Investing apps and investing-as-a-service products have emerged as a hot new trend over the last few years. You've likely heard the names: Robinhood, Acorns, Webull, Stash, and the list goes on.

And each of these companies has a unique pricing model. Some are free - where the users are the product. Some charge a monthly fee subscription - where it's investing-as-a-service. And others rely on a more tradition asset-under-management (AUM) pricing model.

In order to see how these products are changing people perceptions of investing, and feelings about how they pay for investment products, we conducted a survey of investors to find out.

Surprisingly, we found out that 75% of Americans were familiar with trading apps such as Robinhood, and even more (78%) were familiar with subscription investing apps like Acorns.

Let's take a deeper look at the results:

Key Findings

With the growing trend of investing apps and investing services businesses, we wanted to see if Americans were familiar with these products and services.

Here's what we found:

- 78% of Americans are familiar with investment-as-a-service products like Acorns, which charge a monthly subscription fee.

- 75% of Americans are familiar with free trading apps like Robinhood, which advertise commission-free stock and options trading.

- Only 43% of Americans were familiar with robo-advisor services like Wealthfront or Betterment.

When it comes to how people want to pay for investing, it's divided among Americans:

- 34% of respondents preferred a monthly-fee based model with unlimited trades

- 33% preferred a flat-fee commission system (such as $4 per trade)

- 28% preferred commission-free trading, with the understanding that the free options may be limited

- Only 5% preferred an asset-under-management (AUM) model for pricing

With pricing in mind, it's interesting to see how consumers view how these companies make money. When it comes to commission-free trading, only 45% of respondents understood how free investing apps make money. Yet, 61% of investors thought it was important to understand how these companies make money.

Awareness Of Investing Apps

Let's dive into the awareness of these popular investing apps. Those that follow the investing space may think that most investors are extremely familiar with apps like Robinhood because of trends like /r/wallstreetbet.

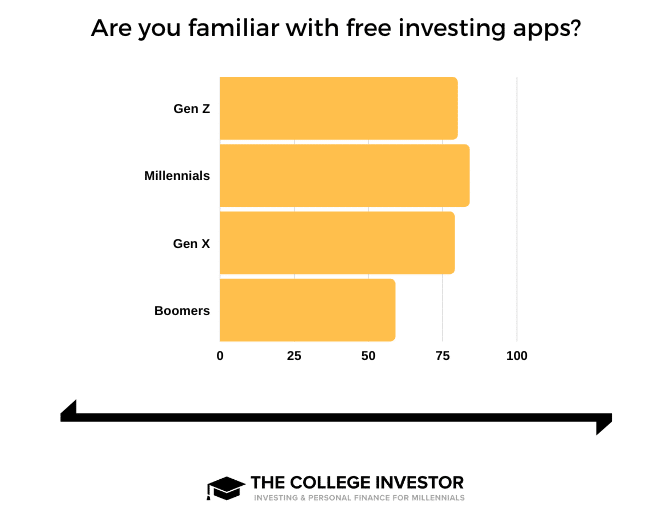

And while 75% of Americans overall are familiar with free trading apps, it's definitely generational.

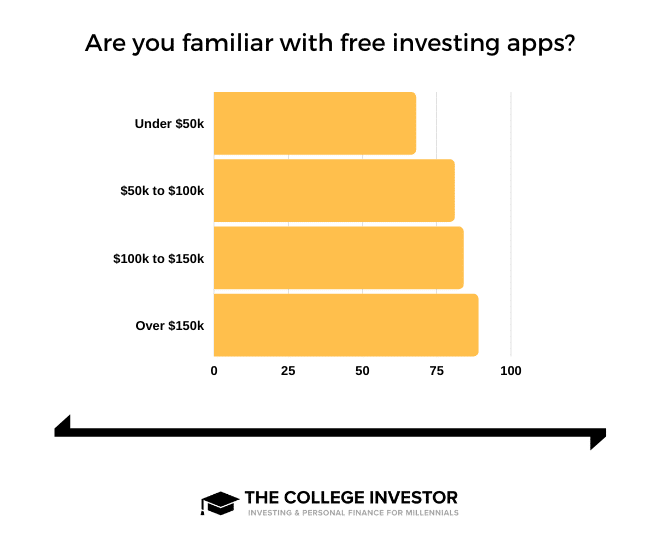

Income also plays a factor in the awareness of investing apps. At the low end, with people making under $50,000 per year, only 68% are familiar with free investing apps. At the high end, people making over $150,000 per year, 89% are familiar with these apps.

When it comes to investing-as-a-service, which we define as companies that allow you to invest with a monthly service fee (such as Acorns and Stash), these companies are more well known by investors.

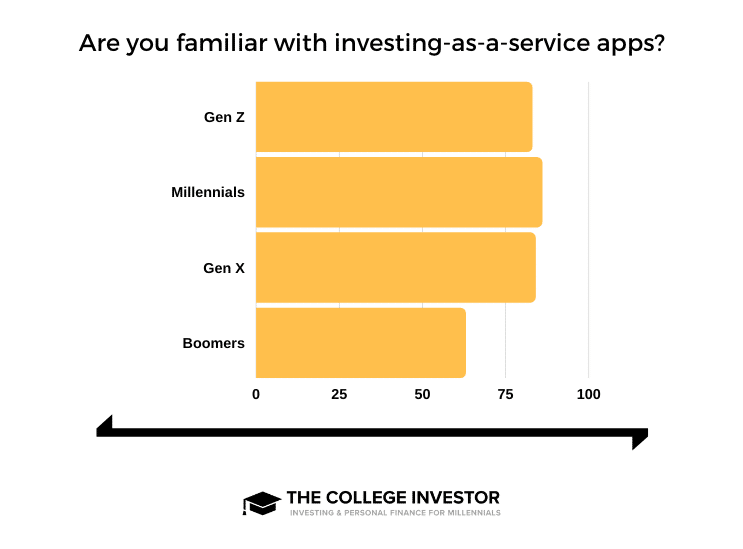

Overall, 78% of Americans are familiar with investing-as-a-service companies. We do see similar patterns by both generation and income.

Millennials are the most familiar with investing-as-a-service apps, with 86% familiar with these services. Boomers and older are the least familiar, at just 63%.

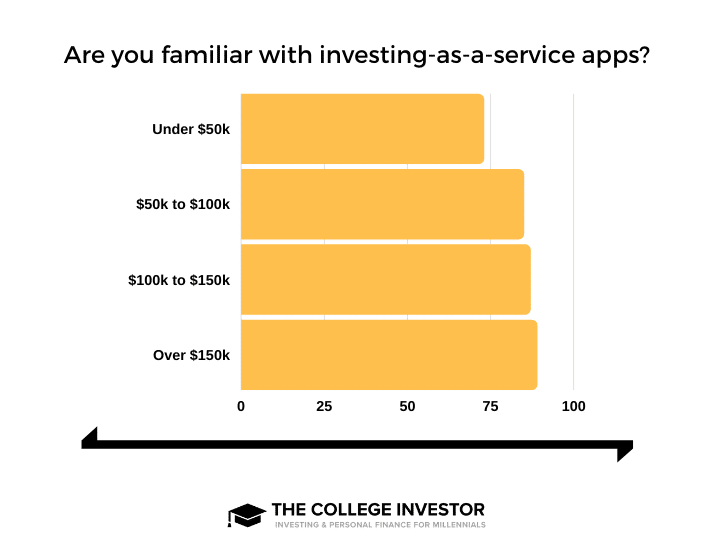

However, even in the lower income tiers, we're seeing more people familiar with these services. For individuals making less than $50,000 per year, 73% are familiar with these apps. At the top, with individuals making over $150,000 per year, 89% were familiar.

Finally, we wanted to look at robo-advisors. These are services that will automatically invest your money based on factors you input. They have been gaining popularity over the last few years as an alternative to a traditional financial advisor. They provide more guidance than doing-it-yourself, but cost less than meeting with and using a financial advisor.

The most popular robo-advisor services are Wealthfront and Betterment, but companies like Vanguard have also launched similar services.

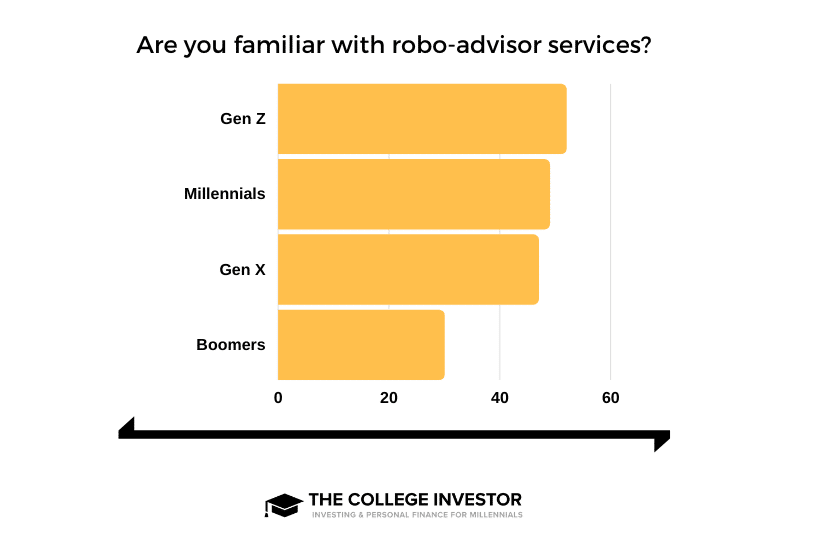

Overall, just 43% of Americans were familiar with robo-advisors. When you break it down, 52% of Gen Z are familiar with these apps, while only 30% of Boomers and older are.

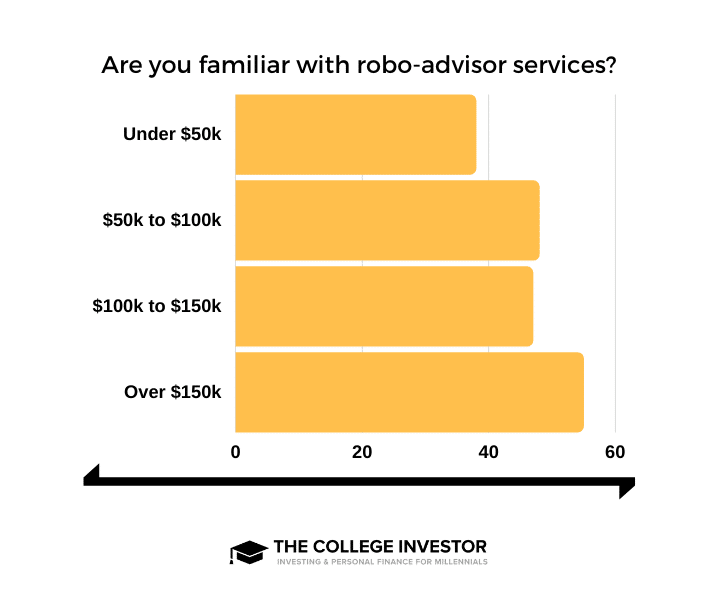

Income also plays a factor, with higher income earners being more aware of robo-advisors. Of those making less than $50,000 per year, only 38% were familiar with robo-advisor products and services. However, of those making $150,000 per year or more, 55% were familiar with these tools.

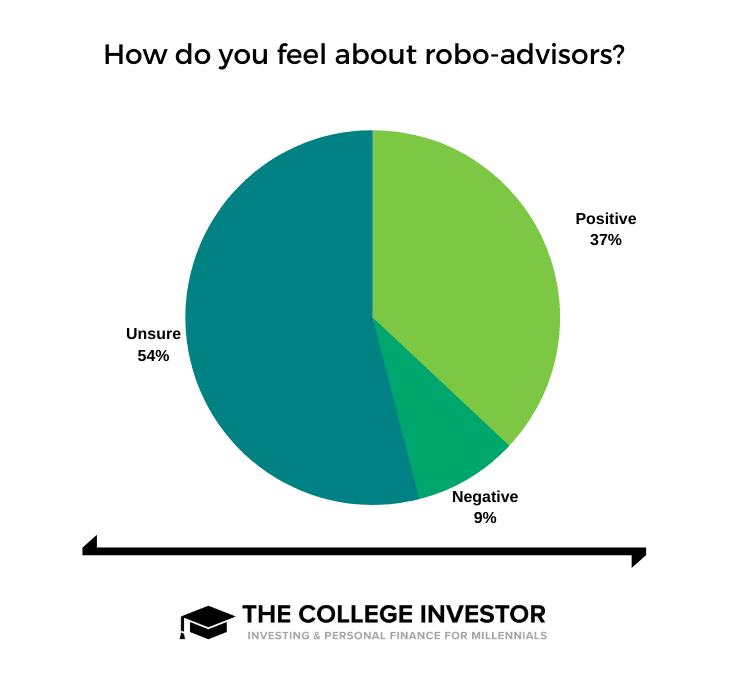

Finally, just because people are aware of these products and services doesn't mean people like them. We wanted to check on the sentiment of how people felt about these services.

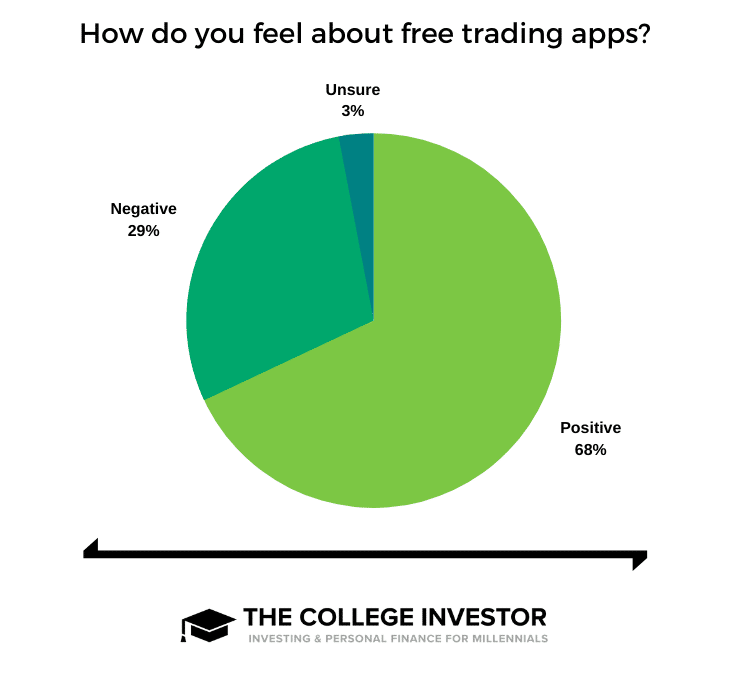

When it comes to free investing apps, people had a positive sentiment about them.

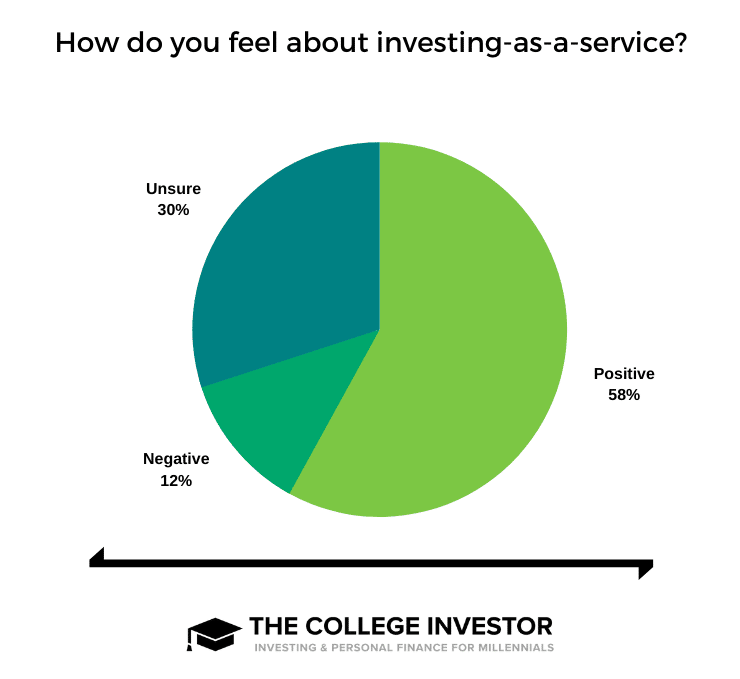

When it comes to investing-as-a-service companies, while people were more familiar with them, they also didn't have as positive a sentiment about them. In fact, roughly 30% of respondents were unsure how they felt, and 12% had a negative view of them.

Finally, we looked at the sentiment towards robo-advisors. Robo-advisors had the lowest sentiment - with only 37% of people having a positive view towards them. In fact, 54% were unsure about their view.

Most Important Features Of Investing Apps

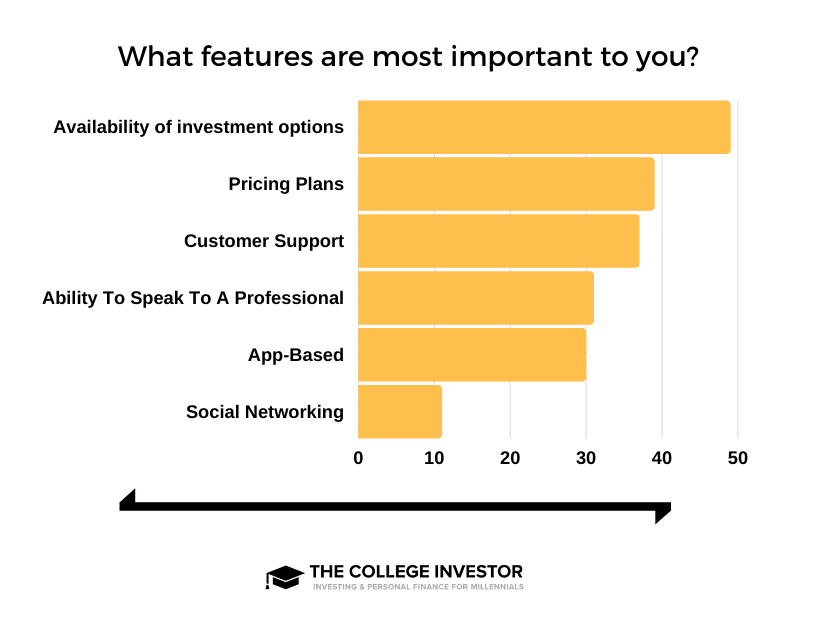

Now that we have a better understanding of the awareness of these apps, and know the sentiment towards them, we thought it was important to look at what featured mattered most for investors.

In general, the two biggest factors for an investor looking at an investment platform were the pricing model and the availability of investments.

With the pricing model, this could be commission-based, monthly fee-based, or AUM-based. With the availability of investments, this focused on things like whether a platform supported all stocks, options, cryptocurrency, and more.

We were surprised that pricing plans weren't above and away the most important factor, especially considering the drag on your total returns pricing can play in your portfolio. It seems that most investors actually care more about the investment options they have access to, whether or not they take advantage of them.

We also wanted to see how important connecting with other investors was - which is the "social networking" component. Apps like Public are making a big push into this space, but only about 11% of investors cared about this being a feature.

Preferred Pricing Models

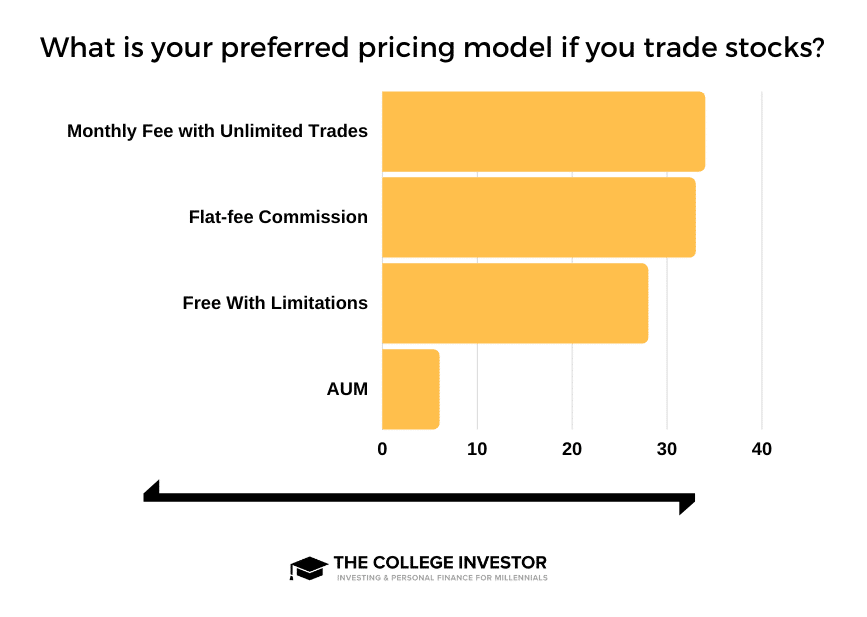

Given that pricing plans were one of the most important features, and they play a big role in total returns, we thought it was important to assess the preferred pricing models for investors.

Given there are different needs with pricing, we looked at both what DIY investors and traders preferred, and also what those who wanted to speak with a professional preferred.

For those who are interested in trading stocks, options, and ETFs, the most preferred pricing model was a monthly-fee for service with unlimited trades (34% of respondents). This was closely followed by commission-based pricing (33% of respondents).

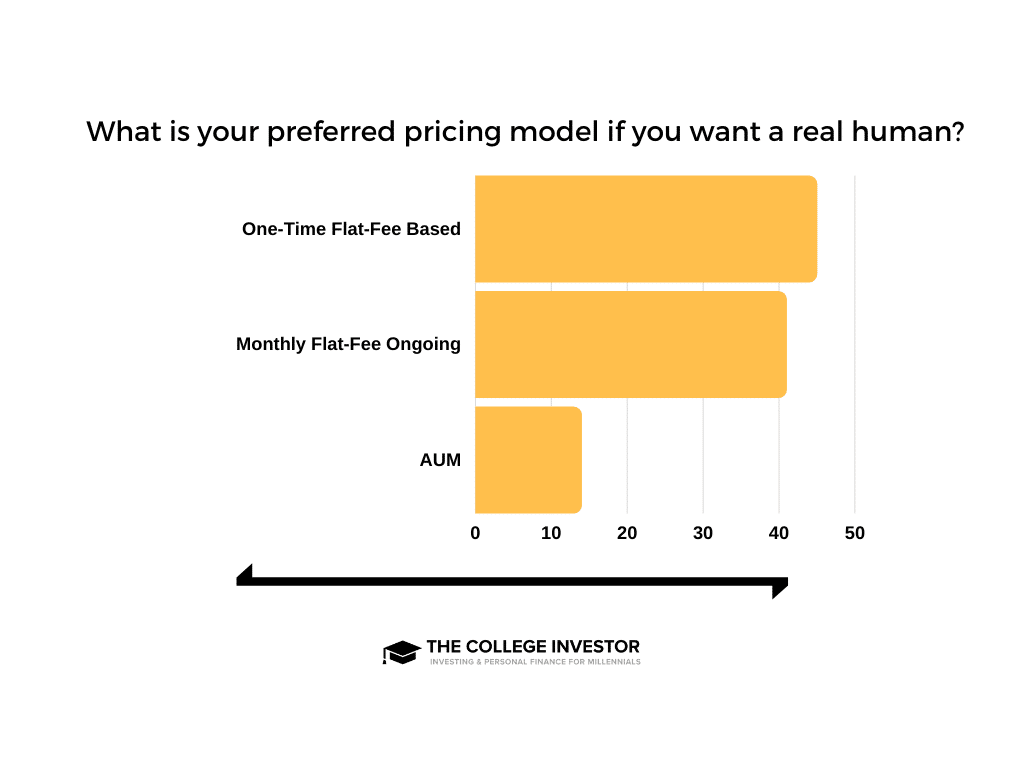

However, everyone isn't a DIY investor. There are still a lot of people who want a real human to help them invest and manage their finances. And there are a lot of models for this.

We look at a few of the more common and promising models: a flat-fee one time for advice as needed (whether a fee-only financial planner or something like what Betterment offers), a monthly-fee model (like what Facet Wealth offers), or a traditional assets-under-management pricing model.

By far, the flat fee options where most popular, with 45% preferring a one-time flat-fee, and 41% preferring a monthly subscription. Only 14% preferred the AUM model.

Final Thoughts

More and more investors are looking at investing apps and services to help them manage their money. And it appears that commission-free trading apps are going to lead the way.

It also appears that people are becoming frustrated with the traditional asset-under-management approach to money, with both less popularity of robo-advisors, and a low preference for the AUM pricing program.

It will be interesting to see how investment firms adapt for the future.

Methodology

The College Investor commissioned Pollfish to conduct an online survey of 2,000 Americans. The survey was fielded October 18-19, 2020.

Generations are defined as the following ages in October 2020:

- Generation Z are 18-24

- Millennials are 25-39

- Generation X are 40-54

- Baby boomers are 55+

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.