Looking for the latest technology to help you eliminate student loan debt? That's where the Chipper App comes in!

Chipper is a true one-stop-shop for student loans. Chipper is a student loan repayment app that can help you find the best student loan repayment plan, loan forgiveness options, and even let you round-up your purchases to "chip" away at your student loan debt faster!

Will it help you pay down your student loan debt faster? Here’s what we found.

Chipper App Details | |

|---|---|

Product Name | Chipper |

Options | Find the best repayment plan |

Cost | Free |

Promotions | None |

What Is The Chipper App?

The Chipper App is a tool that has helped over 75,000+ borrowers pay off their student loan debts more effectively by helping them navigate the repayment plans and forgiveness options out there.

Chipper also offers a “round-up” feature that automatically rounds up credit and debit card purchases to the nearest dollar. Round-Up balances stay in your linked bank account and are applied directly to your (federal and private) student loan accounts weekly on Mondays. Users can also choose a minimum or maximum amount for Round-Up deposits per month, so Chipper can plan to evenly distribute weekly deposits according to your preferences.

Chipper is an accurate name for this app. You’ll chip away at student loans.

What Does It Offer?

Chipper works by linking your student loans to their app. You do this within the app, and Chipper will pull all of your loan data and analyze it. Right now, navigating repayment plans and forgiveness programs are only available for federal student loans. However, Round-Ups and other features are available for both federal and private loans.

Optimize Your Repayment Plan

Once you link your loans, the app guides you through exploring your options and enrolling you in the right repayment plan without ever leaving the app.

See If Qualify For A Forgiveness Program

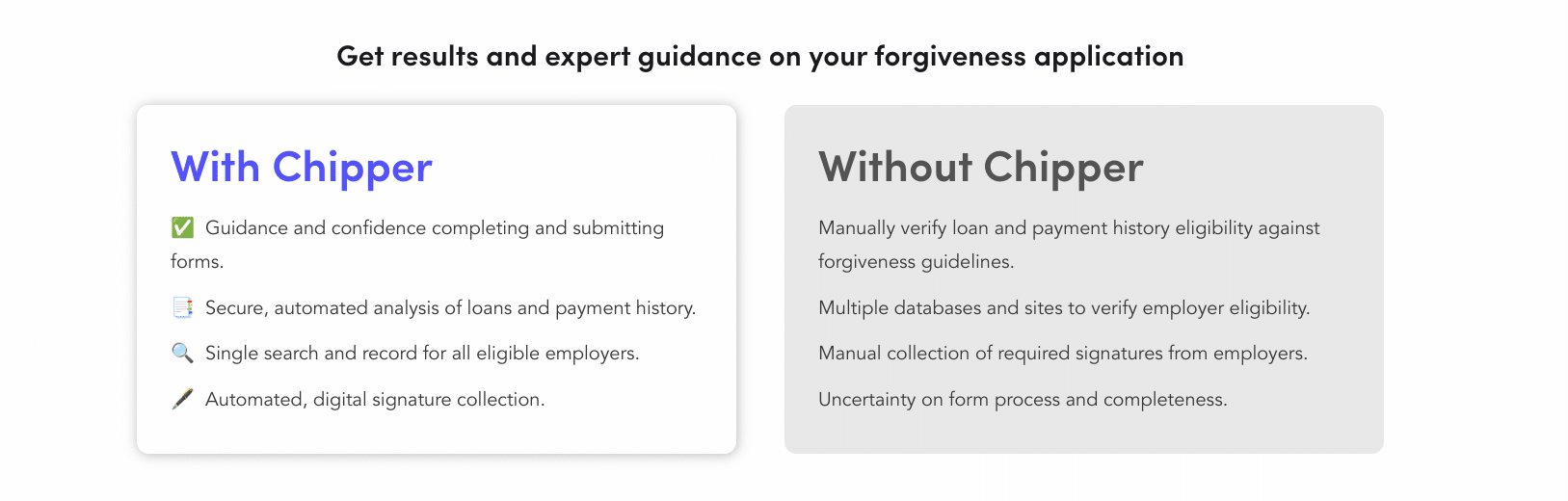

Chipper looks at over 150 loan assistance, income-driven repayment plans, and forgiveness programs including Public Service Loan Forgiveness (PSLF) and Teacher Loan Forgiveness (TLF). In the case of PSLF, Chipper can evaluate your payment history, employer eligibility, and automatically collect your signatures on the appropriate forms.

Note that in October 2021, the Department of Education announced a slew of changes to PSLF that are intended to simplify the program and expand eligibility. Due to these changes, it could be worth it to check to see if you qualify, even if your application has been denied in the past.

Chipper has helped borrowers become eligible for more than $81M in student loan forgiveness.

Round-Ups

Once you're on track with repayment, you can take advantage of Chipper's Round-ups, where you can round-up your purchases and apply that amount to you student loans. This is the core concept of "chipping" away at your student loan debt.

Note that while you can't link private student loans (for things like tracking their balances and payment histories), you can connect them to make payments with Round-ups. This is great news if you're a private student loan borrower and you're primarily wanting to sign up with Chipper to use its Round-ups feature.

Note: Chipper doesn't touch Round-Up funds, it just facilitates the application of those funds to the student loans.

More Features "Coming Soon"

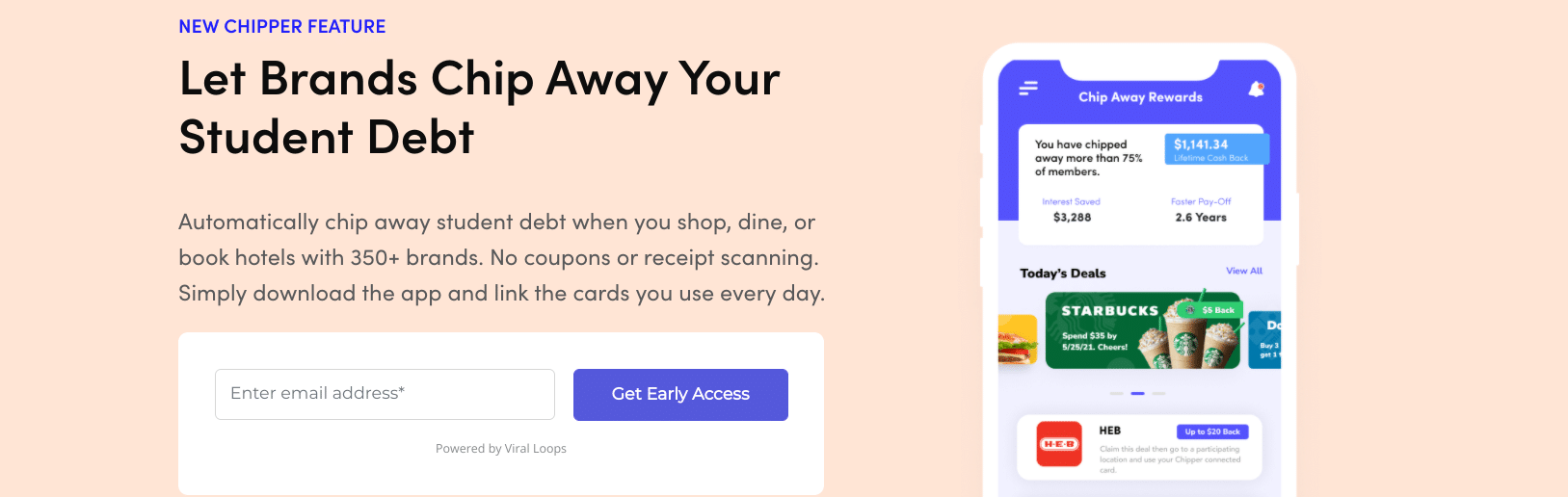

Soon, Chipper is launching Chipper Rewards. You can sign up for early access today.

Rewards will work like Round-Ups where the cash rewards earned actually get deposited into their student loan accounts.

Are There Any Fees?

Chipper is focusing on creating as much value as possible for its members before federal student loan payments resume in September 2022, so they've made their service free until then. After that, they may resume their subscription service of $2 or $4/mo.

How Does Chipper Compare?

There are two other main apps that can help you pay down your student loan debt and help you enroll in loan forgiveness: GradJoy and Snowball Wealth.

GradJoy - This app also allows you to connects your loans, find the best repayment plan, and make all your loan payments from this simple app. They don't have a real human feature, and their pricing isn't transparent. Learn more here.

Snowball Wealth - This app also connects your loans and helps you find the best repayment plan. This app is very community-driven, mostly focused on women. This app is free, and makes money by recommending student loan refinancing if it makes sense. Learn more here.

Header | |||

|---|---|---|---|

Rating | |||

Cost | Free | Unclear | Free |

IDR Plan/PSLF Document Prep | |||

Mobile App | |||

Web Access | |||

Cell |

If you're looking for a real human approach to help you with your student loan debt, there is only one real solution - The Student Loan Planner. This is a group of CFPs that are trained in helping people with their student loans. However, the price is significantly higher, since you're paying a financial planner to craft a plan for you. Learn more about Student Loan Planner here.

How Do I Open An Account?

You can create an account with Chipper on their website in less than two minutes. You'll only need to provide your name and email address to get started. Once your account is created, you can start to link your loan servicers. You can also download the mobile app to manage your account on the go.

Is It Safe And Secure?

You won't actually have any money on deposit with Chipper - your money stays in your bank account until the authorized transfers occur. Still, it will have access to a lot of your personal, student loan, and transaction information.

Chipper protects your private data with 256-bit encryption (the same level of encryption that banks and other financial institutions use). However, it's unclear if there are any other security tools available such as two-factor account authentication.

How Do I Contact Chipper?

You can get in touch with Chipper by submitting a question through the chat bot on their website and in-app. If the bot can't automatically answer your question, a member of the Chipper team will reach out to you to provide personal assistance.

Is It Worth It?

Compared with other debt payoff apps, I love the Chipper app. When looking at your student loan repayment, there are over 100 different options for borrowers. Having a technology at your disposal that automatically helps you analyze and compare your options is great.

If you're looking for help with your student loans, check out Chipper here >>

Chipper FAQs

Let's answer a few of the most common questions that people ask about Chipper.

How does Chipper make money?

Chipper is backed by several large investors including Sofi and Nerdwallet. They are currently offering their product for free and do not make money. In the future they will probably make money through payment processing and other add-ons.

Does Chipper offer live consultations?

No, while at one time Chipper offered a Student Loan Concierge service, they've moved away from that as they've continued to improve their app. They still have humans to help out, but that's no longer the core of their product.

Can you search for eligible PSLF employers with Chipper?

Yes, Chipper offers a single search and record for all eligible employers.

Does Chipper offer student loans?

No, Chipper is not a lender and does not offer student loans. However, we could see Chipper recommending third-party student loan refinancing lenders down the road, as some of its competitors already do this.

Chipper Features

Products |

|

Cost | Free Until Student Loan Pause Ends |

IDR Plan Filing Assistance | Yes |

PSLF Filing Assistance | Yes |

Payment Tracking | Yes |

Average User Savings | $307 per month |

Human Assistance Available | Yes |

Loan Types |

|

Employer Accounts Available | Yes |

Customer Service Options | Email, chatbot, support tickets and help center |

Mobile App Availability | iOS and Android |

Web/Desktop Account Access | Yes |

Promotions | Free Until 9/1/22 |

Chipper App

-

Pricing And Fees

-

Tools and Resources

-

Ease Of Use

-

Customer Service

Overall

Summary

Chipper App is an app that’s designed to help you pay off your student loans and find the best repayment plan. They will also help you find loan forgiveness options, and their tools allow you to round-up your purchases to “chip” away your loans faster.

Pros

- Find the optimal repayment plan

- Compare your loan forgiveness options

- Round-up purchases to pay off loans faster

Cons

- Users can link private student loans to Chipper, but there just aren’t any repayment or forgiveness options for private student loans.

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Claire Tak