The Guide To Saving For Retirement

You’ve slaved through college, started working a 9 to 5 job, and now you have some money that you don’t know what to do with. You never learned this in school, and now you need to know what to do!

You scour the internet and find thousands of different articles and advisors touting different options. After reading for hours, nothing.

Before you drive yourself crazy about what you should be doing with your money, take a step back and breathe. You’re probably doing an amazing job earning money, now it’s just tweaking things so that your money works for you. The problem is options – there are so many different options and ways to save.

Luckily, you can work through this problem with focus and dedication, and a few minutes of your time. The next 20,000+ words will teach you, step-by-step. You’ll do more than just understand how to save for retirement – you actually will! To get started, all you need to do is be ready to learn!

Contents

Part II: Types of Employer Sponsored Retirement Plans

- 401k Retirement Plan

- 403b Retirement Plan

- 457 Retirement Plan

- Pensions

- Stock Options

- Employee Stock Purchase Plans

- How to Set-up Your Employer Sponsored Retirement

Part III: Retirement for Entrepreneurs and Freelancers

- Roth IRA

- Deductible IRA

- Non-Deductible IRA

- Simple IRA

- SEP IRA

- Solo 401k

- Keogh Plans

- How to Get Started

Part IV: Tips and Tricks for Retirement Planning

- Develop a Savings Habit

- Feed the Pig Campaign

- Interest Rates & Risk and Return

- Tax Benefits of Retirement Plans

- What Happens to My Retirement if I Change Jobs

Retirement looms ahead of all recent college graduates. Again and again, retirement is pushed at you, but when it seems so far away, why should you worry about it now? The average college graduate, graduates at the age of twenty-five, forty years before most plan to retire. Forty years is a long time – so why start thinking about saving for retirement now? Take for example the following scenario:

A young recent college graduate, age twenty-five, finds his first employment after college. Although he may only be eligible for an entry-level position with a company, he sees the opportunities for promotions and upgrades down the road. Ultimately, this job will be worth it in the long run. The company offers him a reasonable salary, but not anything to brag about. A retirement consultant approaches him and talks with him about pulling money out of his check every month to send to his retirement fund. With student loans now due and other traditional expenses, he opts out of retirement for the time being. He reasons that paying off his student loans will help to save him more money in the long run, allowing him to start contributing to his retirement in five or ten years. This will still leave him at least thirty years to save for retirement.

This has become an all to familiar scenario for recent college graduates. You will find yourself giving excuses – some of them very valid excuses – to wait to save until situations improve. So then, what is wrong with having this kind of attitude?

Every retiree has a number goal – an amount of money they hope to have saved when they retire. This number can be generated using a couple different methods, but ultimately, think of setting your own goal based on the following statement. At the time of retirement, you should not have a reduction in your quality of life. Here’s a little more insight into this idea.

The last few years of working, you will get used to a certain quality of living. The salary you are awarded from your job defines that standard. This quality of living will include things like cars, homes, vacations, monthly spending money (i.e. play money), etc. After retirement, your salary no longer comes each month, so where is your living allowance? Retirement. Whatever retirement money you have currently saved, will determine if your quality of life can stay the same. During retirement are your house and car payments still affordable, or are they too expensive for the monthly budget? If every year, you and your spouse plan a certain vacation, does it still fit in the budget? Is the monthly play money you used to allow yourself staying the same, allowing for movies, extra shopping trips, mini-getaways, etc.?

Ultimately, your goal should be that the lifestyle being led at sixty or sixty-five pre-retirement should be the same lifestyle continued after retirement. If quality or standard of living must change, then there was failure to save the appropriate amount of money.

This doesn’t necessarily mean that you’ll need to receive the same paycheck during retirement that you received your final years working, in fact for most people it is less, but that doesn’t mean the quality of life changes for them. They can still live in their current home, but consider that perhaps it is paid off. The same could apply for cars. But perhaps the most important thing to consider in your monthly budget is that you’ll no longer need to contribute any money into your retirement, since you are living it!

For most people, the closer they get to retirement, the more they invest in their retirement accounts. As we get older, our lives tend to become simpler rather than more complicated. Things like children and all their related expenses tend to be removed from the budget. Perhaps you are able to pay off your home, cars, and other toys that you had monthly payments on previously. Thus, there tends to be a surplus in your income, and most people, as they are anticipating retirement, contribute that surplus into those accounts.

So then when retirement rolls around, you find yourself not needing nearly the same amount of money you needed before retirement. Let’s take for example the following couple:

Jared and Danielle make a combined monthly income of $10,000. They are 64 years old and planning to retire at 65. Here is a list of their monthly expenses:

Jared and Danielle make a combined monthly income of $10,000. They are 64 years old and planning to retire at 65. Here is a list of their monthly expenses:

- House Payment – $3,000

- Utilities – $250

- Car Payment #1 – $300

- Car Payment #2 – $300

- Boat Payment – $250

- Groceries – $400

- Date Money – $200

- Personal Money – $300

- Other – $500

- Savings – $1,000

- Retirement – $3,500

Now let’s say that everything in this budget is to stay exactly the same when Jared and Danielle retire – except their retirement contribution. If everything were to stay the same, including putting away $1,000 each month into savings, Jared and Danielle can live comfortably on 65% of their pre-retirement monthly income now that they no longer need to save any more for retirement.

Perhaps it is hard to think now, in your twenties, what type of lifestyle you will have when you are in your sixties, but thinking about basic needs and what you spend your money on now will essentially be the same. You will still have a rent/mortgage payment to take care of your housing. You’ll still need to eat, so you’ll have a grocery budget, you’ll probably have a car or two, perhaps a toy like a boat or RV, etc. The difference between your budget now and your budget in the future is that you will have more money to spend on things in the future. However, the things you enjoy now probably won’t change. If you love movies, you will still go to the movie, but whereas now you only go on opening night every once in awhile because you don’t like to shell out the money for a first-run movie, in the future you won’t mind spending the extra money to see a movie during opening weekend or before it hits dollar theaters. Essentially you’ll end up spending your money on the same things just in larger quantities. Of course that’s not to say you won’t pick up other hobbies as you get older, golfing for example. And we all know that golfing isn’t a cheap sport, so you’ll make room in your budget to include golfing. This may mean you don’t go to movie as often or you don’t have a boat payment. Regardless, all of the principles still apply.

There are also online resources to help you determine the amount of annual money you’ll need at retirement. By using percentages and general ideas about the US population, they can help you decide how much you will need at retirement.

It may seem overwhelming at first, but it doesn’t need to be. There are some key things to understanding retirement. Being knowledgeable and prepared at a young age will ultimately help you plan for retirement. To see the general idea of a retirement calculator click here. Remember that you may not understand all of the parts about retirement that they ask you to know. We will explain each of them through out the book, so revisit this calculator after reading to give yourself a better and more accurate representation of how much you’ll need.

In the introduction, we looked at an example showing a typical college graduate faced with the decision to start saving for retirement now or put it off for a few years down the road. Understanding the benefits of saving now, might sway his and your decision to start with the first paycheck.

The Benefits of Compounding Interest

Although there are many different retirement programs available (discussed individually in subsequent sections), the following example will help to illustrate a basic retirement saving principle.

Although there are many different retirement programs available (discussed individually in subsequent sections), the following example will help to illustrate a basic retirement saving principle.

Let’s take for example two employees at the same company. George chooses to contribute $100 every month from his first paycheck, or $1200 a year. He starts saving at the age of 25 and plans to retire at 65, thus giving him 40 years to contribute. For the sake of the example, George is going to continue to only invest $100 a month for forty years. Now, let’s look at a second employee, Jane, who chooses not to invest her money into retirement when she first starts working. Unlike George, Jane waits five years, at age thirty to start saving. She contributes the same amount, $100 each month, but now she only has 35 years instead of 40 to save her money. What is the difference in their two lump sums at the age of 65?

George will have saved just over $310,000 while Jane will have only saved $206,000. That five year’s difference cost Jane $100,000 in her retirement. How does this happen?

Compounding Interest. This is something you were probably taught in junior high or even elementary math, and had that thought, “When will I ever use this?” – well here is the real world application.

A little refresher on interest in general. When you put money into any kind of a savings account, whether it is the traditional savings account at the bank, or a retirement savings account (401k, 403b, etc.), the institution or company you save with will give you an interest rate. Interest is money that is paid to you at particular intervals based on a percentage. It is sort of like a bank’s way of saying “thank you” for putting your money in their institution.

When it comes to interest rates, an account that allows you to put in and take out your money at any time will have a lower interest rate than an account that has limitations. This is the case, because the savings institution where your money is placed can always count on your money to be there – therefore giving them the freedom to use it for other purposes.

For example, if you have a money market account that has a minimum balance of $5,000, then you’ve told the bank that at all times you will have at least $5,000 in that account. They then, knowing that you will always have $5,000 in the bank, can give someone else a loan for $5,000. When you decide to close your account, they will do the same for you, giving you back $5,000. Because they can guarantee your money will be there, they reward you by giving you a higher interest rate. Other accounts like CDs or Education Funds have a time limitation as well on them before you can touch the money. Therefore, the bank knows that the money in those types of accounts won’t be accessed until a designated time. These accounts also have higher interest rates.

There are two types of interest that you could see when saving your money, simple and compound. Simple interest, is interest paid only on the principal amount; whereas, compounding interest pays interest based on the principal amount and the interest accrued. Let’s better understand this idea with an example.

Let’s say you have $10,000 sitting in your bank account. The bank tells you that they work on simple interest, paying you once a year. The interest rate is 5%.

The formula for calculating what you will have in a year is:

Interest = Principal*(Rate)*(Number of times accumulated)

So in our case the equation would look like this:

?? = 10000*(.05)*(1) with the answer being 500.

So every year you keep your money with that bank, you’ll see an increase of $500. So consider if you wanted to see what would happen to your money in 20 years.

?? = 10000*(.05)*(20) with your final answer being 10000. Now remember this is the amount of interest you will have accrued in 20 years. So your ending balance will be $20,000. Not too bad, right?

Well let’s look at the same numbers, but with compounding interest, rather than simple interest. Essentially, the first year will remain the same. You’ll still receive $500 in interest at the end of the year, but here is where the bonus comes. As you start the second year, you build interest on $10,500 rather than your original principal amount. And each year going forward will be the same. You will continue to see the amount of interest you earn increase as your principal + interest increases.

Here is a formula for compounding interest:

Future Value = Principal Value × (1+interest rate)n Where n =the number of years

So let’s use the same numbers as above to illustrate the point. You have $10,000, with an interest rate of 5%. After twenty years …

?? = 10000 x (1 + .05)20 with your answer being $26,532.98.

Pretty stark differences, right? (Note: the value you receive in the second formula is all of the money, not just the interest.) Regardless, you’ll see that with compounding interest, you have earned an additional $6,500.

To play with a compounding interest calculator, click here. This calculator will allow you to spend some time seeing the differences between simple and compounding interest.

Retirement plans, like a 401k or 403b, all work with compounding interest. This is one of the major factors that influenced how much money was saved in our earlier example with George and Jane. By using the principle of compounding interest effectively, George was able to accumulate $100,000 more than Jane, simply by starting five years sooner.

It may be hard for you to think about retirement now, in your twenties, but you’ll find that it’s much easier to start now than later. By waiting even a year or two, you’re costing yourself large amounts of money in the long run. Thus, even if you can only spare $100 a paycheck, it will be worth it.

Consider this scenario to better understand starting now rather than waiting until later. There are four individuals all investing the same amount of money. Each individual contributes money into their retirement for ten years, then stops and simply lets the money grow until retirement. Investor #1 contributes $5000 a year starting at the age of twenty-five. Investor #2 contributes $5000 a year as well, but starts at the age of thirty-five. Investor #3 contributes $5000 a year, and starts at the age of forty-five. And finally, Investor #4 contributes $5000 a year, starting at the age of fifty-five. They all plan to retire at 65 and each is receiving an 8% rate of return on their account.

Investor #1 – After ten years, the total will be $72,431. From the age of 35 to 65, Investor #1 contributes nothing else, and just leaves his money to grow. At the age of 65, Investor #1 has $728,848 saved in the retirement account.

Investor #2 – At the age of 45, Investor #2 also has $72,431, but now only has twenty years to watch it grow. At the age of 65, Investor #2 has $337,597 saved in the retirement account.

Investor #3 – When this Investor stops contributing at the age of 55, the total is also $72,431, and has ten years to grow before retirement. At the age of 65, Investor #3 has $156,373 saved in the retirement account.

Investor #4 – Now Investor #4 contributes and saves for ten years, but after ten years, this Investor plans to start using the money. Thus there is no time for the money to “continue growing” after the contributions stop. So Investor #4 has saved $72,431 in the retirement account.

By looking at each of these investors, you can see how starting young can make a huge difference. Each of these investors contributed the same amount of money into their retirement – $50,000 ($5,000 x 10) – but their ending balances were widely different based on the amount of time the money grew in the account. Thus remember that time is your friend when saving for retirement.

Let’s look at one final example to help illustrate the point.

At twenty-five, you have just graduated from college, finding your first job making $65,000 a year. When you first start your new employment you meet with a retirement representative to set up a 401k. This retirement rep convinces you to contribute 15% of your annual income every year to your retirement. (As your annual income increases, so will your retirement contributions.) So your first year, you will be contributing $9750 or just over $400 a paycheck into your 401k. Remember your paychecks are over $5000, so $400 is a small amount. If you continue to make these 15% contributions every year, at age 65 you will have $3,047,998 saved in your 401k. (We are assuming a few things, like your interest rate and inflation costs.) Remember although three million sounds like a lot of money, you’ll need to live on that for somewhere between 25 and 35 years. So divided into each year, you’ll have $122,000 to live on.

Now let’s take the same scenario, except when you meet with that retirement rep you decided to wait a few years until you feel more financially stable. Now remember you need to save at least three million dollars, but now you’re starting to contribute to your retirement at age thirty instead of twenty-five. Let’s do the math and see what that does to your monthly paychecks. By age thirty, you will probably be making around $79,000 after yearly raises (we are assuming a 4% yearly increase). In order to achieve the same goals of having three million at retirement you’ll need to contribute 19% of your annual salary to retirement. That means your fifth year working, at age thirty, you’ll contribute $15,000 or $625 a paycheck.

In other words, by being willing to contribute now, you’ll save yourself 4% of your paycheck in the coming years. Now like we talked about before, if you can’t afford 15% right now, figure out what you can afford even if its only 3% or 4%. Then as you pay off other debt and become more financially stable, you’ll be able to increase your contributions to 15%.

Although financial planners and retirement representatives are helpful, the initial planning process is something you can do yourself. Here are the first steps to figuring out your retirement needs.

- Decide how long you will need retirement money – this involves two things. First you’ll need to know your life expectancy. You can use online life expectancy calculators to help you determine this, or you can make a good educated guess based on the health of parents, grandparents, etc. To use an online life expectancy calculator, click here. The second decision you will need to make is at what age you are going to retire. Most people like to retire around age 65; there are even some industries that force retirement at this age. So putting these two numbers together, you’ll be able to figure out how many years you’ll need retirement money. For example, let’s say you determine your life expectancy is 90 and you want to retire at age 70. That means you’ll need twenty years of money to live on.

- How much money do you need/want at retirement – basically, ask yourself what kind of a salary you want to live on during your retirement. Of course you could survive on $30,000, and you would live in luxury at $1,000,000 a year. Instead of going to either extreme, try to find something in the middle that will allow you to live comfortably, but also doesn’t kill your paychecks now. Most people determine their salary from a year or two before retirement and decide on a percentage of that salary. For example if you were making $200,000 the year before retirement you could choose to have a salary of 70% of that salary, giving you $140,000 annually. Maybe this number is too high or too low for the style of life you want to live. If so, adjust it accordingly.

- Determine your retirement goal – so now that you know how long you’ll need retirement money and how much you anticipate needing each year, you can find the total amount you need when you retire. Using the numbers we have already talked about, let’s say you need twenty years of retirement at $140,000 a year. This equates to $2,800,000. That becomes the golden number you want to reach in your retirement savings when you retire.

- Determine amount to contribute annually – with these numbers in mind, you can determine how much you need to contribute annually in order to reach your goal. Using some numbers we’ve used before, let’s determine your annual contribution. If your initial salary is $65,000 and we expect a 4% income increase, and you want to accumulate $2.8 million for twenty years of retirement, you’ll need to contribute 12% annually into your retirement savings. This is $7800 your first year, or $325 a paycheck. (We are assuming a modest 7% interest rate for this exercise.)

Determining these amounts can give you a great start to your retirement planning. With these numbers in mind, you can walk into a meeting with your retirement advisor feeling informed and knowledgeable about your plan for retirement. Your advisor will then help you with all of the smaller details and the best plan to help you reach your goal. By following these four steps, you’re well on your way to being prepared for retirement. Now that you understand a little bit more about the retirement numbers you are looking for, here is the link to the retirement calculator again – Retirement Calculator.

Looking at this retirement calculator, let’s talk about each of the individual pieces of information they are asking from you. Some of them are obvious, but some of them may not be so obvious.

Current Age: This should be obvious; however, if you’d like to compare starting to save at different ages – this would be a good tool to do so. Change your current age to an age you think you’d like to start saving at and then note the differences in numbers.

Age of Retirement: As we talked about earlier, here is the place where you will put the age at which you plan to retire. Again, just like with your current age you can play with this number to see what happens to your retirement funds based on what age you plan to retire. See what happens if you want to retire early say at 55 instead of 65. Or how the numbers are affected if you decide to retire at 70 rather than 65.

Annual Household Income: Here you will place your current salary in your industry. Now like almost all people, we hope that our financial situation will improve as the years progress, and this calculator will take that into consideration (see Expected Income Increase).

Annual Retirement Savings: Here they would like you to decide a percentage of your income that you plan to save every year. Because the calculator will adjust your income with an annual salary increase, it will also use this percentage to determine your retirement contribution each year.

Current Retirement Savings: This box only applies if you already have some retirement saved in an account. If you don’t have anything saved, put a zero in this box.

Expected Income Increase: Unless you have a fixed idea on the percentage your salary will increase each year, leave this number at 3% (the national average). If you have seen something like a salary schedule that indicates a different percentage, feel free to change that number to something more aligned with your salary.

Income Required at Retirement: Again you’ll need to decide on a percentage. The calculator will take whatever percentage you put here against the salary you were making during your last year of work. For example if you put that you plan to live on 60%, and your last year’s salary is $180,000, you are looking at a annual salary of $108,000. Remember as we talked about earlier, you most likely won’t need 100%, but you’ll probably need more than 50%. Playing with this number as well, will give you an opportunity to see what kinds of retirement salaries you can expect based on the contributions you make.

Years of Retirement Income: You should already have a general idea about this number for our exercise earlier. Based on your life expectancy and the year you plan to retire, you’ll find a number to indicate how many years you will need retirement money to live.

Rate of Return Before Retirement: This is the interest rate you expect to receive during the years you are saving for your retirement. Although this number can vary from year to year based on the market, your decisions to invest, etc., you can generally expect a 7% return. This is a very modest number, and most people will see something higher, especially in the early years, but to be safe, use something around 7%. Later in the book we’ll talk specifically about the rate of returns you can expect based on the portfolios you choose.

Return During Retirement: Once you have entered retirement, it’s not as if you can’t continue to earn interest on your money. Since you are only pulling out a fraction of it every year/month, you can still expect to earn something with the money that continues to sit in the bank. In order to keep the money safe, and prevent any loss, most people move their money into smaller interest accounts, but ones with little to no risk. Thus, your rate of return during retirement will be significantly smaller, but you can assume a modest 4% if you don’t have any idea.

Expected Rate of Inflation: This is a national rate that the country plans to see over the next forty years, or until your retirement. Again, this number should be left at 3% unless you feel or have seen research stating otherwise.

Then you will see that there are spaces available for you to check if you are married and if you want to include social security. Checking the married box will only change your numbers if you also ask it to include Social Security (married couples receive up to 1.5 times as much annually as a single person). Reliance on Social Security should be approached with caution (see the discussion on government programs in our next section). Although it is fine to look at it as part of your retirement, we would also suggest planning without it to ensure financial stability.

After you have entered all of the numbers into the calculator, you’ll see a graph and information about your retirement accounts. These are general numbers, but you will see how much money you’ll accumulate before retirement and if it is enough to sustain you through your expected years of retirement. If you find that your funds run out before you expected, try playing with a couple different numbers to see how you can reach your goal. You can change your age of retirement or how much you contribute each year in order to have your goal attainable. If you have an immense surplus at retirement, consider changing these numbers as well. Look at retiring earlier or contributing less. However, it’s never a bad idea to have a little extra in your retirement, so don’t sell yourself short when making these decisions.

Overall the calculator is there to help you see the effects of saving and to help you with your expectations. Use this calculator prior to speaking with a financial advisor or retirement counselor. By doing so, you’ll have a better idea of the numbers you are looking to obtain by retirement. Once you start talking with a financial planner, together you’ll create the perfect plan for you.

Instability of Government Programs

It is important to start now and rely on yourself for retirement. One factor that you haven’t seen presented in any of the aforementioned scenarios is Social Security or any other government sponsored retirement help. With our generation, we just can’t assume anything.

It is important to start now and rely on yourself for retirement. One factor that you haven’t seen presented in any of the aforementioned scenarios is Social Security or any other government sponsored retirement help. With our generation, we just can’t assume anything.

For those unfamiliar with Social Security, it works like this. Every paycheck you receive has federal taxes removed from it. Depending on your situation, when you file your taxes in April each year, you can receive part of that money back. But two parts you will never see returned to you are Medicare and Social Security. Out of every paycheck you’ll see a percentage taken for these two programs. Both of these programs exist for those who are retired. The idea is that you will pay into these programs for thirty to forty years, and then you’ll receive a paycheck each month from the government giving you your money back – this is Social Security. Medicare is health insurance specifically offered to those in retirement. The government steps in to help those in retirement with insurance since they are not employed to receive insurance benefits. It is also assumed that receiving a private insurance is difficult for most elderly because of their age and/or health conditions. These two programs are something you pay for while you still have a job, so that you can reap the benefits when you are no longer working. It’s not exactly that simple, but theoretically, that’s how it works. The amount you receive changes, depending on the cost of living each year and your annual salary.

The important thing to understand is that by 2033 it is estimated that the government will only have 77¢ for every dollar they owe back in Social Security. So in order for the government to ensure it has enough money to sustain the Social Security Program, it will need to find 33¢ somewhere else for every dollar it owes. This can be done by raising taxes or cutting back in other programs. And the biggest problem is that it’s only going to get worse. If you’re twenty-five in 2013, then you probably won’t be retiring until sometime around 2053. That’s twenty years after the government is expected to already be bleeding money from Social Security.

One of the biggest reasons the Social Security Program is struggling so much and will struggle in the future is life expectancy. When the Social Security Program was first started, most people didn’t live much passed their age of retirement. Even twenty years ago, the life expectancy was only five to seven years after retirement. So that means the government was only issuing retirees Social Security checks for five years. Now, however, the life expectancy is much higher than that. It is not uncommon for people to live well into their eighties and even their nineties. This means the government is issuing Social Security checks for twenty or twenty-five years rather than five. Now you see the dilemma the government is faced with.

So essentially, we better not count on any money from the government and then if there is some, it’ll be a nice monthly bonus we weren’t planning on getting. There are current reform plans to help with the problem, but no real solution has been found yet. Those that are currently paying into Social Security are claiming it’s unfair that they pay, but will never see a return or will see a smaller percentage of their return. This could very well be the case, but don’t forget that forty years ago there wasn’t the panic about Social Security there is now. So those that are retiring or have been retired were planning on Social Security, because there was no reason to believe it wouldn’t be there. Without a Social Security check each month many retired people would be in financial hardship.

So, in conclusion, remember to start saving now, even if it’s only a small amount. Small amounts can become large amounts through the principal of compounding interest. And don’t rely on the government to provide for you, because by the time you are at retirement, there may or may not be anything left.

When you first interview for a job, most likely the employer will mention their retirement options. The part about retirement may be the last thing you are worried about when he’s mentioning your salary, healthcare benefits, etc. But, as we’ve already discussed, understanding your retirement is vital to your future final stability, so it’s important you understand what different retirement plans you might see.

It’s crucial you understand a few key things before we talk specifics. First, companies may offer a matching program. This means that for every dollar you place in your retirement, they will match it up to a certain percent. For example, your company will match 100% of your annual contribution up to 3% of your annual salary. So if your salary is $65,000, and you choose to invest $5,000 a year into your retirement fund, the company will add an additional $1950 just for working for their company. Most people consider this “free money,” and would strongly suggest taking advantage of it.

It’s crucial you understand a few key things before we talk specifics. First, companies may offer a matching program. This means that for every dollar you place in your retirement, they will match it up to a certain percent. For example, your company will match 100% of your annual contribution up to 3% of your annual salary. So if your salary is $65,000, and you choose to invest $5,000 a year into your retirement fund, the company will add an additional $1950 just for working for their company. Most people consider this “free money,” and would strongly suggest taking advantage of it.

Second, it’s important for you understand that some plans are tax-deferred and some are not. We will talk more later about the tax benefits associated with retirement. However, if a plan is tax-deferred, it means the money is removed from your paycheck prior to taxes being taken out. If the plan is not tax-deferred, the money invested into your retirement comes out after taxes are removed from your paycheck.

Third, retirement money is set for retirement, and shouldn’t be pulled out early. When you invest money into a tax-deferred retirement plan, you are not required to pay any taxes on that money until retirement. However, if you elect to remove your retirement early for any reason, you will face penalties from the IRS. This rule is mainly in place for you. It makes you think long and hard before dipping into your retirement early. Of course there are circumstances that might warrant you pulling your money out early, but realize that you will be required to pay those penalties as well as taxes on the money before you use it. For the majority of retirement plans the golden number is 59 and ½ years old. Once you have reached that age, you can remove your money without penalty.

Take for example if your retirement had been growing for ten years (from age 25-35) and then you decide that you’d like to cash out your retirement for a down payment on a new house. If you had been contributing just $5000 a year at an 8% rate of return, you would have $72,500 built in your account. Now if you decide to cash it out, you’ll hit with two different debits. The first is the 10% penalty for removing your money early. So you’ll loose $7250 to the IRS, leaving you with $65,250 for your down payment. Now essentially, this the check you would receive from your retirement fund, but don’t forget that you have to pay additional income taxes on that money. The IRS sees your $72,500 as additional income for the year and will expect you to pay the taxes as such. With an additional $70,000 in your income, you could change your tax bracket requiring you not only to pay additional taxes for the retirement cash out, but also additional taxes on your current salary.

So let’s say that your taxable income is $85,000 annually when you decide to cash out your retirement fund. This puts you in the 25% tax bracket, but with the additional income from your retirement cash out you now have taken yourself to the 28% tax bracket. The IRS does not care what you plan to do with the money you receive from your retirement fund. They don’t care if you spend every penny paying off bills or loans. They only see that you gave yourself a salary increase for the year and want their cut. With the IRS, things are pretty cut and dry.

So ultimately, put your money into retirement and leave it be – forget it is even there until the time comes when you retire and need it

For the next bit, we are going to list the different retirement plans that could be sponsored by your employer.

401k Retirement Plan

Many employers will offer a 401k retirement plan. Only an employer can sponsor this plan. A 401k is tax-deferred. So basically any contribution you make into this plan will have great tax benefits. The contribution amount is taken out of your paycheck pre-tax, which brings your taxable income both for each paycheck and for the year down based on how much you contribute. Ultimately, by investing money into your 401k each month, you will save yourself in the amount of tax you owe at the end of the year.

Many employers will offer a 401k retirement plan. Only an employer can sponsor this plan. A 401k is tax-deferred. So basically any contribution you make into this plan will have great tax benefits. The contribution amount is taken out of your paycheck pre-tax, which brings your taxable income both for each paycheck and for the year down based on how much you contribute. Ultimately, by investing money into your 401k each month, you will save yourself in the amount of tax you owe at the end of the year.

Once you have put your money into your 401k, it will be invested in different areas of the financial market. It may be invested in stocks, bonds, mutual funds and money market accounts. Your employer will have partnered with a financial institution to take their company’s retirement funds and invest it. You will be introduced to a retirement representative from that company. The representative will talk with you about how much you want to invest and how you would like to invest it. You can choose to have a high-risk, medium-risk or low risk portfolio. We will discuss these different types of plans later. However, it is important you make time to meet with your company’s representative in order to ensure your money is placed where you feel comfortable.

403b Retirement Plan

A 403b Plan is very similar to a 401k. Again, any money you invest in your plan is tax-deferred and saves you in taxes owed each year. The biggest difference between these two plans is that 401k retirement plans are offered by for-profit organizations and 403b retirement plans are offered by non-profit organizations. You will most likely see a 403b if you work for a school district, a hospital, a church, or some other non-profit organizations (501(c)(3) organizations).

A 403b Plan is very similar to a 401k. Again, any money you invest in your plan is tax-deferred and saves you in taxes owed each year. The biggest difference between these two plans is that 401k retirement plans are offered by for-profit organizations and 403b retirement plans are offered by non-profit organizations. You will most likely see a 403b if you work for a school district, a hospital, a church, or some other non-profit organizations (501(c)(3) organizations).

Essentially, a 403b and 401k are different based on the tax codes the government assigns them. All of your money will still be taken by an investment company and invested into the type of portfolio of your choosing.

457 Retirement Plan

A 457 retirement plan is also similar to a 401k or 403b retirement plan. It works exactly the same, with employee contributions and some employer matching. Again, your money will be invested based on your portfolio preference.

A 457 retirement plan is also similar to a 401k or 403b retirement plan. It works exactly the same, with employee contributions and some employer matching. Again, your money will be invested based on your portfolio preference.

Again, the major difference in this plan is who can offer it. In order to offer a 457 retirement plan, the organization must be a state/local government or a tax-exempt organization.

All of the money contributed to a 457 retirement plan is tax-deferred until retirement. This allows employees the tax benefits similar to the 401k and 403b retirement plans.

Pensions

Pensions are not as popular as they used to be. In the past, instead of a 401k, 403b or 457b, a company would offer a pension. With economic struggles, most pensions are being reduced or completely discontinued and replaced with a 401k, 403b or 457b. The main reason companies are shying away from pensions is the immense cost to a company. An employer offers a pension plan and generally the only money contributed into the pension plan comes from the employer. There are two different types of pension plans – a defined benefit pension plan and a defined contribution pension plan.

Pensions are not as popular as they used to be. In the past, instead of a 401k, 403b or 457b, a company would offer a pension. With economic struggles, most pensions are being reduced or completely discontinued and replaced with a 401k, 403b or 457b. The main reason companies are shying away from pensions is the immense cost to a company. An employer offers a pension plan and generally the only money contributed into the pension plan comes from the employer. There are two different types of pension plans – a defined benefit pension plan and a defined contribution pension plan.

With a defined benefit pension plan, an employer promises an employee a certain amount of money at retirement. Generally these plans include required years of service in order to receive a full pension. For example, a correctional officer is required to work for twenty years in the department. After twenty years of service, the employer will pay 75% of the officer’s last year of service. This amount is guaranteed every month until death.

When you have a defined contribution pension plan, your employer will invest a certain amount into your plan, and however much you have at retirement is what you have. Your employer may invest money monthly, quarterly or annually. As these contributions grow, so does your retirement. You may also lose money, depending on the market, but overall your money will grow in the long run. The disadvantage of this type of pension is that it is very hard to determine how much you will have at retirement. The employer may also require a certain amount of years of service to receive your pension, but not always. Some employers will give you your pension wherever it currently sits if you decide to leave before retirement.

Pension plans are very expensive for an employer. Since the employer is generally the only contributor, pensions will cost the company immense amounts of money each year. Especially now that the retirement years are longer due to life expectancy, companies are struggling to maintain their pensions. This is why you will see pensions fading in the job market over the years.

Stock Options

Some companies will offer new employees stock options as part of a retirement plan or as a sole retirement option. In order for this option to be available you must work for a company that has stock. If you work for a company that does have stock, your employer may offer you a “deal” to purchase stock in the company at a good price. Sometimes this price may be half the current market value. This still requires you to purchase the stock outright, but then instantly after purchase you have doubled your investment (if purchased at 50% the current market value). There is always a designated time frame for you to use your stock options.

Some companies will offer new employees stock options as part of a retirement plan or as a sole retirement option. In order for this option to be available you must work for a company that has stock. If you work for a company that does have stock, your employer may offer you a “deal” to purchase stock in the company at a good price. Sometimes this price may be half the current market value. This still requires you to purchase the stock outright, but then instantly after purchase you have doubled your investment (if purchased at 50% the current market value). There is always a designated time frame for you to use your stock options.

The idea is for you to invest in your own company. As the company improves, so will your stock. If, however, the company fails or struggles, your stock will drop in value, ultimately hurting your retirement investment. Even though this can be a great buy, it’s quite risky.

An advantage of having stock options is that there is no specific age at which you can cash out your stocks. However, there are penalties now in place if you buy the stock and then sell it again within a short period of time. Understandably, employers will be disappointed if they give you stock options only to have you sell them shortly after being hired. Generally, when an employee sells his/her stock, it means there is or will be a termination of employment.

A disadvantage of stock options is that they are not tax-deferred. Initially, you will pay tax on the incentive part of your options. Let’s use an example for further explanation.

Let’s say your employer offers for you to buy stock at $50 a share when a share’s market value is $75. Your employer grants you up to 1,000 shares if you want it, but you elect only to purchase 100 shares. So you spent $5000, but instantly your shares are worth $7500. However, for your taxable income in that year, you must pay tax on the difference between the two. So by subtracting $7500 from $5000 you learn your additional taxable income. In this case you would see an additional $2500 on your W-2 at the end of the year. It would be reported as extra income granted to you during the year. Basically the IRS sees that you invested $5000 of your own money (money that was already taxed), but they see that your investment granted you $2500 that had not been taxed; therefore, the IRS will see it as taxable income.

In addition to paying tax when you initiate your stock options, you will also pay tax when you sell your stock. Depending on when you decide to sell, the tax will be slightly different, but you will pay tax nonetheless.

Stock options are not a bad investment, as much as it may seem so. Even though you pay tax on them twice, you will still most likely be ahead by a good amount of money considering you were able to buy the stock at a good price. The only time this wouldn’t be the case would be if the company struggled and your market shares dropped significantly.

Employee Stock Purchase Plans (ESPP)

A stock purchase plan is similar to stock options. Employers offer the company’s stock for a reduced rate, usually only up to 15% off. Employees can use after-tax money to purchase this stock. Unlike stock options, stock purchase plans are available to employees indefinitely. There is no set time frame that an employee must purchase the stock. There will be a period surrounding each pay period that an employee must exercise the right to purchase the stock; otherwise the employee will need to wait until the next pay period. That being said, the stock price will fluctuate based on the company’s performance in the stock market. However, employees will still receive the designated discount prescribed by the company.

A stock purchase plan is similar to stock options. Employers offer the company’s stock for a reduced rate, usually only up to 15% off. Employees can use after-tax money to purchase this stock. Unlike stock options, stock purchase plans are available to employees indefinitely. There is no set time frame that an employee must purchase the stock. There will be a period surrounding each pay period that an employee must exercise the right to purchase the stock; otherwise the employee will need to wait until the next pay period. That being said, the stock price will fluctuate based on the company’s performance in the stock market. However, employees will still receive the designated discount prescribed by the company.

Some stock purchase plans qualify as a 423 stock purchase plan. In this case, you are not taxed when you first purchase stock. Instead, you are only taxed when you withdraw your money. Withdrawing your money can take place at any time, but the taxes will be different if you choose to withdraw under a year from the original purchase. Unfortunately there are non-qualifying stock purchase plans. With a non-qualifying stock purchase plan, you do not receive the tax benefits and are therefore taxed on both your purchase and when you sell your shares.

Usually your company will determine a set amount of your paycheck that can be used for a stock purchase plan. Generally, it is less than 15%. If your plan is a 423 qualified plan, you cannot exceed $25,000 every calendar year in stock purchases.

How to Set-up your Employer Sponsored Retirement

When a company first hires you, they will give you some sort of benefits package. This package will include health insurance, life insurance, retirement, etc. There will be a period of time in which you need to enroll in their programs or elect to opt out. Retirement is just as important as all those other pieces of your benefits package.

When a company first hires you, they will give you some sort of benefits package. This package will include health insurance, life insurance, retirement, etc. There will be a period of time in which you need to enroll in their programs or elect to opt out. Retirement is just as important as all those other pieces of your benefits package.

There will most likely be three different individuals you will work with in regards to setting-up your retirement. Most companies have an on-staff employee that handles retirement. This individual doesn’t work for an investment company, but he/she can direct you to a representative from the investment company that can work with you on your investment decisions. The on-staff employee works as a liaison between your company and the investment company. The representative from the investment company is a great resource for getting you started. In some cases the representative will want to meet with you, but if you are not contacted by him/her, ask for the contact information from the on-staff employee. Call and arrange a meeting with your representative as soon as possible to ensure you get things set-up before your first paycheck. The third individual that you will need to consult with is a tax consultant. Because different plans have different tax benefits, having a tax consultant will ensure you take advantage of as many tax benefits as possible during the retirement planning process. Your retirement representative can give you some tax information, but consulting a tax professional will give you the best understanding and knowledge about the tax portion of your retirement account. You can use the same CPA you have used for your taxes in the past for this consulting. If you do not have a tax consultant, ask your retirement representative or the on-staff employee retirement liaison for a recommendation.

Before you meet with your representative, have in mind some numbers that you feel comfortable with contributing. This number can change, but it is always a good idea to walk in the door with something in mind. Create a monthly budget with all of your expenses. This will help you see how much you can contribute to your retirement plan each month. Even if this number is small, remember its importance. It would probably be a good idea to bring a written copy of your budget with you to the meeting with your retirement representative. Although the person you will speak with specializes in retirement planning, they are trained in all areas of finances, and if needed they can help you plan your monthly budget efficiently. This will also help them understand why you came to the meeting with a certain number in mind. By sharing with them your expenses, they can better help you find the best amount to invest in your retirement.

Your representative will take your money each month along with every other employee in your company and invest it in a variety of different places. Like we discussed earlier, your money may be invested in stocks, bonds, money market accounts or mutual funds. The type of accounts your money is invested in depends on the type of portfolio you decide to create.

As we have discussed before, you should strongly consider starting your retirement with your first paycheck. We have already talked about the importance and benefits to starting earlier rather than later, but we will continue to stress the great value of starting at the beginning rather than playing catch-up at the end.

As questions arise on your retirement, don’t hesitate to call and visit with your retirement representative. You will receive quarterly and annual statements in the mail regarding the current value of your retirement fund. Inevitably as you begin investing, there will be things that are unfamiliar to you, or that you don’t understand. Your representative is a great resource to utilize as you plan for retirement.

Obviously, some of you won’t have a retirement plan offered through your work. Don’t worry; there are options for you, too. Some employers don’t offer retirement options through their company, and some of you might be entrepreneurs starting your own start-up business. If you are doing any type of freelancing work, you can also take advantage of these retirement opportunities since you won’t have a company to offer you any type of plan.

The same principles apply with these types of retirement plans as those we’ve already discussed. Starting sooner will prove advantageous now as well as at retirement. Therefore it is important to start saving in a retirement plan right away even if it’s in small increments.

There are some plans that are available to individuals like freelancers, and there are different plans if you are a small business owner or self-employed. Some of the plans are available to both types of individuals, but others are only available to one group or the other. If you fall into this type of category, make sure you are looking into a plan that best fits your needs.

Here are some retirement plan options you can look into if you find yourself in a situation like this.

Roth IRA

A Roth IRA is a retirement plan available to any individual. Roth designates the type of investment you are making and IRA stands for Individual Retirement Account. Even if you have a 401k with a company, you can still obtain a Roth IRA. For example, if you have maxed out the 401k you have with an employer, but you want to contribute more in a year, using a Roth IRA just may be the answer. You can also open a Roth IRA if you have no other retirement plan.

A Roth IRA is a retirement plan available to any individual. Roth designates the type of investment you are making and IRA stands for Individual Retirement Account. Even if you have a 401k with a company, you can still obtain a Roth IRA. For example, if you have maxed out the 401k you have with an employer, but you want to contribute more in a year, using a Roth IRA just may be the answer. You can also open a Roth IRA if you have no other retirement plan.

There are a few restrictions for Roth IRAs. There are restrictions on how much you can contribute in one year. In 2013, the maximum you could contribute as a single person or as head of a household was either $5,500 or your taxable compensation for the year – whichever number is smaller. Also, the money you contribute into a Roth IRA is not tax-deferred. Instead, you pay into your Roth IRA with after-tax dollars. However, the growth and earnings you receive in your Roth IRA are not counted against you in taxes each year. You’ll pay regular income tax when you begin withdrawing your money.

Like other retirement plans, you cannot withdraw your money until you are 59 and ½ years old without penalty. In the case of a Roth IRA, you’ll pay a 10% penalty if you withdraw your funds early. One benefit to a Roth IRA is that you can begin taking your money any time after 59 and ½. Some retirement funds require that you begin your withdraws at a certain age, regardless of if you need them or not. With a Roth IRA, you can wait until you are 65 or 70 if you choose, depending on your living situation.

There are also income limits to Roth IRAs. If you make less than $112,000 a year you can contribute up to the limit discussed earlier. If you make between $112,000 and $127,000 you can still contribute, but it is a reduced amount based on your income and situation. If you make over $127,000 a year, you cannot contribute to a Roth IRA and you’ll need to look into other retirement plan options.

Traditional “Deductible” IRA

A deductible IRA is a tax-friendly Individual Retirement Account. When you contribute to a deductible IRA, you use after-tax dollars just like the Roth IRA. However, unlike the Roth IRA, you can use your total contribution amount to add as a deduction each year on your taxes. There is a limit to this that changes every year, so beware that not all of your money may be used as a deduction if you contribute over that limit. Additionally, your money is put away tax-deferred until you start to withdraw it at which time you’ll pay income tax.

A deductible IRA is a tax-friendly Individual Retirement Account. When you contribute to a deductible IRA, you use after-tax dollars just like the Roth IRA. However, unlike the Roth IRA, you can use your total contribution amount to add as a deduction each year on your taxes. There is a limit to this that changes every year, so beware that not all of your money may be used as a deduction if you contribute over that limit. Additionally, your money is put away tax-deferred until you start to withdraw it at which time you’ll pay income tax.

Also unlike the Roth IRA, there are no income limits to participate in a deductible IRA unless you are using a Deductible IRA as a supplement to a company sponsored retirement plan. If you are also using a company sponsored retirement plan, there are income limits for eligibility. For single tax payers, the income limit is between $52,000 and $62,000. For married couples the limits are higher.

As with many of the other retirement plans we’ve talked about, there is a 10% penalty for withdrawing any money before the age of 59 and ½. In addition, you have to start withdrawing your money by age 70 and ½ regardless of your living situation.

Non-Deductible IRA

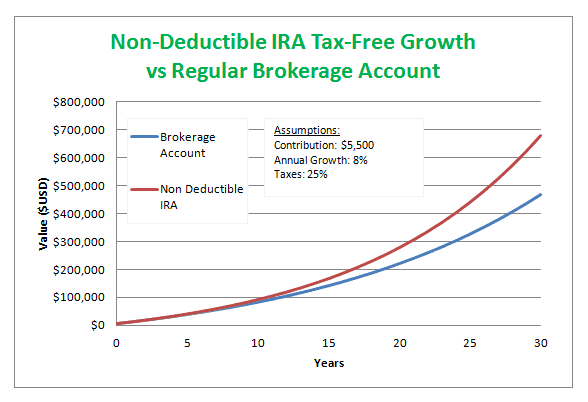

A non-deductible individual retirement account works almost the same way as a deductible individual retirement account, except you cannot claim any contributions made into this account as a deductible on your taxes. These accounts are still subject to limits each year.

A non-deductible individual retirement account works almost the same way as a deductible individual retirement account, except you cannot claim any contributions made into this account as a deductible on your taxes. These accounts are still subject to limits each year.

As with the deductible IRA, there are no income eligibility requirements for single tax payers. If you are married and filing a joint tax return there are income requirements for eligibility. There is also the penalty for withdrawing before 59 and ½ and you must start withdrawing funds at 70 and ½.

This type of retirement account is best for those who make too much to be eligible for a Roth IRA or deductible IRA.

Simple IRA (Small Businesses/Self-Employed)

A simple individual retirement account works with small businesses and those who are self-employed. In order to be eligible for this type of retirement plan, your company must have less than 100 employees. (The 100 employees only count if they make more than $5,000 a year.) These types of plans are great for those who are self-employed business owners with a small number of employees because this type of plan makes it possible to chose how you contribute to the plan at the beginning of each year.

Any contribution into a simple IRA is made with pre-tax dollars, giving you the tax advantage other IRAs do not. Once you start to withdraw your money, you will pay income tax, but otherwise your money grows in the account tax-deferred until then.

With a simple IRA, the employer must make contributions in addition to anything the employee contributes. There are two different possibilities that an employer might use to match. The employer can match up to 3% of an employee’s earnings in a calendar year. Depending on the year, the employer can also change between 1% and 3%. So the contribution matching percent can vary from year to year. The second option for employers is to make contributions to a retirement fund even if the employee does not. These are called non-elective contributions. With this option, an employer can make contributions up to 2% of the employee’s annual pay.

There are contribution limits for a simple IRA. There are two different contribution limits on a simple IRA – the employee limit and the employer limit. In 2010, the employee limit was $11,500. The employer must contribute something into your retirement in order to keep the account active. If the employer contribution is a match dollar for dollar, it can’t be greater than 3% of your salary. If they are making non-elective contributions, the limit is 2% of your salary.

An individual must wait to withdraw any money from a simple IRA until at least 59 and ½. In addition at 70 and ½, if you do not start withdrawing funds, you’ll receive a 50% penalty on your required minimum withdraw. This number will be given to you when you first sign-up for your simple IRA.

SEP IRA (Self-Employed/Small Business Owners)

An SEP IRA stands for Simplified Employee Pension Individual Retirement Account. It was created to help employers that had originally offered pension plans, or companies that might traditionally have offered them. This individual retirement account is specified for small business owners, in addition to self-employed individuals, sole proprietors and partnerships. This plan requires employers to contribute to the retirement plan for any employee that has worked with them for three years or more. This prevents an employer from opening the retirement for himself, and then choosing not to offer it to his employees.

An SEP IRA stands for Simplified Employee Pension Individual Retirement Account. It was created to help employers that had originally offered pension plans, or companies that might traditionally have offered them. This individual retirement account is specified for small business owners, in addition to self-employed individuals, sole proprietors and partnerships. This plan requires employers to contribute to the retirement plan for any employee that has worked with them for three years or more. This prevents an employer from opening the retirement for himself, and then choosing not to offer it to his employees.

All contributions made into an SEP IRA are made with pre-tax dollars. An SEP IRA also grows tax-deferred until you start to withdraw it at retirement. With this plan, you receive all the tax benefits available to retirement plans. There are limitations on how much you can contribute into your SEP IRA. In one calendar year, you cannot contribute more than 25% of your salary or $51,000 whichever is less. These are the numbers in 2013; however, the limitations can change each year, so continue to be informed of the limitations as time moves forward.

Any employee that makes less than $500, does not have to be offered the retirement plan by the employer. Until you have worked with the company for three years, your employer is also not required to make any contributions into your plan. However, you can, it is important for you to start contributing even if your employer is not. After three years, the employer can match your contributions or make non-elective contributions.

As with almost every retirement plan, you’ll be penalized 10% if you withdraw funds before 59 and ½, and you must start withdrawing funds at 70 and ½. The amount that is required to be withdrawn at 70 and ½ is outlined when you first sign-up for a SEP IRA.

Solo 401k (Sole Proprietors)

The Solo 401k is available to sole proprietors looking to open a retirement plan. A sole proprietor is an individual that runs his or her own company. If you are a sole proprietor, owning and running a company all by yourself, a Solo 401k is a perfect option for you. A Solo 401k is especially beneficial for those who want to contribute significant amounts into the plan.

The Solo 401k is available to sole proprietors looking to open a retirement plan. A sole proprietor is an individual that runs his or her own company. If you are a sole proprietor, owning and running a company all by yourself, a Solo 401k is a perfect option for you. A Solo 401k is especially beneficial for those who want to contribute significant amounts into the plan.

All contributions made into a Solo 401k are made with pre-tax dollars and anything you earn or gain each year is tax-deferred until you start to withdraw at retirement. With a Solo 401k you receive all the tax benefits available for retirement plans.

There are limits to how much you can contribute into your Solo 401k. In 2013, you can contribute $51,000 a year into your Solo 401K. This is by far one of the higher limitations we have seen in retirement funds. This number is also subject to change every year, most likely increasing.

There are no income eligibility requirements for a Solo 401k, which is helpful for both ends of the spectrum. If you are a new proprietor, not making a huge salary, you still have the option to start a Solo 401k and contribute as much as you can. With a Solo 401k, you are not required to contribute the same amount every year, which means you can increase your contributions as your business becomes more successful. If you have a tough year, you can also elect to contribute less that year. However, if your business is doing extremely well, you are also eligible for a Solo 401k and you can contribute significant amounts of money each year to build your retirement quickly.

Another great benefit of the Solo 401k is the fact that you can withdraw your money starting at 50 and ½ instead of 59 and ½. If you withdraw funds earlier than 50 and ½ you will see the same 10% penalty as other retirement funds. Additionally, you will pay a penalty if you do not start withdrawing the required minimum withdrawal by 70 and ½.

Keogh Plans

The Keogh plan isn’t extremely popular today, having been replaced by other plans. The reason these plans are not as popular is that they tend to be high-maintenance and have a lot of administrative burdens. People don’t want to have one more thing that they need to constantly be worrying about. Instead, people want to plan that is simple and they only have to think about once in awhile.

The Keogh plan is a form of a pension plan for self-employed individuals and unincorporated businesses. A great benefit of these plans is that they are tax-deferred until retirement. In other words, you won’t need to pay any tax until you retire at which time, you’ll pay income tax every year.

There are two different types of Keogh plans. The first is defined-benefit. With a defined-benefit plan, you decide how much money you will need at retirement, and then based on that number, the number of years you have left until retirement, and the average growth of the market, you determine how much you need to contribute annually to get to that goal. The second is a defined contribution plan. This plan dictates exactly how much you will contribute each year. You contribute the same amount regardless of the outcome. Essentially, you will contribute a certain amount of money and how ever much it grows by retirement is how much you have. Instead of setting a retirement goal as with the first type of plan, you trust in your contributions and the market to take care of you financial goals. Now of course this is done within reason, but you get the idea.

The Keogh plan also allows for individuals to make their contributions and have them be tax deductible each year. There is a limit to the amount you can take as a deduction, but it is considerably high compared to other plans. In 2007, you could deduct up to 25% of your income, unless it was more than $47,000. So generally those that looking to put away large amounts of money each year, will find this plan helpful.

Keogh plans take your contribution and can invest it in stocks, bonds, certificates of deposit and annuities. These are the same places a 401k and a traditional IRA will invest your contributions.

As with so many retirement plans, you will receive a penalty if you start withdrawing your money before 59 and ½. You also need to begin making withdrawals by 70 and ½ in order to pay an additional penalty there as well.

Although Keogh plans are more difficult to manage and may require more work on your part, the contribution limits are higher than other plans. Because the contribution limits are high, these plans work well for business owners and proprietors.

How to Get Started

The first thing to consider is what you want to do with your money and which types of plans you are eligible for. Once you have a general idea, you’ll need to meet with a financial planner and retirement consultant to help you get started.

The first thing to consider is what you want to do with your money and which types of plans you are eligible for. Once you have a general idea, you’ll need to meet with a financial planner and retirement consultant to help you get started.

Before meeting with anyone, do a little digging and research to ensure you have found a financial planning company that works best for you. There are specific retirement plans out there designed for freelancers or self-employed individuals. In other words, a financial company has taken a significant amount of freelancers, grouped them together, making it possible to offer them a 401k. The same type of plan exists for self-employed individuals. These types of plans are rare and only offered by certain financial companies, so if you are interested in something like this rather than a traditional retirement plan for entrepreneurs, freelancers, or those who are self-employed, you’ll need to do a little research. Walking into the financial planning company with a good idea of the types of retirement plans available and your eligibility in those different types of plans is also a plus. The consultant won’t need to explain everything to you, but can focus more of his/her time helping you find the best plan for you.

And don’t forget, that whichever financial planning company you decide to work with will charge you. Any company you chose will have its fees associated with helping you start and maintain your retirement plan. Thus, shopping around is always a good idea, but remember that you’ll want a mix of experience and value in order to have your money invested in a safe and reliable company. And when you are shopping around, don’t be afraid to go in a meet with different consultants to see what they recommend and what they can do for you. It’s perfectly fine to spend time with different consultants before you choose the one with the best options and even the consultant that best works with your personality. Think of it as shopping for a new pair of jeans. Rarely would you try on one pair and stick with it. That’s not to say the first pair you try on isn’t ultimately the one you purchase, but more often than not, you’ll try on a couple other pairs just to compare them with the first. Using your skills of comparison, you are able to choose the best pair of jeans based on value, fit, style and durability. The same principles apply to choosing a financial institution to partner with in your retirement planning.

When you first meet with them, they will ask a lot of questions about your personal financial situation. Having the most accurate up to date information will save both you and your consultant a great amount of time. Your consultant will have all the information about plans you are eligible for and what will work best with you personal financial situation.

It’s important to walk in the door of your financial planning institution with a list of questions in mind that you need answered before you walk back out. Your consultant should be able and willing to answer any of your questions, even if they sound elementary. If you need a refresher in how the interest works, or what the difference is between a 401k and a Solo 401k, your consultant should take the time to answer them – and continue explaining them until you fully understand. Don’t shy away from asking follow-up questions to ensure your comprehension. Remember, this is your money and it should be placed where you want and how you want. You need to feel comfortable with your decision.

As time continues, you may speak less to your retirement consultant, but remember there are important things in your retirement plan that can change from year to year. In these cases, you’ll want to at least be in touch with your consultant once a year to review these numbers. Whether it is a contribution increase or decrease or the limits have changed on your plan, it’s important you be aware of what is happening with your money.

When retirement starts to get closer, you’ll want to meet with your consultant more often to make sure you are on track to have the amount you need at retirement. Your goals may change, as you get closer to retirement, either deciding you will need more or less than you had originally thought. In that case, you’ll need to meet with your retirement consultant to change your contributions accordingly. You may also find that the current contributions you are making are maxing out your plan every year, but you would like to save more. In these cases, your retirement consultant can help you set up additional accounts to help you save more for retirement.

Saving for retirement as a freelancer, entrepreneur, or self-employed individual doesn’t have to be difficult. It may sound that way, but by finding the right help in a retirement consultant and creating the right plan for you makes it easy to contribute your money and let it grow until you have reached your retirement goal.

You now have a basic understanding of the retirement plans out there, and how retirement money works. There are still a few things to understand that will help you in your decisions about retirement.

These tips and tricks will not only help you decide which retirement plan is the best fit for you, but also will encourage the development of good habits and give you general knowledge in the financial world.

Develop a Savings Habit

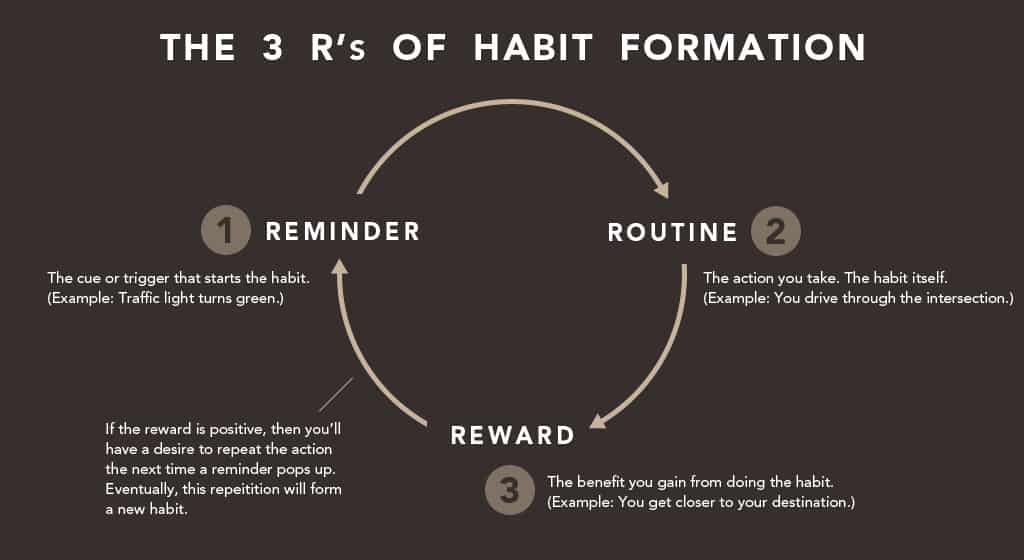

Saving isn’t just about retirement. Saving is an integral part of everyday living. It is important for you now, at an early age, to develop the habit of saving something with every paycheck you receive. At first it doesn’t need to be a lot, but starting now, will help you develop the habit of knowing that part of your budget should include savings every month.

By developing this habit now, early in your career, you are ensuring that through out the next 30-35 years you will find yourself living comfortably. Retirement is a savings plan, just like having a savings account with your bank. By having any type of savings, you are preparing for the future.

A traditional savings account will accrue some interest, but not nearly as much as a retirement account could. That is why having two separate types of accounts will prove valuable. You can’t put all of your money in either account. Unlike your retirement account, a savings account can be used at any time for any situation without any sort of penalty. This is another reason it is important to have both kinds of savings. You’ll need a traditional savings account for emergencies like car repairs, unplanned hospital visits, home repairs, etc. These are the types of things you use the money in your savings account to pay for. By preparing for these types of life events with a traditional savings account, you won’t feel pressure to dip into your retirement early in life.

Those that are really budget-friendly and savings oriented will have multiple kinds of savings accounts. These types of accounts could include a retirement plan, an emergency savings, a big purchases savings, and a traditional savings. Obviously, the money that is put in the retirement savings is intended for use at retirement. An emergency savings can be used for the things we discussed earlier like car and home repairs. These wouldn’t be like cosmetic changes or remodels, but instead for a new water heater or furnace if yours breaks. A big purchase savings could entail a few different things. This is where you could save for your kitchen remodel. It could also be used for down payments on cars or homes. And lastly you’ll have a traditional savings for smaller purchases that may or may not be planned, like a new television or computer.

Regardless of how you decide to structure your savings, planning in your monthly budget to contribute designated amounts into these savings plans is crucial. After you get paid every month, designate amounts for all the different areas of your life that will need money. Be realistic with your budget, so you do not disappoint yourself if you can’t keep to it. However, don’t be extra frivolous with your money either. Find a medium ground where you can live comfortably without putting money places that is unneeded.