With the cost of college constantly on the rise, simply putting money away in a savings account for a child’s educational future may not be enough. Setting up and contributing to a 529 plan — a tax-advantaged savings plan for educational costs — is one of the best ways to start saving early and maximize those savings.

And you don't have to be a parent to take advantage of a 529 plan. Anyone — grandparents, aunts and uncles, godparents, and friends — can establish a 529 to invest in the educational future of a child they care about.

There are two different kinds of 529s available in the United States: education savings plans and prepaid tuition plans. Education savings plans are much more common, and they’re usually what people are referring to when they talk about 529s, but this piece will talk you through each form.

Within each kind of plan, however, there are different investment options, minimum contributions, fees, and restrictions on fund usage. Making a decision can feel overwhelming, especially when college is years away, but as long as you know your financial goals and the options that matter most to you, there are excellent tools available to help you compare plans and make the best choice for you and the people you care about.

Education Savings Plans vs. Prepaid Tuition Plans

An education savings plan is an investment account sponsored by a state government that allows you to save money for a beneficiary’s future education. Its funds can be used to pay for any qualified educational expenses, including tuition, fees, and room and board, and its earnings are not subject to federal tax.

Most of the time, people use these plans to save and pay for post-secondary education in the United States, but they can also be used in a more limited fashion to pay for public, private, and religious education on the elementary and secondary levels. Since these are investment funds, they benefit from having plenty of time to grow.

Prepaid tuition plans are a much less common form of 529. Rather than growing contributions through investment, these plans allow you to prepay tuition at some public and private colleges and universities. With most plans, contributors purchase credits or “Tuition Certificates” at current rates, and beneficiaries can then redeem them for equivalent credits or tuition in the future, no matter how much the cost of tuition per credit has gone up. Since these funds do not need time to grow, and can only be used at specific institutions, they can work well for beneficiaries who are already nearing college.

Contributing to an Education Savings Plan

Education savings plans are very flexible investments. Most people think about this kind of 529 as an investment made by parents in the educational future of their child. While that’s the most common configuration, anyone can set up an education savings plan and designate anyone as the beneficiary — a niece or nephew, a friend’s child, or even themselves — as long as the beneficiary is a U.S. citizen or resident alien.

You can contribute to multiple plans, and one beneficiary can be the recipient of funds from multiple contributors. Moreover, though these plans are sponsored by state governments, you don’t usually have to be a resident to invest in a given state’s plans.

Each available plan offers a range of investment options — usually mutual funds and exchange-traded funds — with one of two approaches.

The age-based approach shifts the mix of assets so that it becomes less risky as the beneficiary approaches college age, much like target-based funds do with retirement investments.

A static fund will maintain the same profile throughout the life of the investment. Many state plans also offer money market accounts and principal-protected bank products.

Fees and Restrictions on Educational Savings Plans

These plans usually have some restrictions on contributions. Most plans have minimums for initial and subsequent contributions, though these limits are often quite low.

Most plans also have a maximum contribution limit, and that limit is not based on how much a given contributor has put into a plan, but on how much has been contributed to all plans with the same designated beneficiary in that state. One solution is to open additional plans in other states.

Individual yearly contributions over $14,000 may trigger the gift tax, though it’s unlikely to be a problem for most investors.

Education savings plans also have a number of one-time and recurring fees which vary from plan to plan, just as investment options and contribution limits do. In general, plans will charge a fee for the initial enrollment, as well as ongoing or annual fees for account maintenance, asset management, and program management.

Using the Funds in an Education Savings Plan

The funds from an education savings plan can be withdrawn at any time. There are no limits for yearly withdrawals to pay for post-secondary education, though you can only withdraw $10,000 per year for elementary or secondary education.

There is also no requirement that beneficiaries begin withdrawal of funds by a certain age, so there is no need to worry if your designated beneficiary chooses to wait a while before heading to college.

As long as the funds from these plans are used to pay for qualified educational expenses, they are not subject to federal tax. Qualified educational expenses include tuition, mandatory fees, books, supplies, and equipment, plus room and board for students attending half-time or more. This means that even if a beneficiary receives significant scholarships, the education savings plan can be used to pay for many things that scholarships often don’t cover.

Moreover, leftover funds can be rolled into the plans of new beneficiaries, such as younger siblings, or even into a 529 ABLE account, a savings plan for Americans with disabilities. These are important options to remember, as any funds withdrawn that are not used on qualified educational expenses are subject to taxes on the plan’s earnings and an additional 10% penalty.

Contributing to a Prepaid Tuition Plan

Prepaid tuition plans are offered by a number of states as well as a consortium of nearly 300 private colleges. Unlike education savings plans, which cover a range of educational expenses, these plans can only be used to cover tuition at colleges and universities.

State-based prepaid tuition plans can only be used to pay for institutions within that state. In some states, your contributions pay tuition directly, while in others, you are purchasing “units” equivalent to a certain percentage of yearly tuition.

Private College 529, the only prepaid tuition plan, does not lock the beneficiary into a particular institution or set of institutions. It turns contributed funds into Tuition Certificates that can be redeemed at any of the participating colleges. How much tuition each of those certificates will pay for in future, however, depends on the current tuition rate at each of the participating schools; $10,000 in Tuition Certificates purchased now may later be worth half a year at one institution but only a third of a year at another.

In both cases, the value of your contributions increases as tuition costs rise, but just as with education savings plans, those “earnings” are not subject to federal tax.

Fees and Restrictions on Prepaid Tuition Plans

Since these plans are not investment accounts, they have much lower associated fees — usually just an enrollment fee.

Using the Funds in a Prepaid Tuition Plan

In general, state-based prepaid tuition plans only allow you to use the funds for tuition — not room and board, books, or other school fees. The Private College 529 Tuition Certificates can be used to cover tuition and mandatory fees.

With state-based plans, the funds can only be used to pay for tuition at that state’s institutions, but that doesn’t mean the beneficiary is restricted to one school. Most of these plans allow you to use your prepaid tuition at any of the state’s public institutions, and some plans, like Massachusetts’s “U.Plan,” even include some private colleges and universities.

Only four states — Mississippi, Massachusetts, Florida, and Washington — currently provide a full-faith guarantee on the funds in their plans. Others only guarantee the funds that are currently in the plan, and some provide no guarantees at all. Given the frequency of state budget shortfalls, beneficiaries of state-based plans may have trouble redeeming their tuition as planned.

Beneficiaries of Private College 529 plans can use their Tuition Certificates at any of the participating institutions, but again, given the disparity in tuition rates across those institutions, the funds in the plan may go much further at some colleges than others.

Much like the penalty you pay for using education savings plan funds for non-qualified uses, you will often lose some of your money if you want to use prepaid tuition funds at another set of institutions, but the penalties vary from plan to plan. Private College 529 funds can be switched to a new beneficiary, rolled over into a state-based 529, or directly refunded. If the refunded money is not used for qualified educational expenses, however, it is subject to the same taxes and 10% penalty as education savings plan funds.

Selecting and Setting Up a 529 Plan

As you can see, education savings plans and prepaid tuition plans are very different, so you should consider your needs, and the needs and goals of your beneficiary, when choosing which approach to take.

Beyond this most basic choice, however, there are many options, especially since there are rarely residency restrictions for state-based plans. As a result, it's really worth it to compare plans. The most important things to consider are the investment approaches offered, the fees and expenses required, and the minimum initial and recurring contributions. Some plans will even waive or reduce fees if you enroll in an automatic contribution plan — including one that deducts directly from your paycheck — or maintain a high balance, so it helps to shop around.

Moreover, while residency may not be required to join most state-based plans, many will exempt residents from state taxes on earnings, waive some fees for residents, or allow you to deduct a portion of your contributions from your state income tax.

Some states offer matching grants to lower- and middle-income residents, and Rhode Island even provides seed money for a 529 to every baby born in the state. All that being said, the recurring fees for your state’s plan may be so high they wipe out any residency benefits, so it is important to compare carefully.

Where to Start:

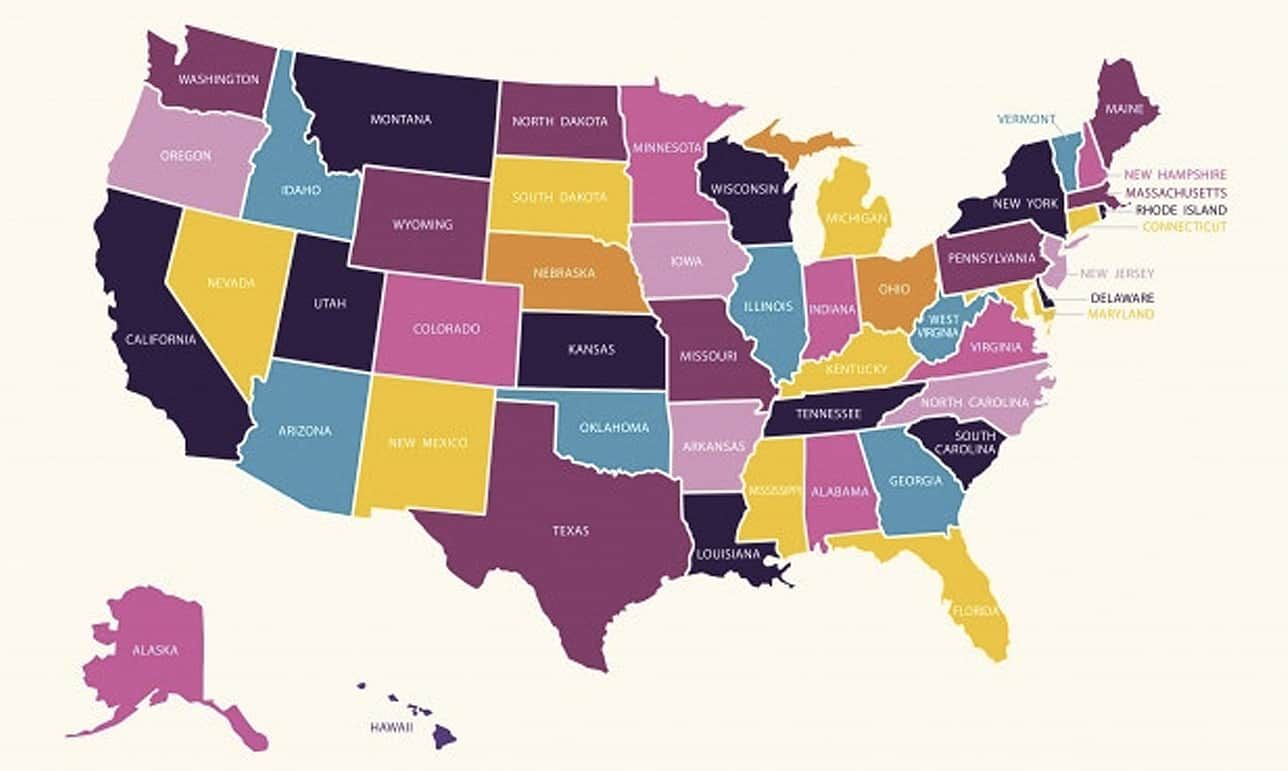

Thankfully there are a few tools to help you make an informed decision. Check out this map below and see where to start:

When you’ve chosen your plan, there’s one remaining question: how do you set it up? 529s can be purchased directly from the state or organization that sponsors the plan or set up through a broker. Purchasing through a broker will incur additional fees, however, so in most cases, it makes sense to set up your plan directly.

With all of these options — and a few good tools to help you sort through them — there’s bound to be a 529 plan that works for you. And remember: just as it’s never too early to start investing in a child’s education, it’s never too late either!

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller