Every brokerage account has what is called a "sweep" feature or sweep account. It can be both a benefit or a detriment depending on how you use it and what options you selected when you set it up.

When you setup a new brokerage account, you usually have to assign what you do with your cash. This is called the sweep. As you deposit cash into an account, it will, by default, go into the sweep. Also, if you elect to have dividends paid in cash, they will sweep into the account.

The great thing about the sweep account is that when you want to buy more securities, the cash is automatically swept back into your brokerage to buy the securities. If you trade on margin, the cash in your sweep account will also be counted towards your margin requirement.

Benefits of a Sweep Account

There are several benefits of setting up a sweep account correctly. First, most sweep accounts are FDIC insured, which provides your cash with a level of protection.

Second, you can earn interest on the money in the sweep. If the money just sat in your brokerage, chances are you would earn nothing. To earn some interest with the cash outside of a sweep account, you would have to invest in a money market fund.

Third, many brokerages are now allowing you to set their money market fund as your default for the sweep account (but you have to make that choice)!

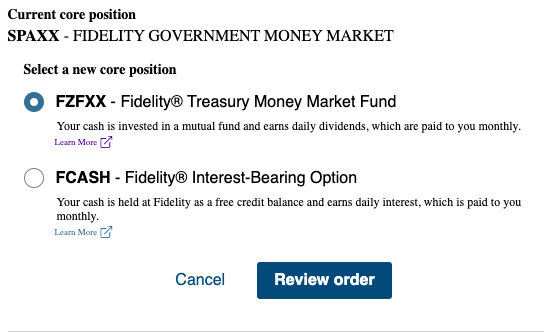

For example, Fidelity allows the following sweep account options (they call it the core account):

- Fidelity Government Money Market Fund (SPAXX) - 4.91% Yield

- Fidelity Treasury Fund (FZFXX) - 4.91% Yield

- Taxable Interest Bearing Cash (FCASH) - 2.69% APY

Interest rates as of August 12, 2023.

Dangers of a Sweep Account

It is important to note that sweep accounts are one of the most profitable products that investment firms offer. You may wonder why? Because most individuals don't set them up correctly, and as a result, the firm pays you nothing on you cash.

When setting up your sweep account, look at the options available to you. Money market, savings accounts, etc. Don't just settle for a yield of 0.01%. Even some accounts (like Robinhood) pay well, but below the market - meaning they can profit on your cash.

Here's an example straight from the company's earnings report. The company anticipates making an extra $15 million due to rising interest rates. If they pay you 4.90% on Robinhood Gold, but they can earn 5.25% or more buying safe US treasury bills, they get to profit on that 0.35%. Multiply that out by millions of dollars invested, and that's a sizable income.

When you're earning 0.01% - like some major brokerage firms today charge - they're making even more money on you!

If you don't make a choice, many brokerages just keep your cash sitting there - doing nothing for you! You have to make a choice to put your money to work for you!

How To Select And Setup Your Sweep Account Properly

Now that you know what a sweep account is, let's talk about how to actually set one up properly so you're not missing out on that sweet, sweet interest!

We're going to use Fidelity as an example - and they call their sweep account the "Core Account". In your brokerage, once you have some cash deposited, you'll have a menu option available in the "Positions" page to change your core position:

Once you click that, another menu comes up that allows you to select which of the sweep options you want. In Fidelity's case, you have three options. The two money market funds are NOT FDIC insured, but they do earn higher interest and they tout themselves as being very safe due to investing in US Treasury bonds. The FCASH account is FDIC insured.

Once you select your position, your un-invested cash will be in that. And you will earn any interest on that cash based on your investment selection!

Taking Sweep Accounts To The Next Level

Some institutions are very flexible with what you use as your sweep account. There are some that even let you link your sweep account to your regular checking account. This can be very convenient if you draw on the cash in your brokerage regularly. On the same front, if you have a high-yield savings account, this could be a great sweep account.

It is important to note that the sweep feature is only available on standard brokerage accounts. If you have a retirement account, you need to look at how your cash is being handled in the account.

Readers, are you maximizing your sweep account, or is your cash just sitting there?

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.