A 403(b) plan is a tax-advantaged retirement savings plan designed for employees of certain tax-exempt organizations, such as public schools, colleges, universities, hospitals, and religious organizations. The plan allows eligible employees to save for retirement by making pre-tax contributions, reducing their taxable income and providing tax-deferred growth on their investments.

However, like all similar retirement plans (401k or IRA), there are contribution limits to how much you can contribute every year. Here are the limits for 2023 and 2024, and a basic guide to how the 403b contribution limits work.

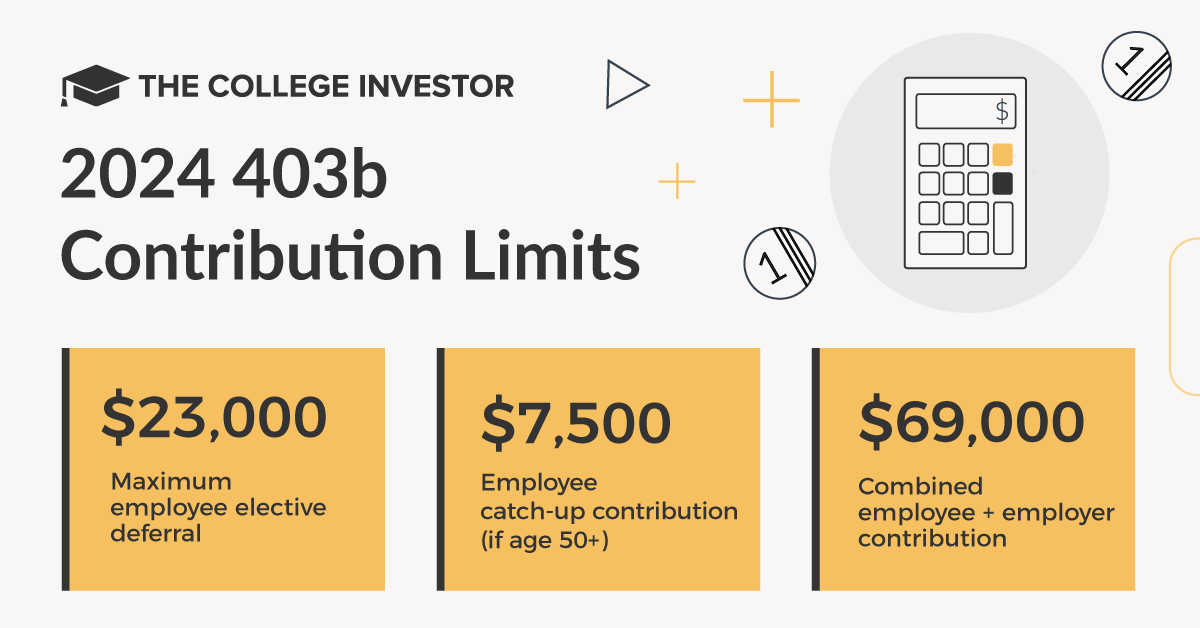

2024 403(b) Contribution Limits

The 403b contribution limits for 2024 are:

Contribution Type | Limit |

|---|---|

Maximum employee elective deferral | $23,000 |

Employee catch-up contribution (if age 50+) | $7,500 |

Combined employee and employer contribution | $69,000 |

This means that for savers under 50, you can defer $23,000 per year, or a total combined $69,000. If you're over 50, you can save $30,500 per year, or a combined limit of $76,500.

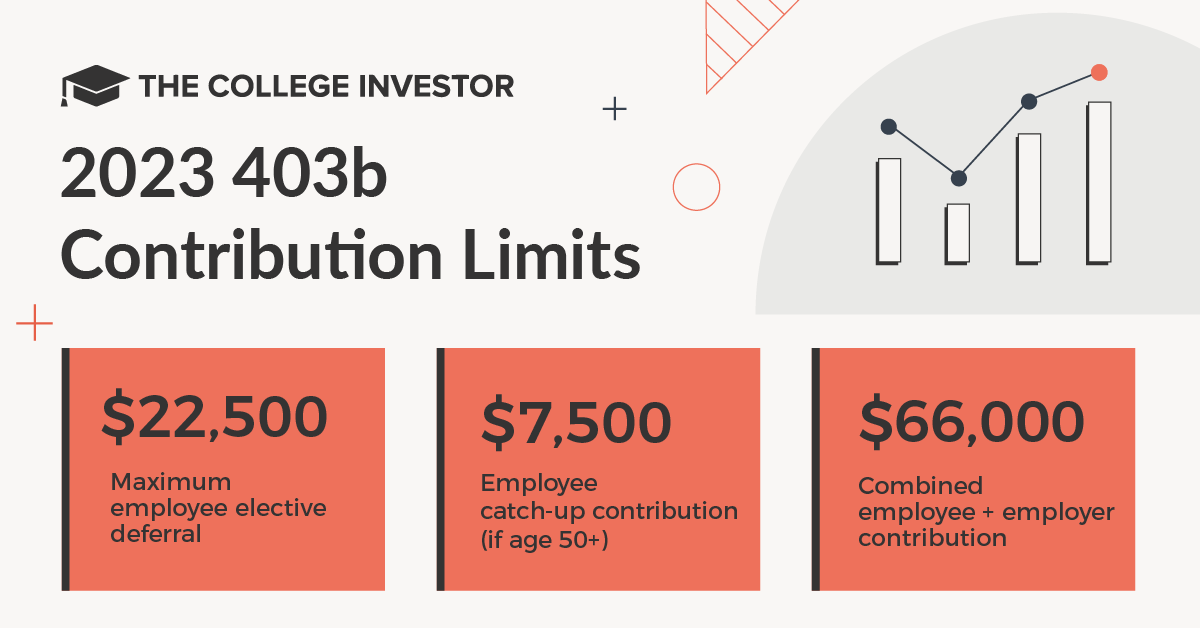

2023 403(b) Contribution Limits

The 403b contribution limits for 2023 are:

Contribution Type | Limit |

|---|---|

Maximum employee elective deferral | $22,500 |

Employee catch-up contribution (if age 50+) | $7,500 |

Combined employee and employer contribution | $66,000 |

This means that for savers under 50, you can defer $22,500 per year, or a total combined $66,000. If you're over 50, you can save $30,000 per year, or a combined limit of $73,500.

Prior Years' Contribution Limits

If you're looking for reference to past year's limits, here you go:

2022 403b Contribution Limits

This year was the first year inflation was really making contribution limits rise.

Contribution Type | Limit |

|---|---|

Maximum employee elective deferral | $20,500 |

Employee catch-up contribution (if age 50+) | $6,500 |

Combined employee and employer contribution | $61,000 |

2021 403b Contribution Limits

Contribution Type | Limit |

|---|---|

Maximum employee elective deferral | $19,500 |

Employee catch-up contribution (if age 50+) | $6,500 |

Combined employee and employer contribution | $58,000 |

2020 403b Contribution Limits

Contribution Type | Limit |

|---|---|

Maximum employee elective deferral | $19,500 |

Employee catch-up contribution (if age 50+) | $6,500 |

Combined employee and employer contribution | $57,000 |

Understanding 403(b) Contribution Limits

There are three main types of contributions made to a 403b plan:

- Employee elective deferrals: The employee chooses to contribute a portion of their salary to the plan.

- Employer contributions: The employer may choose to contribute to the employee's account, usually through a matching program.

- Non-elective contributions: These are contributions made by the employer on behalf of the employee, regardless of whether the employee contributes.

Employee Elective Deferrals

In 2023, the maximum amount an employee can contribute to their 403b plan through elective deferrals is $22,500. This limit applies to all employees, regardless of their age or years of service.

Employer Contributions

There is no specific limit for employer contributions to a 403b plan. However, the total combined contributions, including both employee elective deferrals and employer contributions, are subject to a limit. In 2023, that limit is $66,000 for employees under 50, and $73,500 for employees over 50.

Total Combined Contributions

The total combined contributions to a 403b plan in 2023 cannot exceed the lesser of:

- 100% of the employee's includible compensation for the year, or

- $66,000 (subject to cost-of-living adjustments).

This limit includes employee elective deferrals, employer contributions, and non-elective contributions.

Catch-Up Contributions For Individuals Aged 50 And Above

Employees aged 50 or older are eligible to make additional catch-up contributions to their 403b plan. In 2023, the catch-up contribution limit is $7,500. This means that an employee aged 50 or older can contribute a total of $30,000 through elective deferrals ($22,500 + $7,500).

Factors Affecting 403(b) Contribution Limits

There are other factors impacts 403b contribution limits, some of which are unique to 403b plans.

Employee's Age

As mentioned earlier, employees aged 50 or older can make additional catch-up contributions, which increases their overall contribution limit. In 2023, this catch-up contribution for age is $7,500.

Years Of Service

Certain employees with 15 or more years of service at a qualifying organization may be eligible for an increased contribution limit. This is unique to 403b plans.

The additional amount is up to $3,000 per year, for a maximum lifetime increase of $15,000. This is subject to specific plan provisions, so employees should consult their plan documents for eligibility and rules.

The exact amount you can contribute may be reduced based on your previous contributions to your employer's plans. You should check with your plan before taking advantage of this option.

Compensation

The maximum contribution limit is based on the employee's includible compensation. Includible compensation refers to the total taxable income an employee receives from their employer, which is used to determine the maximum allowable contribution. You cannot contribute more than 100% of your includable compensation.

Coordination With Other Retirement Plans

Employees who participate in multiple retirement plans, such as a 403b and a 401k, should be aware of the combined contribution limits. The total amount contributed across all plans cannot exceed the individual limits for each type of plan.

How To Maximize Your 403(b) Contributions

Maximizing your 403b is a great way to build wealth over the long term. However, depending on your ability, it could be challenging to do at first. Here are some tips to try and maximize your 403b contributions.

Planning Ahead

To make the most of your 403b plan, it's essential to plan ahead and evaluate your financial goals. Determine how much you can afford to contribute and adjust your contributions as needed to reach your retirement savings goals.

Take Advantage Of Employer Matching

If your employer offers a matching contribution, try to contribute at least enough to receive the full match. This is essentially free money, and it can significantly boost your retirement savings.

Review Your Contribution Limits Annually

Contribution limits may change due to cost-of-living adjustments announced by the IRS. In fact, over the last few years, contributions limits have been rising substantially. Review your contribution limits each year and adjust your contributions accordingly to maximize your savings potential.

Final Thoughts

Understanding and maximizing your 403b contribution limits is crucial for a successful retirement savings plan. By staying informed about the various factors affecting your contribution limits and taking advantage of opportunities to increase your savings, you can build a solid foundation for a comfortable retirement.

Frequently Asked Questions

Here are some of the most frequently asked questions about 403(b) plans and contribution limits.

What is the 403b contribution limit for 2023?

The employee elective deferral limit for 2023 is $22,500. For employees aged 50 or older, they can make an additional catch-up contribution of $7,500. The overall combined limit is $66,000.

Can I contribute to both a 401k and a 403b plan?

Yes, you can contribute to both plans, but the combined contributions cannot exceed the individual limits for each type of plan.

Do employer contributions count towards the 403b contribution limit?

Employer contributions do not count towards the employee elective deferral limit but are included in the total combined contribution limit.

How do catch-up contributions work for employees aged 50 and older?

Employees aged 50 or older can contribute an additional $7,500 in catch-up contributions to their 403b plan in 2023, bringing their total elective deferral limit to $30,000.

Can I increase my 403b contribution limit if I have 15 years of service?

Certain employees with 15 or more years of service at a qualifying organization may be eligible for an increased contribution limit of up to $3,000 per year, for a maximum lifetime increase of $15,000.

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Chris Muller Reviewed by: Ohan Kayikchyan Ph.D., CFP®