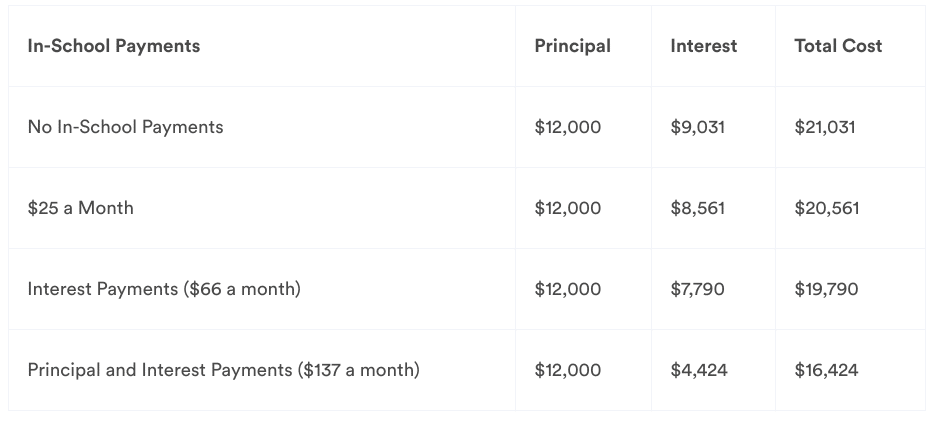

They also provide four different in-school repayment options: full deferment, fixed payments ($25/month), interest-only payments, or full payments (principal and interest).

Rates And Terms

It's important to note that Earnest's Precision Pricing option doesn't apply to its private student loans. If you apply with a cosigner, Earnest will offer you terms of 5,7,10,12, and 15 years. Meanwhile, if you apply alone, your only options will be 5- or 7-year repayment terms.

Currently, they offer the following rates:

Fixed Rates: 4.49% - 12.78% (includes 0.25% autopay discount)

Unfortunately, Earnest does not accept cosigner release requests on its cosigned private student loans. However, you may be able to remove a cosigner by refinancing your student loans.

See how Earnest compares on our list of the best private student loans.

How Does Earnest Private Student Loans Compare?

Earnest is consistently a top lender on our list of the best private student loans. They typically have some of the lowest rates on private loans for highly qualified borrowers.

However, to get the best rate you'll likely need a cosigner.

Check out this quick comparison:

Header |  | ||

|---|---|---|---|

Rating | |||

Minimum Loan | $1,000 | $1,000 | $3,000 |

APR Type | Fixed | Variable and Fixed | Variable and Fixed |

Cosigner? | Required | Not Required | Not Required |

Cell |

What Borrower Protections Are Available?

Earnest offers better protections than most private student loan lenders. For example, borrowers can defer loans during graduate school, Peace Corps, or active military service. Student loan deferment means that you are not required to make payments, but interest continues to accrue.

If you’re facing economic hardship, Earnest may allow you to put loans into forbearance. During forbearance interest continues to accrue on your loan, but you don’t have to make payments. Earnest specifically allows borrowers to take forbearance during an unpaid parental leave. The only major loss for Earnest’s borrowers is that they will not qualify for income based repayment programs.

The last protection that Earnest offers is a somewhat dubious one. Borrowers can skip one payment every 12 months with the extra payment being spread across the remaining payments. If you’re facing an unexpected car repair or hospital bill, skipping a payment sounds like a great benefit. Unfortunately, this raises your monthly minimum payment, and the amount of interest you’ll pay, so it’s tough to count it as an obvious win.

Who Qualifies To Apply?

Earnest has stringent underwriting criteria, but the criteria are quite different than most lenders. If you’re a recent grad who manages money well, you’re likely to qualify for a loan refinance with Earnest even if you don’t have a great credit score yet.

Earnest only requires a 650 credit score, but its financial underwriting doesn’t stop with credit scores. Borrowers must have a stable source of income, two months of savings in their bank account, and be current on rent, mortgage and student loans. Carrying too much credit card debt could disqualify you from the loan.

Earnest is also one of the few lenders we know of that allows you to refinance with incomplete bachelor’s or associate’s degrees. That means if you didn't finish college, you can still potentially qualify.

Earnest is one of the few lenders that also looks into your personal finances. To qualify to refinance with Earnest, you have to spend less than you’re earning. (Of course, this makes a ton of sense, but it’s notable that Earnest actually looks into it).

If you’re a parent looking to refinance Parent PLUS loans, Earnest has a refinancing option for you. The qualifying criteria are the same as for the student refinancing option.

Are There Any Fees?

Like most private lenders, Earnest doesn't charge fees for refinancing or taking out a private student loan. This means you won't have to worry about application and origination fees or prepayment penalties. Notably, Earnest also doesn't charge a fee for late payments.

Earnest Student Loan Manager

Earnest recently partnered with debt repayment company, Payitoff, to launch a free tool, called Student Loan Manager. The program is designed to help federal student loan borrowers with the following:

- Find a borrower's loan servicer

- Enroll eligible borrower's in federal repayment assistance programs

- Deliver automated guidance on federal assistance program eligibility

- Share individualized repayment plan recommendations

If you need assistance getting on track with your student loans, Student Loan Manager may be able to help.

How Do I Contact Earnest?

Earnest self-services all of its loans. So whether you're a prospective or existing customer, you can contact their team for assistance. Its customer service hours are Monday - Friday, 8 AM - 5 PM (PST). You can get in touch with them over the phone at 1-888-601-2801, via live chat, or by email at hello@meetearnest.com.

In addition to regular customer support, Earnest now offers Over The Phone submissions for student loan applications. To initiation a telephone application, contact Earnest at (866)-492-1222, Monday through Friday, 5 AM to 5 PM PST.

Remember to mention The College Investor when you call in order to start the application.

Is It Safe And Secure?

Earnest (formerly MeetEarnest) will not only require your personal information during the application process, but it will also ask you to link your bank and investment accounts. You'll also be asked to provide your LinkedIn credentials and to upload a government ID.

How does Earnest protect all this data? First, all the information you input is encrypted with bank-grade SSL technology before its sent to Earnest's off-site servers. The lender also pledges to never sell its borrower data to third parties.

Why Should You Trust Us

I am America’s Student Loan Debt Expert™ and have been actively writing about and covering student loans since 2009. Myself and the team here at The College Investor have been actively tracking student loan providers since 2015 and have reviewed, tested, and followed almost every provider and lender in the space.

Furthermore, our compliance team reviews the rates and terms on these listing every weekday to ensure they are accurate. That way you can be sure you're looking at an accurate and up-to-date rate when you're comparison shopping.

Who Is Earnest For And Is It Worth It?

Earnest doesn’t offer the lowest interest rates on the market. But it's the only lender that offers low rates to people with mediocre credit scores.

If you can save money by refinancing with Earnest, it could be a great move for you. On the other hand, if you’ve got a credit score above 700, you may find better rates. Consider comparing rates with other private lenders before choosing Earnest.

We recommend comparing Earnest with other lenders on the Credible Marketplace. Earnest isn't listed but most other lenders are. You can get up to a $1,000 gift card bonus no matter which lender you go with on Credible - so compare Earnest and see if they are the best for you. Check it out here!

Earnest Features

Min Loan Amount |

|

Max Loan Amount |

|

APR |

|

Auto-Pay Discount | 0.25% |

Rate Type | Fixed or variable |

Loan Terms | 5 to 20 years |

Origination Fees | None |

Prepayment Penalty | None |

In-School Payments |

|

Forbearance Period | Up to 12 months (issued in 3-month increments) |

Cosigners Allowed |

|

Cosigner Release | No |

Grace Period | 9 Months |

Eligible Schools | Title IV-accredited schools |

Customer Service Phone Number | 1-888-601-2801 |

Customer Service Hours | Mon-Fri, 8 AM - 5 PM (PST) |

Customer Service Email | hello@meetearnest.com |

Address For Sending Payments | PO Box 9202 Wilkes Barre, PA 18773-9202 |

Promotions | None |

Earnest Loans are made by Earnest Operations LLC or One American Bank, Member FDIC. or FinWise Bank, Member FDIC. Earnest Operations LLC, NMLS #1204917. 535 Mission St., Suite 1663, San Francisco, CA 94105. California Financing Law License 6054788. Visit www.earnest.com/licenses for a full list of licensed states. For California residents: Loans will be arranged or made pursuant to a California Financing Law License. One American Bank, 515 S. Minnesota Ave, Sioux Falls, SD 57104. FinWise Bank, 756 East Winchester, Suite 100, Murray, UT 84107.

Earnest loans are serviced by Earnest Operations LLC with support from Navient Solutions LLC (NMLS #212430). One American Bank, FinWise Bank, and Earnest LLC and its subsidiaries, including Earnest Operations LLC, are not sponsored by agencies of the United States of America.

nmlsconsumeraccess.org

© 2024 Earnest LLC. All rights reserved.

Earnest Student Loans Review

-

Rates And Fees

-

Application Process

-

Customer Service

-

Products And Services

Overall

Summary

Earnest makes paying loans back easy by providing a dashboard that can allow you to set your payment date to the date you want and need, set up bi-weekly payments to save on interest, skip a payment once per year, and more.

Pros

- Flexible student loan repayment options

- Typically offers competitive interest rates

- Provides both private loans and refinancing

Cons

- Fewer repayment options than federal loans

- Can’t add a cosigner to refinance loans

- Can’t remove cosigners from student loans

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Ashley Barnett