Once upon a time, the life of a college student meant going to school and then working full-time after graduating.

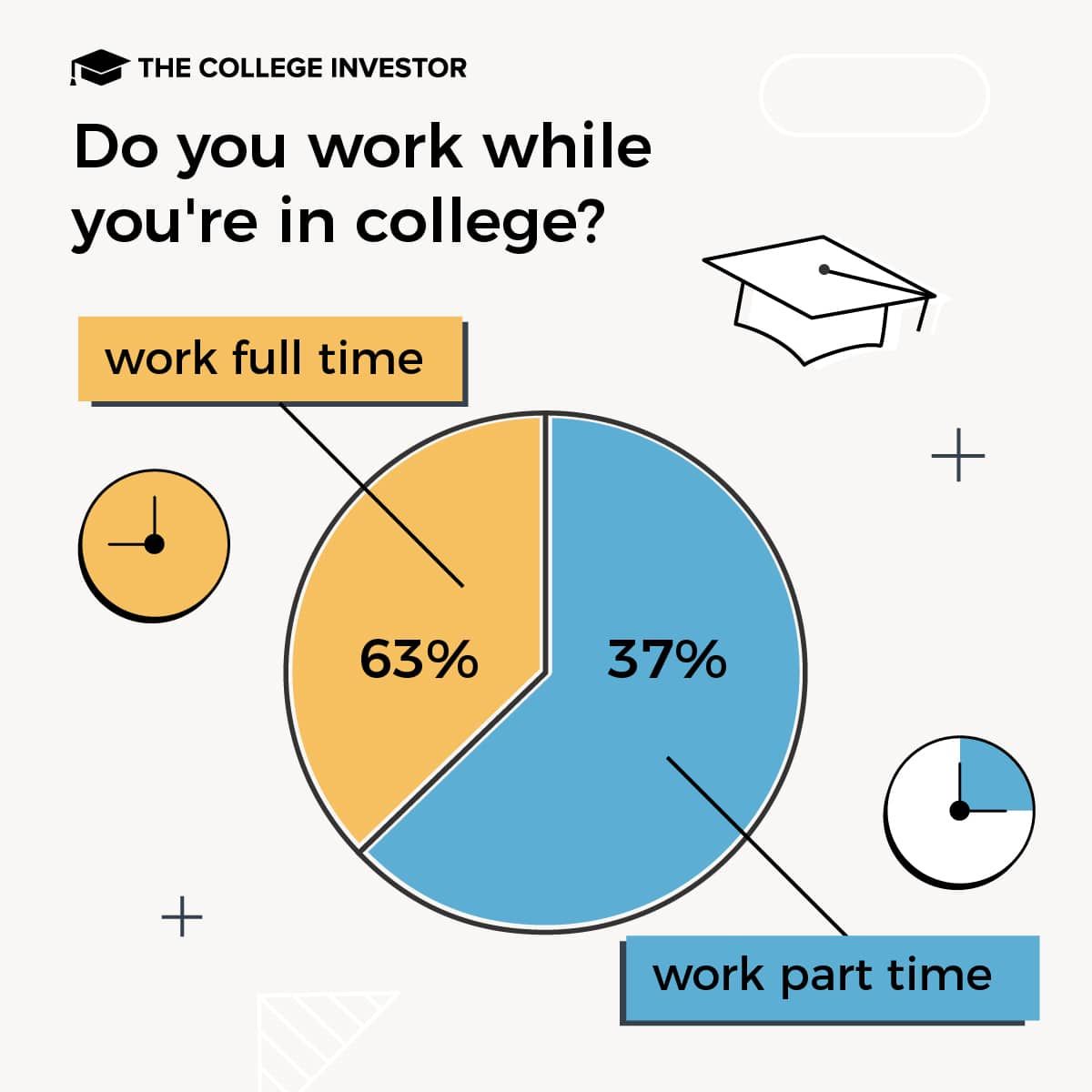

With increasing tuition costs and inflation contributing to the rising cost of living, students are now doing both. According to a new College Investor survey, 62% said they work full-time while also taking a full course load. Eighty-eight percent said they do it because they need the income.

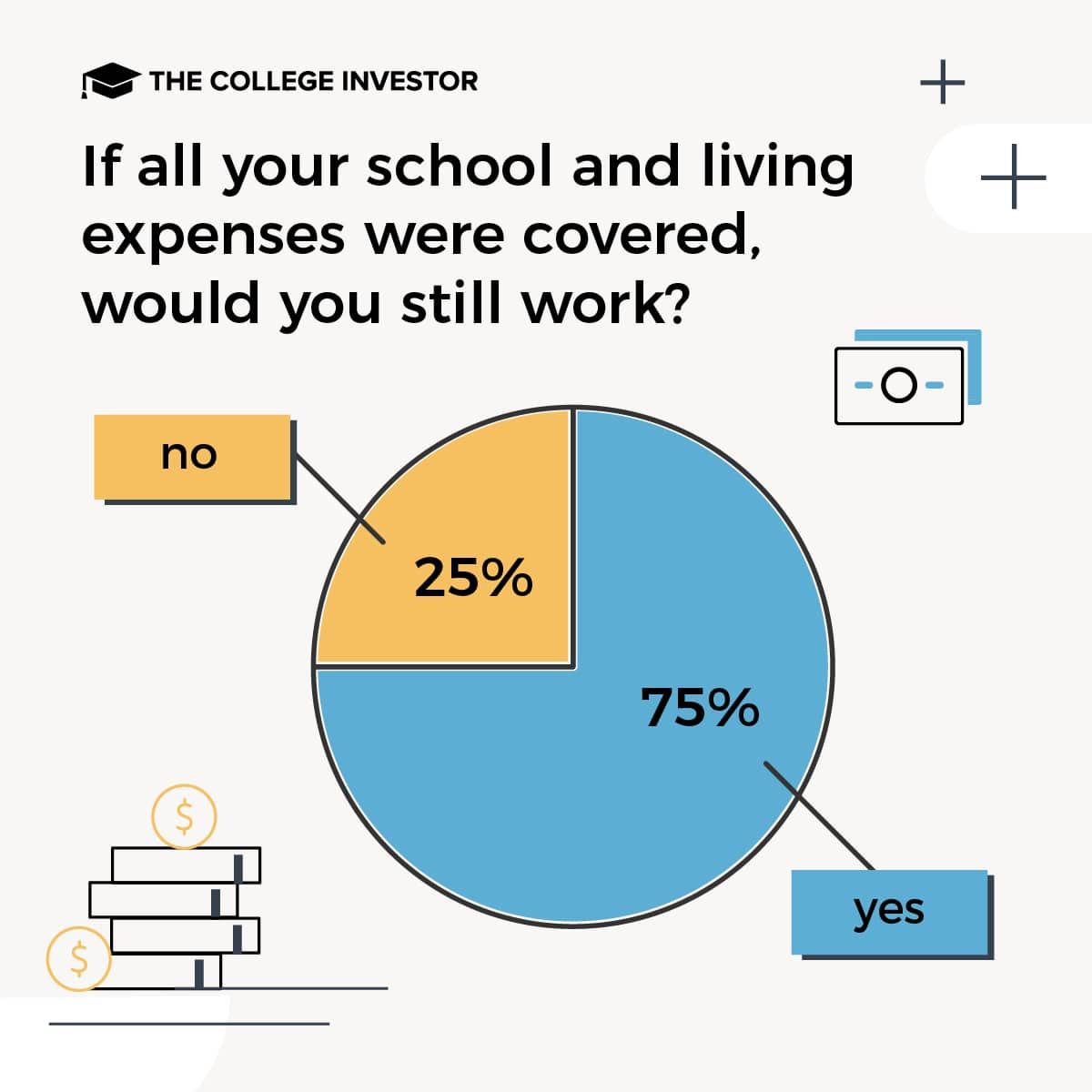

This means students might be stretched thin from trying to do it all—it’s a familiar and stressful dance of a 40-hour work week, attending classes, studying, and trying to enjoy some semblance of college social life. But despite the perceived difficulties of balancing work and school, 75% of survey respondents said they would continue to work, even if their school and living expenses were completely paid for.

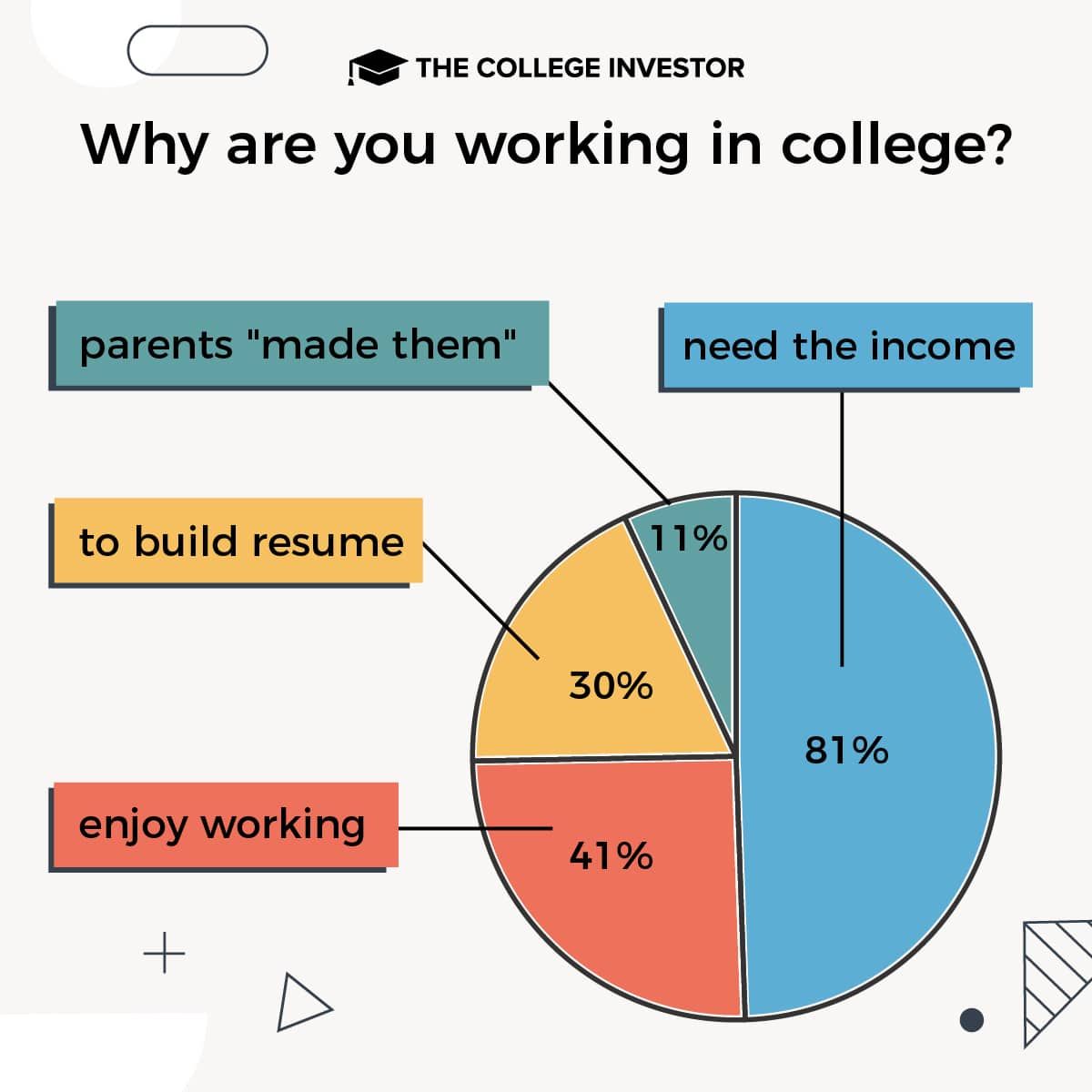

Here are other income-related findings from our survey:

- 81% said this income helps minimize their student loan debt

- 51% worked to cover the cost of living

- 11% said they worked because their parents made them

41% Find Value In Working

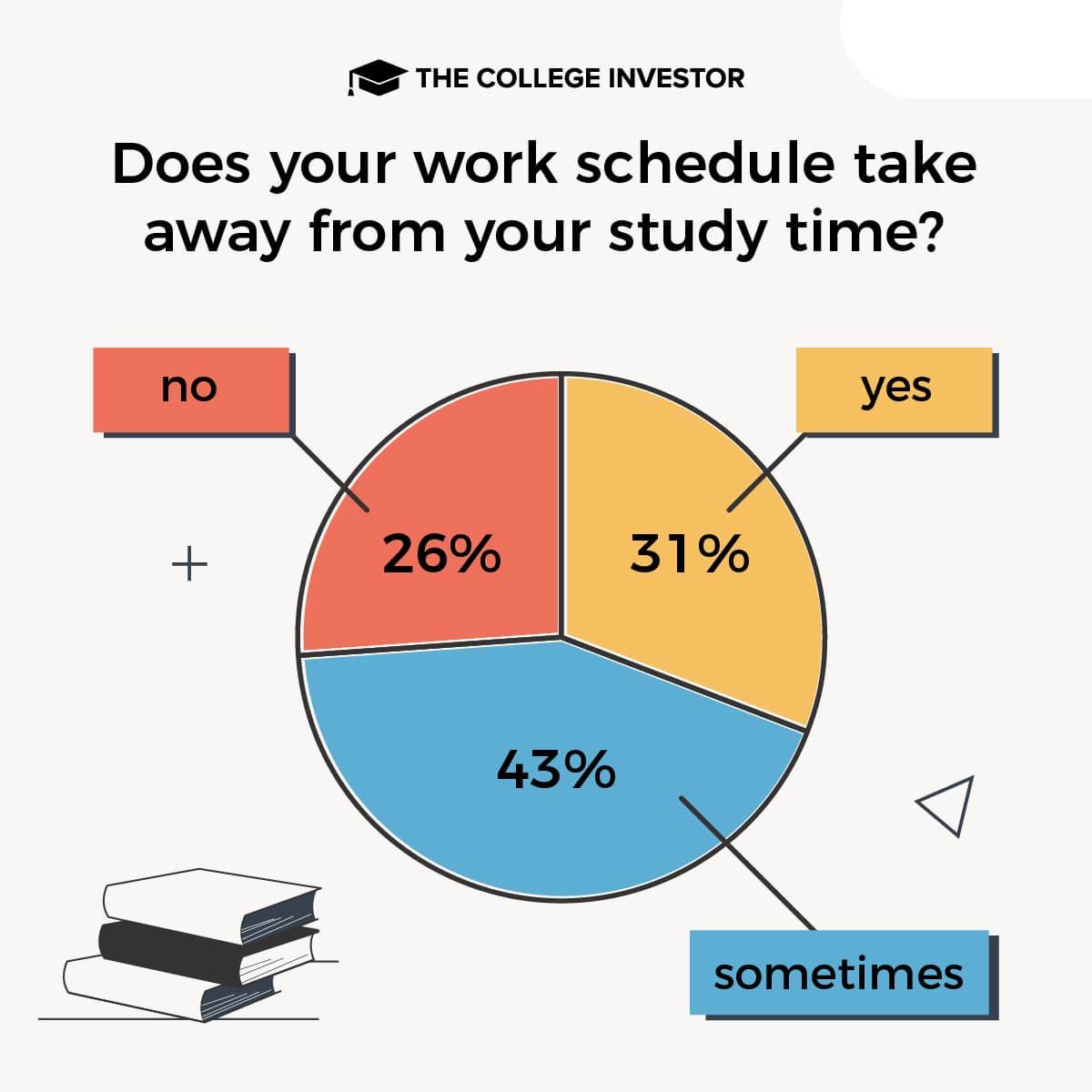

Even though 42% of respondents said working full-time takes away from study time, 41% said they actually enjoy working.

Perhaps these students have experienced the benefits of work that extend beyond the classroom. Meaningful work, responsibilities, working on a terrific team, and having goals to fulfill will no doubt prepare students for the post-graduation workforce. Thirty percent said they work to build their resume.

Even if their entire school and living costs were covered, 75% said they would still continue to work. Gaining useful technical and soft skills could be core reasons why students would still choose to work.

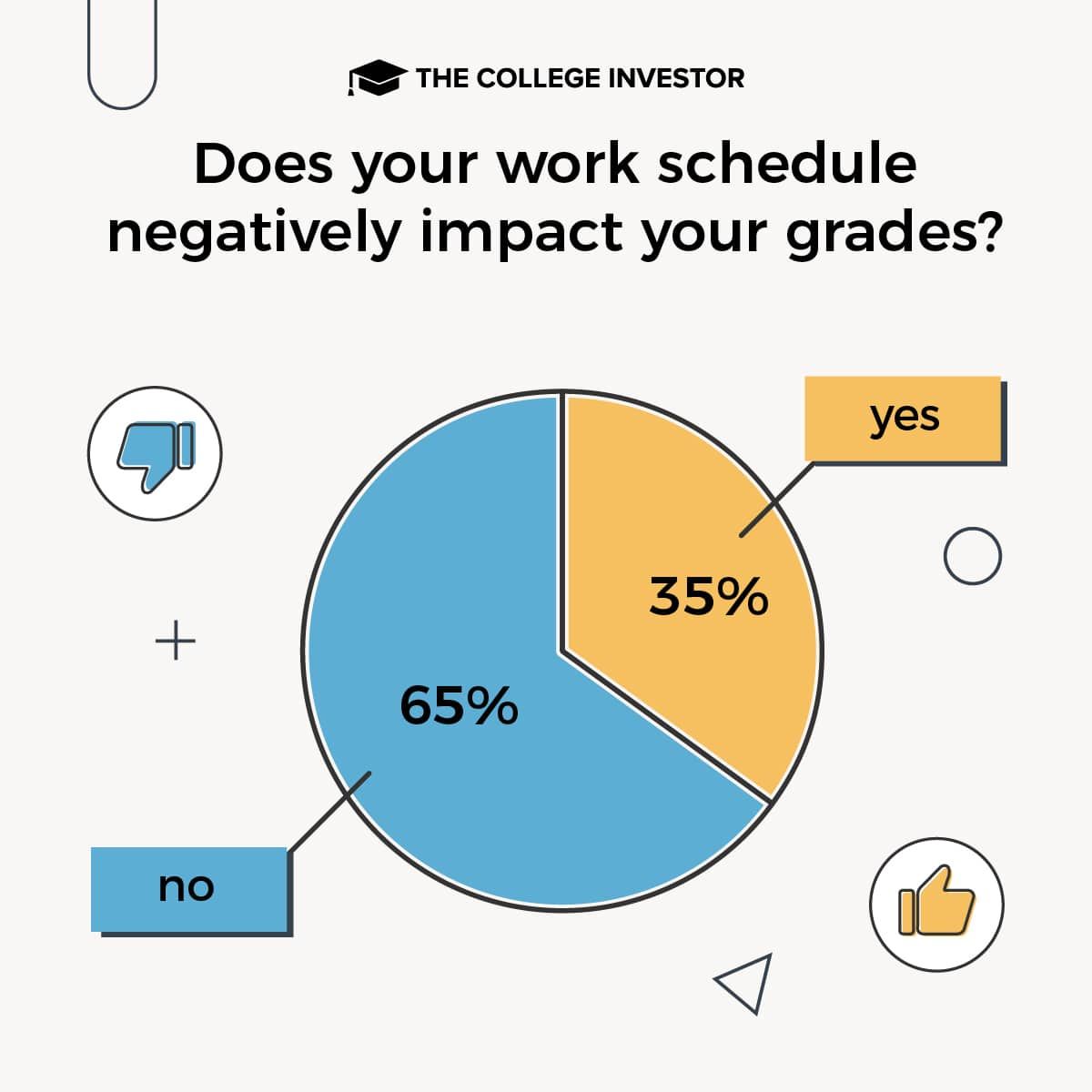

35% Believed A Full-time Job Negatively Impacts Their Grades

Which is worse, cramming for a final or knowing your work colleagues are upset at you for messing up on the last project? The impact and strain from work vs. school can be rough.

According to our survey, work time can bleed into school time:

35%

Work schedule negatively impacts grades

22%

Work was more stressful than school

54%

Work schedule takes away from their study time

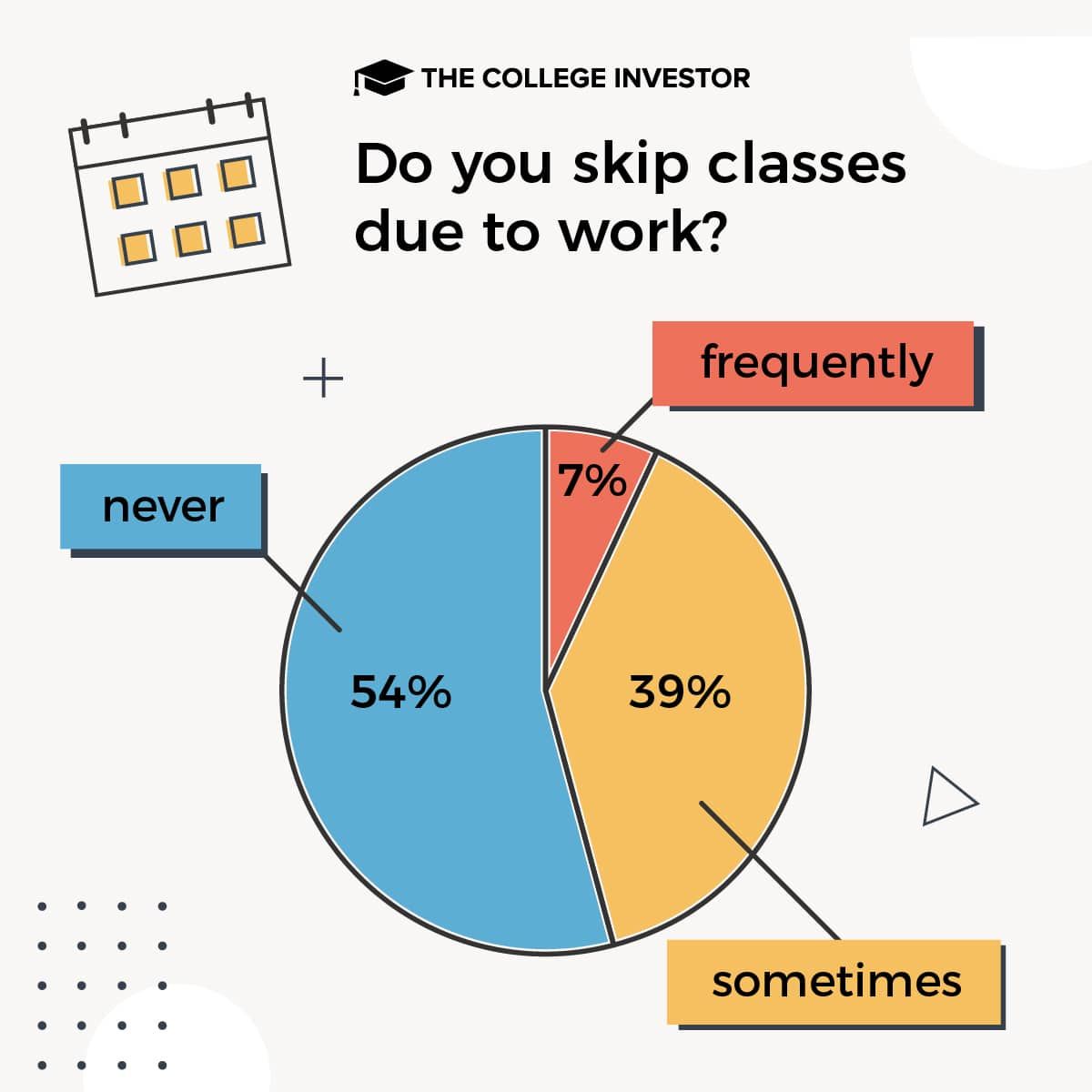

On the contrary, 65% said work doesn’t negatively impact their grades and 35% never skip classes because of work.

Here are more interesting takeaways:

- 33%: School and work were equally stressful

- 26%: Work never takes away from studying

- 7%: Frequently skip class because of work

College Is Crazy Expensive

In light of the soaring prices for college, some students are ditching college all together while others work full-time to get through it.

From those surveyed, 81% said the income earned from their full-time jobs helps offset student loan debt.

Is working a full-time job while you’re in school an unavoidable part of college life? According to our survey, it’s both a necessity and desire. It helps reduce overall debt while likely the burden of taking on new debt.

In planning for life after college, a smaller student loan balance and gaining work experience that can’t be taught in the classroom are all a part of a successful entry into the real world.

What do you think? Would you still choose to work if you didn’t have to? Let us know in the comments section below.

Methodology

The College Investor commissioned Pollfish to conduct an online survey of 1,000 American college students. The survey was fielded September 30, 2022.

Claire Tak is an editor, content strategist, and writer with a specialty and passion for personal finance and tech. Her experience in finance spans from working at San Francisco-based startups like Credit Sesame and Upstart to large institutions such as Wells Fargo. Her work has been published in FOX Business, Bloomberg, and Forbes.

Claire believes financial stability is created through education, long-term investing, and saving. She’s fascinated by the connection between money and happiness and how human behaviors play into achieving financial success.

Besides her enthusiasm for personal finance, she loves snowboarding and traveling. You can learn more about Claire at clairetak.com.

Editor: Robert Farrington