Health Savings Accounts (HSAs) are tax-advantaged individual savings accounts designed specifically to pay for the medical expenses of individuals who are enrolled in high-deductible health plans (HDHPs).

As long as HSA funds are used to pay for qualified medical expenses, account owners will not pay income tax on the amount withdrawn.

The funds in these accounts are similar to any normal investment account, with the account owner fully owning all contributions, even if they are made by an employer, and being able to invest the funds into various investment options the financial custodian offers, which will typically be a range of mutual or index funds.

If you don't have an HSA yet, check out our list of the Best Places To Open An HSA Account.

High Deductible Health Plans

High-deductible health plans offer lower premiums than traditional health insurance plans, with the trade-off being much higher deductibles (the amount that the insured person must pay before the insurance company will begin covering part or all of the cost of the medical treatment or item) than traditional health insurance plans.

For 2023, the health plan deductible rises to $1,500 for single tax filers, and $3,000 for joint tax filers.

For 2023, the maximum out-of-pocket expenses allowed rises significantly to $7,500 for singles and $15,000 for families.

For 2024, the health plan deductible will rise again to $1,600 for self-only, and $3,200 for families. The maximum out of pocket maximum also rises due to inflation, to $8,050 for self coverage, and $16,100 for family coverage.

These limits apply to the plan's in-network costs; there are no specific limits defined for out-of-network costs and coverage.

The Triple Tax Advantage Of HSAs

Contributions to HSAs are tax-advantaged at three levels:

1.) The amount of the contribution is tax-deferred, meaning it is deducted as an adjustment on page one of the account owner’s income tax return and not subject to income tax until it is withdrawn

2) Withdrawals used for qualified medical expenses are never taxed,

3) Investment gains within the account are also never taxed, as long as they are also used for qualified medical expenses.

These are three powerful benefits that exceed the advantages offered by many other tax-advantaged accounts.

These tax advantages are why we call the HSA the Secret IRA!

HSA Contribution Deadline

You must contribute to your health savings account by the tax filing deadline for the year in which you're making your HSA contribution.

Here are some deadlines:

- 2023 HSA Contribution Deadline: April 15, 2024

- 2024 HSA Contribution Deadline: April 15, 2025

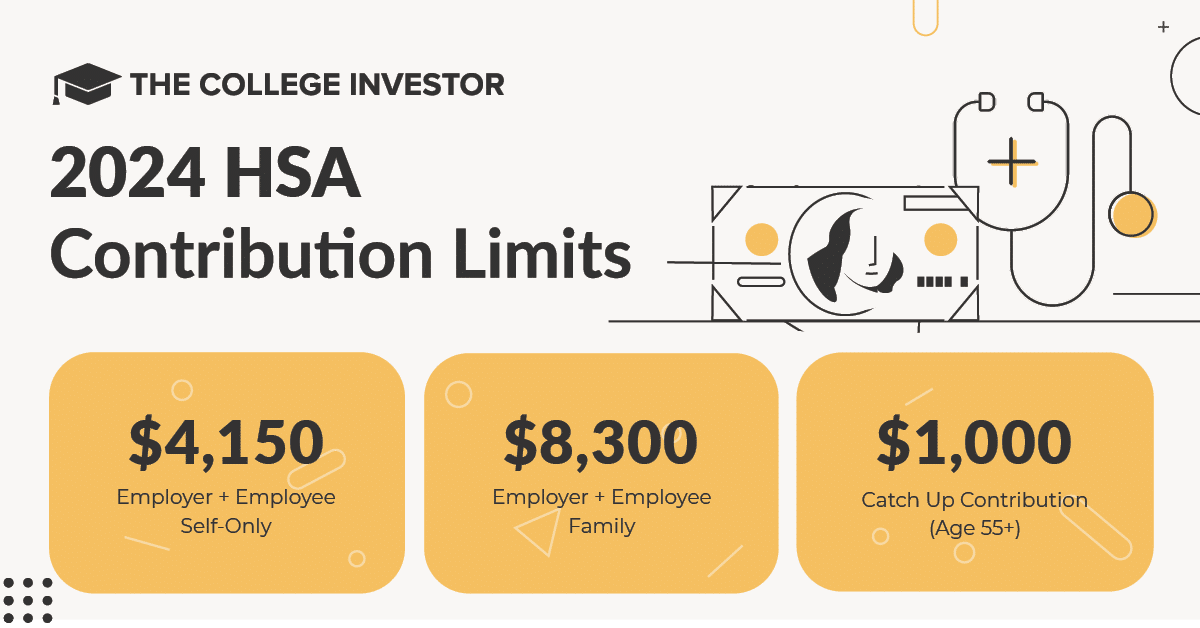

2024 HSA Contribution Limits

The IRS announced that they are significantly increasing the HSA contribution limits for 2024 due to inflation. You can read the official announcement here.

Contribution Type | 2024 Contribution Limit |

|---|---|

Employer + Employee | Self-Only: $4,150 Family: $8,300 |

Catch up contribution (Age 55 and up) | $1,000 |

There are no income limits to be eligible to contribute to an HSA although you do need to enroll through your employer and have a high-deductible health insurance plan in order to qualify.

Contributions are also 100% tax deductible at all income levels.

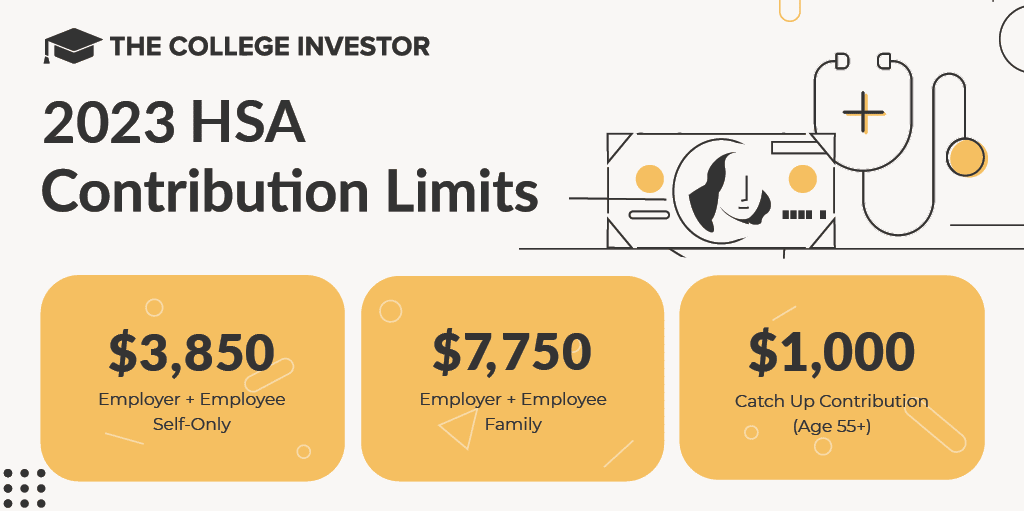

2023 HSA Contribution Limits

The IRS announced that they are significantly increasing the HSA contribution limits for 2023.

Contribution Type | 2023 Contribution Limit |

|---|---|

Employer + Employee | Self-Only: $3,850 Family: $7,750 |

Catch up contribution (Age 55 and up) | $1,000 |

Prior Years HSA Contribution Limits

If you're looking for past years health savings account contribution limits, check out the drop-down boxes below and find your year:

Here are the HSA contribution limits for 2022:

Contribution Type | 2022 Contribution Limit |

|---|---|

Employer + Employee | Self-Only: $3,650 Family: $7,300 |

Catch up contribution (Age 55 and up) | $1,000 |

Here are the HSA Contribution limits for 2021:

Contribution Type | 2021 Contribution Limit |

|---|---|

Employer + Employee | Self-Only: $3,600 Family: $7,200 |

Catch up contribution (Age 55 and up) | $1,000 |

Here are the HSA contribution limits for 2020:

Contribution Type | 2020 Contribution Limit |

|---|---|

Employer + Employee | Self-Only: $3,550 Family: $7,100 |

Catch up contribution (Age 55 and up) | $1,000 |

Here are the HSA contribution limits for 2019:

Contribution Type | 2019 Contribution Limit |

|---|---|

Employer + Employee | Self-Only: $3,500 Family: $7,000 |

Catch up contribution (Age 55 and up) | $1,000 |

Final Thoughts

For those who are already using an HDHP and expect to have a significant amount of qualified medical expenses, the benefits of avoiding income tax on these expenses far outweighs to effort to set up an HSA and incur the annual management fees that the financial custodian may charge.

Combined with the fact that there are no income limits or phase-outs to qualifying for HSAs, this can be a valuable tax-advantaged strategy for anyone with an HDHP.

Are you eligible to contribute to an HSA? If so, are you taking advantage of the triple tax advantage?

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Ohan Kayikchyan Ph.D., CFP®