AcreTrader is a real estate investing platform that focuses on farmland and agricultural land investing (including farms, wineries, timber, and more).

There are many different ways to invest in real estate - from single family homes to commercial real estate. But one area that has been growing in popularity is investing in farmland. And that's where AcreTrader comes in.

AcreTrader is a crowdfunded investment platform that allows you to buy shares in farmland and potentially see gains either through the appreciation of the land, or through rents received by the farmers who use the land.

Read our full AcreTrader review below and let us know what you think. Also consider looking at these real estate investment alternatives that could be of interest.

AcreTrader Details | |

|---|---|

Product Name | AcreTrader |

Min Invesment | $8,000 to $20,000 |

Annual Fee | 0.75% AUM + Other Fees |

Account Type | Traditional, Self Directed IRA |

Promotions | None |

Video Walkthrough

Check out our video walkthrough and review of AcreTrader here:

What Is AcreTrader?

AcreTrader is a crowdfunding platform with a unique offering. Instead of residential or commercial real estate, you can buy farmland shares. Farmland shares provide yet another way to diversify a portfolio.

The company was created in April 2018. They are located in Fayetteville, AR. They are also a member of the Better Business Bureau with an A+ rating and no reviews. They’ve been BBB-accredited since March 2019.The people behind AcreTrader consist of six board advisory members and over 120 employees and growing. The team’s experience is spread across financial services, technology, and agriculture.

The founder and CEO of AcreTrader is Carter Malloy. He grew up in a farming family and spent most of his career in financial services.

Investing In Farmland

AcreTrader offers the opportunity to invest in farmland shares. There are two ways to make money from your investment:

- Land appreciation

- Annual rent payments (dividends)

Returns are expected to be unlevered yield of 3% to 5% for lower-risk properties. While dividends are generally paid annually, the timing and amounts are not guaranteed.

AcreTrader selects less than 5% of the parcels they review. Selected parcels are placed into a legal entity that is separate from AcreTrader. This legal entity is what you are actually buying shares in. The legal entity owns the land. By proxy, you also own the land.

Minimum investments are often between $8,000 to $20,000 and holding periods for properties are usually five to 10 years. However, some properties have minimum investments of an acre or more.

Soon, you can sell shares that you bought before the expected holding period ends in the AcreTrader marketplace. However, this part of the platform is not yet available but expected to be online in the latter part of 2023. Selling your shares doesn’t mean you’ll get more than what you paid for them. You could get less, but this will offer greater liquidity during the life of the investment.

You don’t have to worry about managing farmland. You only own shares. AcreTrader handles all of the accounting, insurance, and working with farmers to ensure soil sustainability. In fact, AcreTrader will even send you a mid-year update - they actually send out a farm manager to each farm to verify what's happening and how things are going.

AcreTrader typically has a couple of investments on the site at a time. Since AcreTrader started, it has had multiple exits, which have done well. However, the performance of buying farmland shares is unknown over the long term.

You can check out the offerings on their site pretty easily here: AcreTrader >>

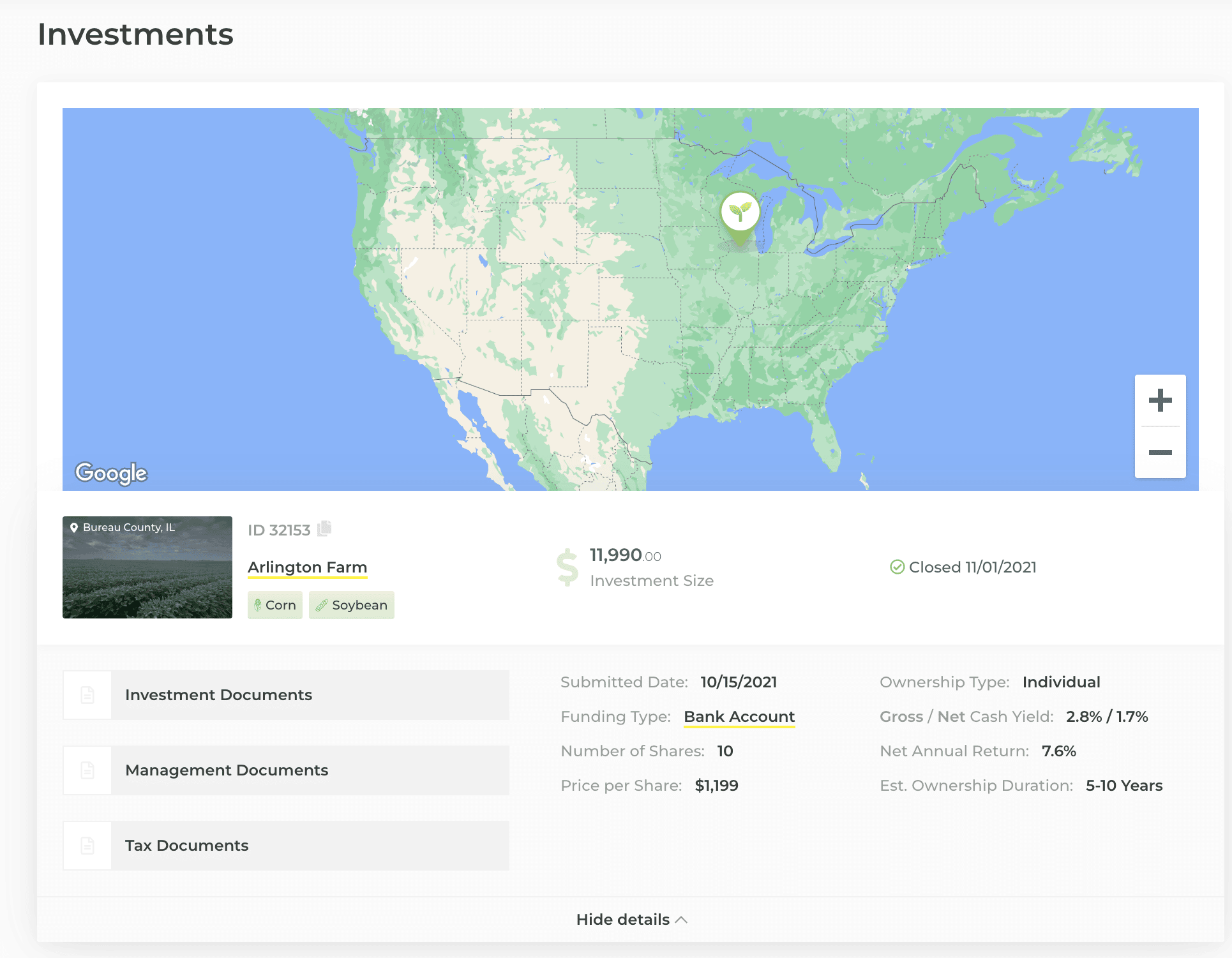

Screenshot of AcreTrader Investor Dashboard

AcreTrader Fees

Yes — there is a 0.75% annual management fee. Additionally, there are closing fees associated with each investment.

These fees are on par with most real estate investment platforms, such as Fundrise, RealtyMogul, and CrowdStreet.

How Does AcreTrader Compare?

Acretrader was the first major online real estate investment firm to focus on farmland. It's also run by a top-notch team with solid industry experience. However, they're not the only offering of real estate these days.

See how AcreTrader compares here:

Header |  |  | |

|---|---|---|---|

Rating | |||

AUM Fees | 0.75% | 1.00% - 2.00% | 1.00% |

Min Investment | $8,000 to $20,000 | $15,000 | $500 |

Open To Non-Accredited Investors? | |||

Cell |

How To Open An Account

You can open an account online at AcreTrader.com. AcreTrader offerings are “private placement,” Regulation D investments. This means one must be an accredited investor to purchase any farmland shares.

AcreTrader is planning to offer Regulation A+ investments, which will open the platform up to the general investing community. There isn’t a set date at this time on when that might occur.

They have a very easy to use interface, with the time it takes to invest is just minutes, and 100% of the investment can take place within our app (you don’t even need to go to email to do DocuSign).

They have the ability for users to log into their bank account inside the app and load funds or invest directly from their bank account. Very easy to use.

Plus, they keep office hours of roughly 7am to 6pm with someone always available to answer the phone. And they are very responsive online.

Is My Money Safe?

When you buy shares, the money goes into escrow at North Capital Private Securities Corporation, a registered broker-dealer and a member of FINRA and SIPC. Once the funding target is met, funds are transferred to the legal entity holding the farmland.

If AcreTrader goes out of business, your invested money isn’t lost. Remember that the entity holding farmland shares is separate from AcreTrader. A different management team will be put in place to run the entity in the event AcreTrader goes out of business. But what exactly happens thereafter isn’t well known since AcreTrader owns the crowdfunded platform.

Just like any investment, you can lose some or all of your investment.

Why Should You Trust Us

I have been writing about and reviewing investment firms and covering real estate investments for 10 years. I have personally owned single family, multi-family, real estate syndications, private partnerships, and more - including farmland. I'm well versed in both the investment aspect and tax aspect of these products and services.

Furthermore, we have our compliance team that regularly checks and updates the facts on our reviews.

Who Is This For And Final Thoughts

If you are an accredited investor and want to try something completely new, AcreTrader may be worth it. Although, you might want to wait for them to build up a track record.

Another competitor to consider is FarmTogether, although it does appear AcreTrader has more deal flow on their platform.

Investing in farmland shares does offer diversification, which is different from performance. In comparison to equity investing, farmland shares offer low volatility. Farmland shares don’t use leverage and they have the potential to be an inflation hedge.

A few drawbacks are that the platform is unproven and the investment is illiquid. And with the current political climate creating a very negative impact on farmers, it could be tough in the short term.

The 0.75% annual fee and closing cost will impact returns. Also, once the platform is available to general investors, more will be known about the performance of investments since there should be more people investing.

AcreTrader Common Questions

Here are some of the most common questions we get about AcreTrader.

Is AcreTrader Legit?

Yes! AcreTrader is an SEC registered investment platform that allows you to invest in farmland.

Why invest in farmland?

Farmland has historically provided steady, non-correlated returns. For some investors, this can make a lot of sense in their portfolio.

Are non-accredited investors allowed?

At this point, AcreTrader is only open to accredited investors.

The College Investor will receive $175 for any successful referral to the AcreTrader Platform.

AcreTrader Review

-

Pricing and Fees

-

Ease of Use

-

Customer Service

-

Products and Services

-

Risk Mitigation

Overall

Summary

AcreTrader helps you invest in U.S. agricultural land and start building a portfolio of quality farmland real estate for as little as $8,000.

Pros

- Invest in farmland online, via handpicked deal flow

- Low investment minimums

- Low AUM

Cons

- Slow deal flow due to nature of vetting

- Some deal minimums are higher than the platform minimum

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Ashley Barnett