It makes headlines daily, you see it in higher utility and grocery bills, and of course the price of gas is still sky high—we’re talking about inflation.

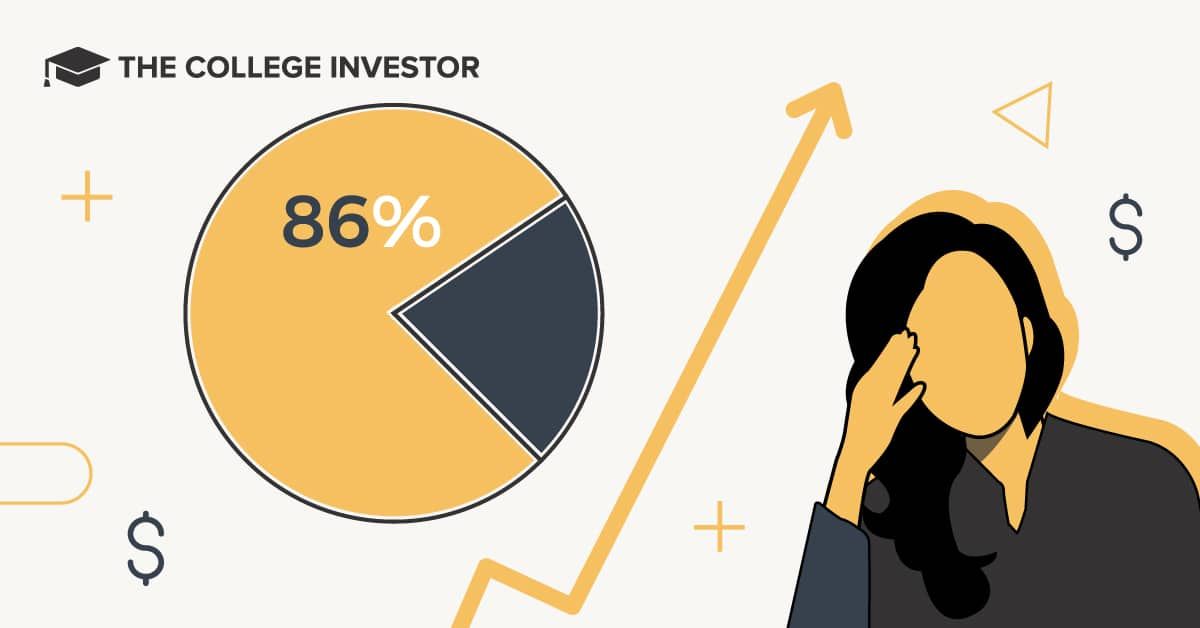

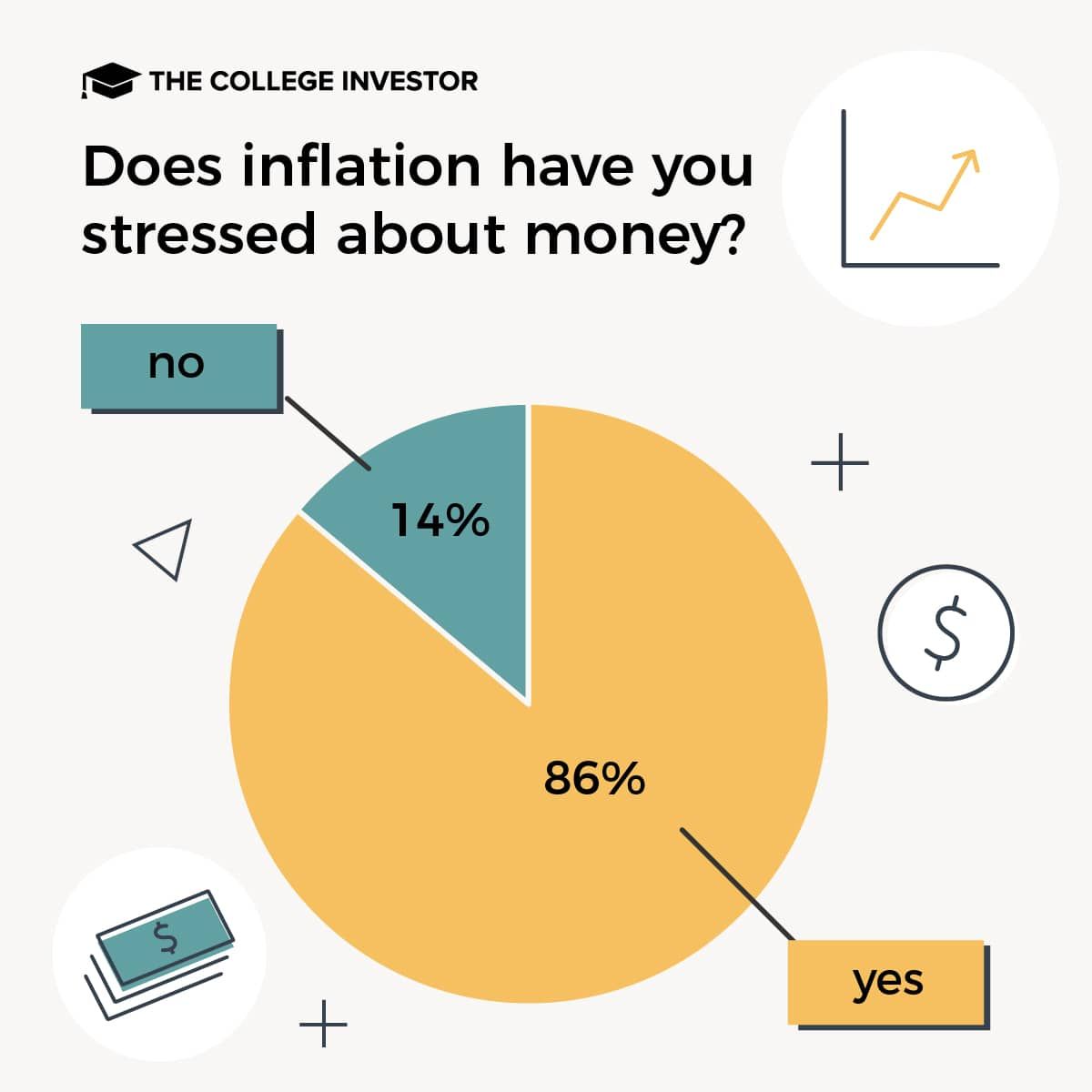

In a new College Investor survey, we asked if people were stressed about money because of rising inflation, and a resounding 86% said yes.

With the holidays fast approaching, inflation, which has increased over 8% in 2022, is weighing heavily on all of our minds.

According to the National Retail Federation, consumers plan on spending around $833 on gifts, decorations, and food. But if you’re finding it difficult to keep up with bills and everyday expenses, spending anything extra, much less $833, feels unattainable.

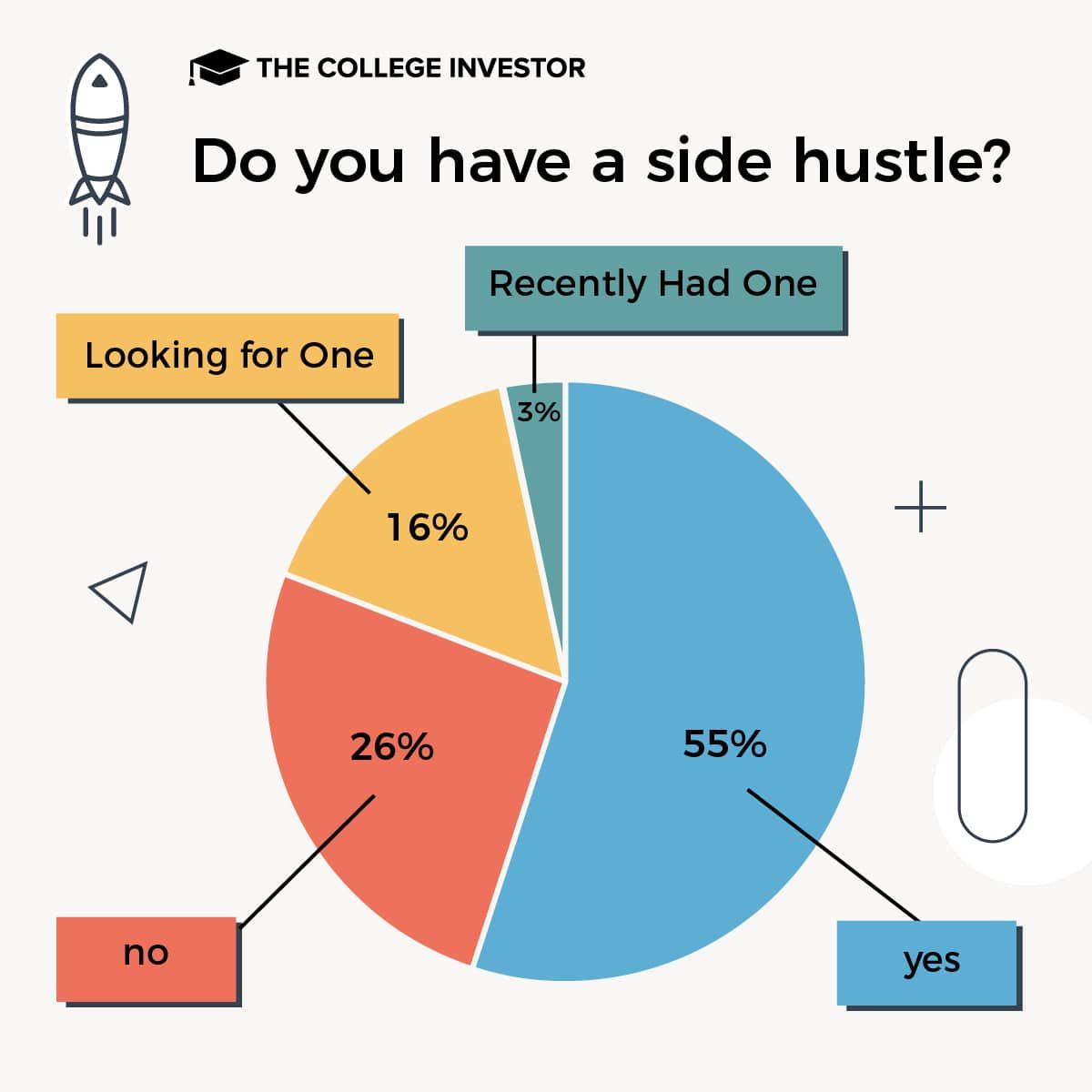

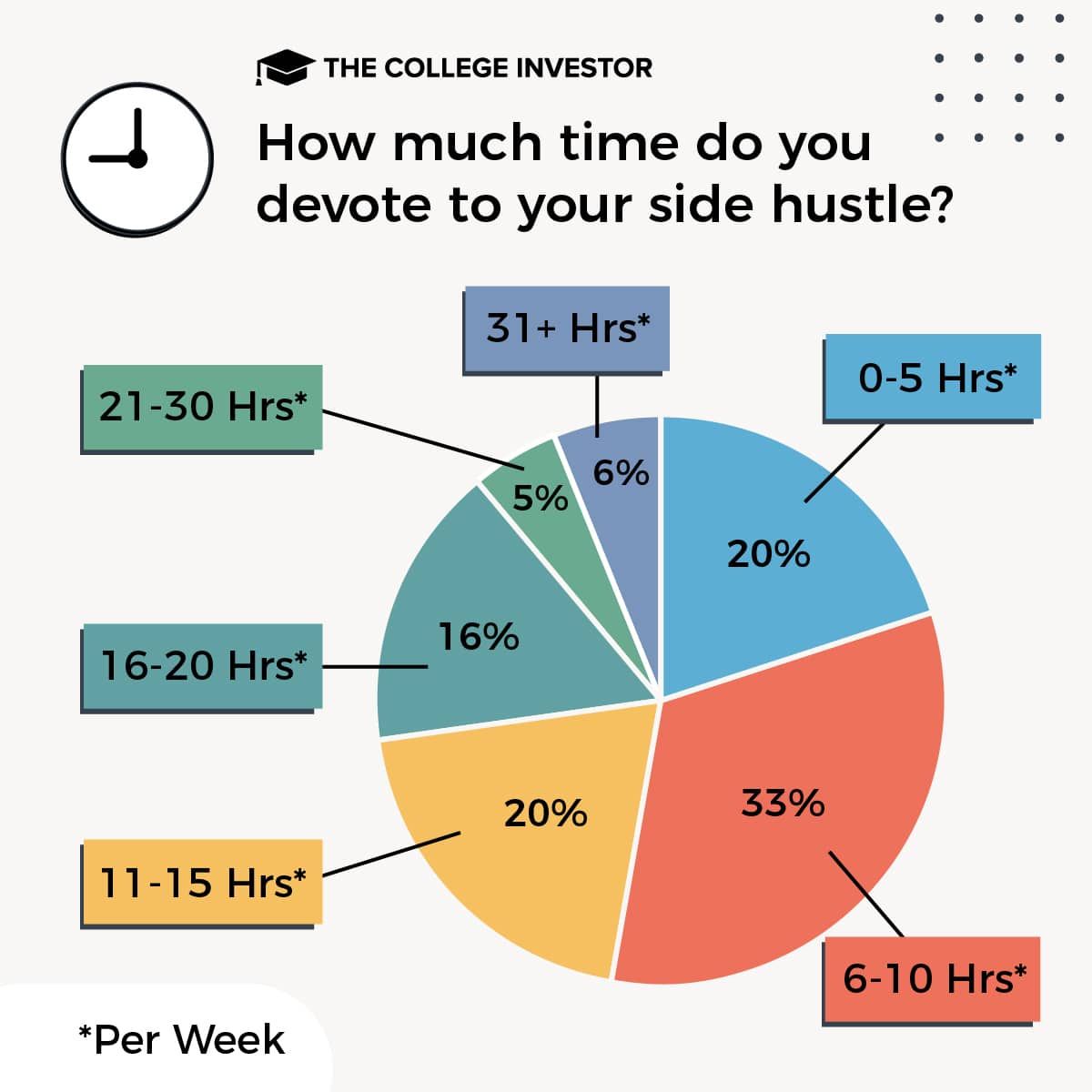

Our survey asked about side hustles and what kinds of work people were doing outside of their “main’ job to help afford the rising cost of everyday expenses. What percentage of people were side hustling? How were they planning to pay for holiday gifts this year?

The results show that while inflation is stressful, it’s also sparking the desire to pick up a side job for extra dough. Let’s explore the details from our survey.

Who’s Side Hustling?

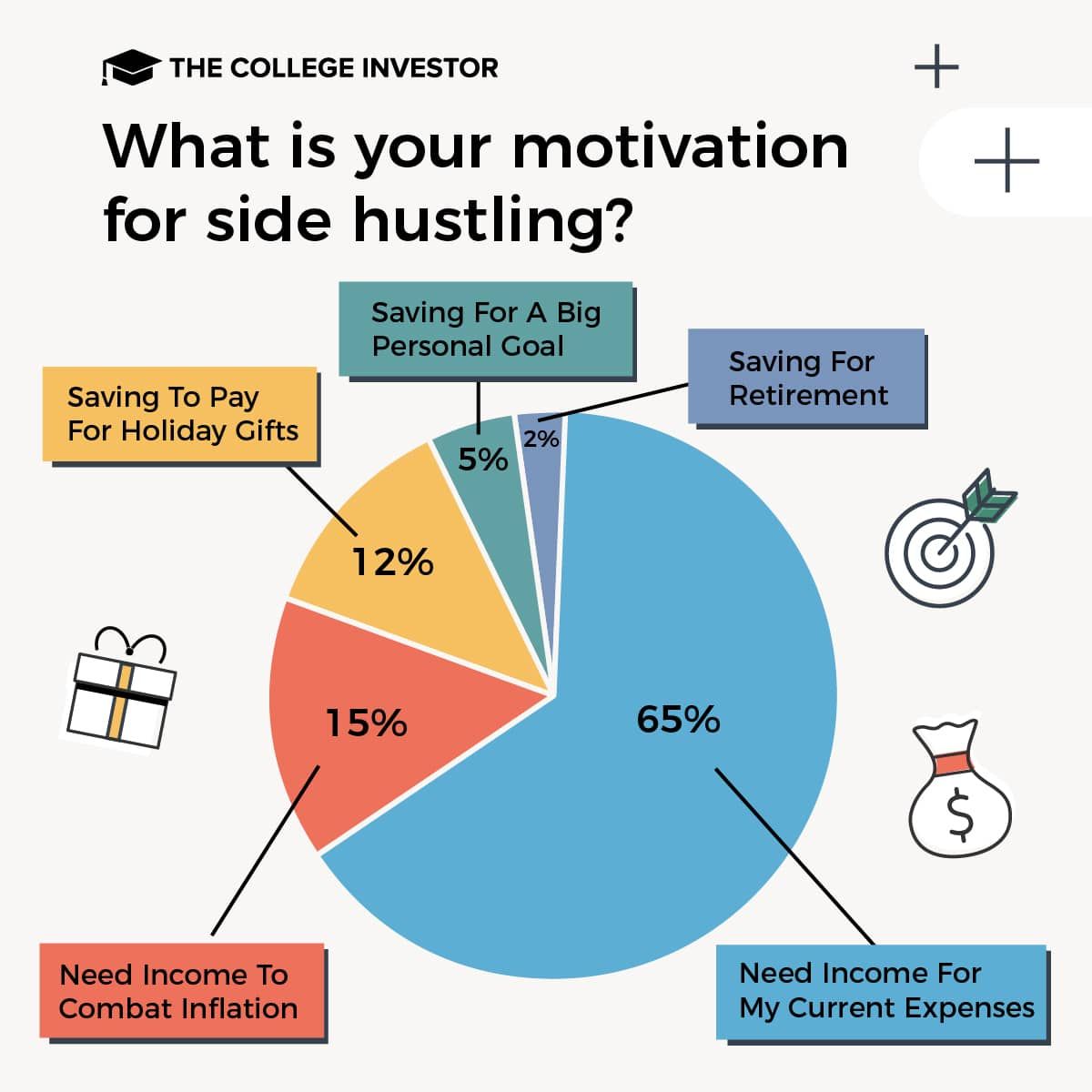

The majority of respondents, nearly 55%, have a side hustle. This extra income can improve wiggle room for monthly expenses such as rent and utilities, which is exactly what 65% use it for.

With seventy percent of respondents being stressed for the dough to pay for presents, only twelve percent said paying for holiday gifts is their motivation for side hustling.

Other interesting findings around include:

What Kind of Side Hustles Are People Doing?

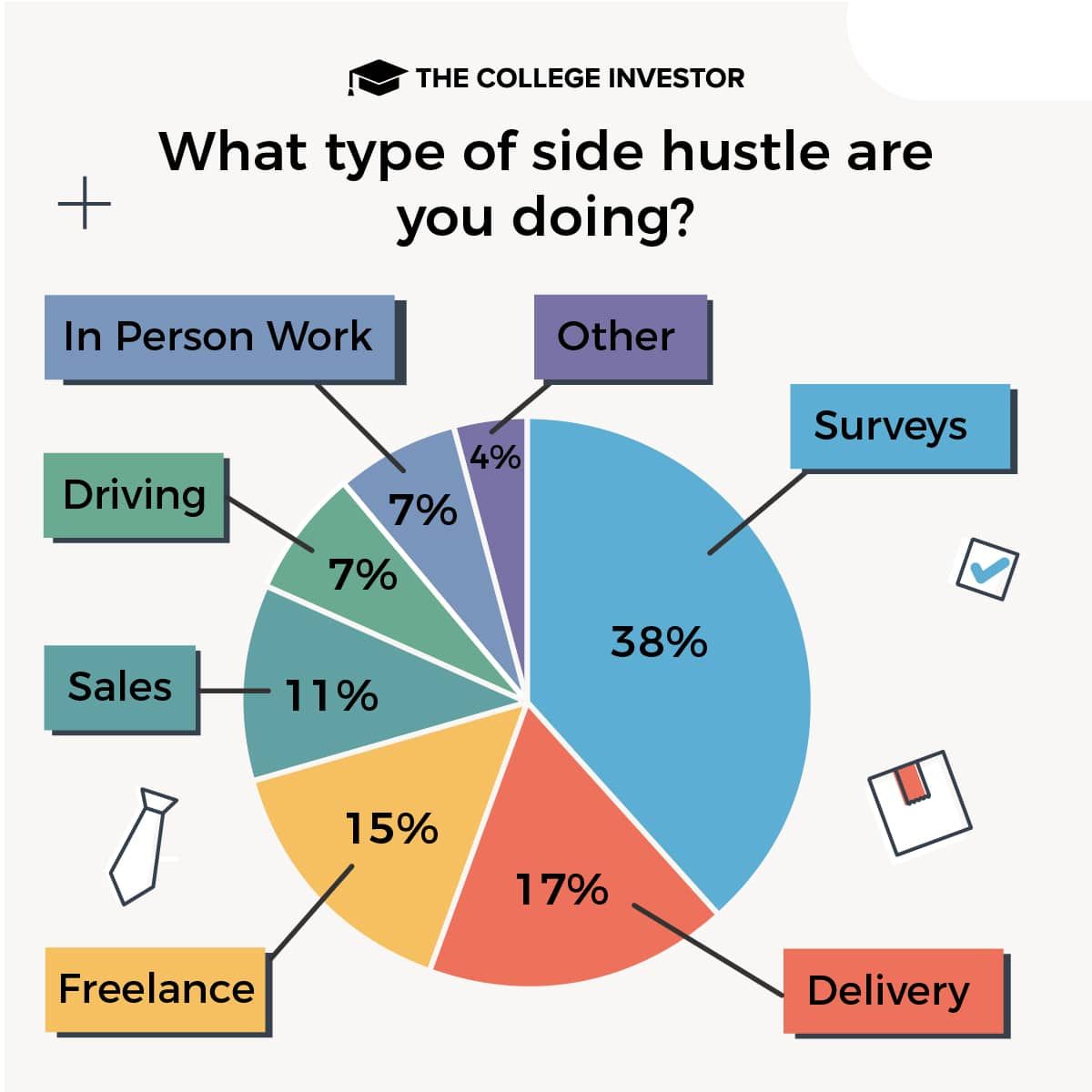

Extra money comes in all kinds of flavors thanks to the internet, rideshare, and delivery services. We thought it would be interesting to find out what kind of side hustles people are into, and here’s what they said:

How Do People Plan on Buying Gifts This Year?

Again, the majority of respondents said they were going to turn to their trusty side hustles to fund their holiday purchases. Here were the complete responses:

- 49%: Income from side hustle

- 21%: Credit cards

- 13%: Buy Now, Pay Later

- 10%: Gift cards

- 3%: Credit card rewards

- 2%: Personal loans

An important factor in sustaining a side hustle is motivation. The biggest reason in having a side hustle was to be able to pay for everyday expenses. Here's what else we discovered about what people were doing with their extra money:

Are You Prepared For This Season?

A side hustle comes in handy to cover higher everyday expenses brought on by inflation as well as pay for presents and holiday expenses.

If you’re ready to jump into a side hustle, we have plenty of ideas for you to get started. You can get started by filling out surveys for a little extra cash or see our articles for how to get started with DoorDash or Uber.

With the uncertainty around inflation, it’s a great time to pick up a side gig so you can have a little bit of cushion to get through the holidays and beyond.

If a side gig isn’t your thing, see the best kinds of investments for inflationary periods.

The College Investor commissioned Pollfish to conduct an online survey of 1,500 Americans ages 18 and older. The survey was fielded November 8, 2022.

Claire Tak is an editor, content strategist, and writer with a specialty and passion for personal finance and tech. Her experience in finance spans from working at San Francisco-based startups like Credit Sesame and Upstart to large institutions such as Wells Fargo. Her work has been published in FOX Business, Bloomberg, and Forbes.

Claire believes financial stability is created through education, long-term investing, and saving. She’s fascinated by the connection between money and happiness and how human behaviors play into achieving financial success.

Besides her enthusiasm for personal finance, she loves snowboarding and traveling. You can learn more about Claire at clairetak.com.

Editor: Robert Farrington