Typically, you need life insurance if you have dependents that depend on your income. However, there are reasons to buy life insurance even if this scenario doesn't apply.

You may be at the age where you’ve never had to consider life insurance. Or maybe you’ve thought about it several times but have been too overwhelmed by the choices, industry jargon, and potential costs to know where to start. Let me just say: you’re not alone.

Life insurance is a good move for everyone, from your single friends to your wealthy neighbors. So, let’s start with the basics.

Life Insurance 101

A life insurance policy sets the terms of an agreement that your insurance company will pay a sum of money to anyone listed as your beneficiary if you die while the policy is in place. In exchange for that eventual payout, you pay the insurer a monthly premium for the duration of the policy.

It sounds like a lot, but the gist is this: You pay the insurer now to ensure a payout later. As a result, you get peace of mind now and your loved ones receive financial support later. Where it gets complicated is in choosing the type of life insurance you want, estimating how much you need, and, generally, gathering all the information required to apply.

Types Of Life Insurance (Term vs. Whole)

There are two basic types of life insurance, term and whole life.

Term insurance covers you for a set period of time, say 10 or 20 years, and during that time you will make a set monthly payment. If you pass away during the term, the life insurance pays out the death benefit. If you don't, the policy ends after the term is up. This type is appropriate for most people.

Whole life insurance is more complicated. Whole life covers you for your entire life in exchange for a monthly premium. However, it's much more expensive and the additional premiums build up in what is called "cash value". This cash value can be used for a variety of reasons, including paying for future premiums and giving you the ability to take a loan from the policy.

Most people will find the best value in term life. Whole life costs more, and has terms like a cash account that most insured-individuals never need and will never use.

To learn more, here's a deeper dive on the differences between term and whole life insurance.

Factors That Influence Your Needs

To figure out how much life insurance coverage you need you'll need to figure out what your family would need if you were to pass away.

It's common to have life insurance provide some cash for living expenses until the youngest child is an adult, enough to pay off the house, and often enough to send the kids to college.

For example, someone who wants to provide $4,000 a month in income for 10 years, pay off the $220,000 mortgage, and provide $50,000 for college would need a policy for $750,000.

If you aren't sure, one "back of the envelope" method is to get 10 times your annual salary in coverage.

Once you have the amount figured out, you'll want to decide on how long you'll need coverage for. Often times, people want coverage until their youngest child is an adult, but your specific situation may be different.

Here's more on how to figure out how much life insurance you need.

Factors That Influence Price

You’re probably aware that insurance companies base life insurance premiums almost entirely on your age. However, other factors come into play, too, like your gender, weight, medical history, family health history, and whether you use tobacco products.

Your premium is also influenced by the policy type you choose and how much coverage you want.

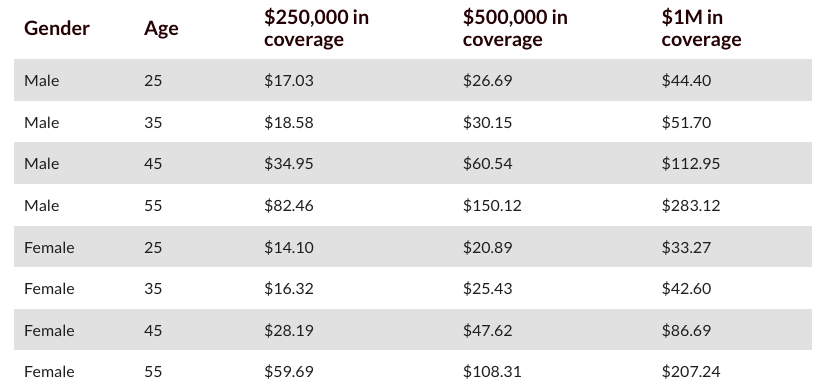

Consider this breakdown of costs of term life insurance based on age and gender:

Generally, the older you are, the higher your premium simply because you pose greater risk to the insurer of having to pay death benefits to your beneficiaries. Fortunately, there are an array of affordable options that can meet your needs at any age.

Life Insurance Needs By Age

No two life insurance policies are alike because we all have unique needs based on who we are and what’s going on in our lives. But how do you know what you do need? And what should you consider even if you don’t think you need it? Here are some things to consider based on your age group.

Young Adults (20s & 30s)

This is when you are most likely to need life insurance. In your 20s and 30s is when you are most likely to be taking care of a family, and you haven't had much time to accumulate a lot of wealth. Therefore, if you were to pass away, your family could be in a very tight spot.

Luckily, the younger you are, the less expensive life insurance will be. Purchasing life insurance while your young and healthy is beneficial for another reason as well, besides just price. Certain health conditions can make you uninsurable. If during your life you are diagnosed with one of these conditions you will not be able to buy life insurance at all.

So, if you are able to buy it, and you know you will need it in the future, it might be a good idea to get life insurance now.

What if I’m single? Having life insurance can still help protect your loved ones from financial burdens (i.e., pesky student loans) brought on by your death. Even if you aren’t partnered, family members, charities, or even business partners could benefit from your financial support in the event of your death. Plus, you may need it in the future so best to get it while you you are young and healthy.

What if I already have life insurance through my employer? Group life insurance is typically offered at little or no cost to employees. Often referred to as “basic” life insurance, coverage is automatically available to you (regardless of your health history), but amounts are typically capped at a low level (i.e. one or two times your yearly pay).

There’s no reason not to sign up for group coverage, but I recommend also having supplemental life insurance. This is because employer coverage doesn’t typically provide the same amount of coverage for your dependents, and your coverage is entirely linked to your place of work.

Middle-Aged (40s & 50s)

As you age, you’ll likely accumulate additional assets. This could be wealth you've built up or a mortgage or other debts that would need to be paid off. You may also start to develop various health problems that will raise the cost of your life insurance premium. You should re-evaluate your coverage as your lifestyle and family dynamics change.

What if I don’t have any dependents? It might seem silly to take out an insurance policy with a death benefit if no one is around to receive the money after you pass. The thing is most people end up with someone in their life who they want to support in the event of their death. And even if you don’t have dependents, you may have aging parents who could use the financial support to cover their care if you aren’t around.

What if I’m independently wealthy? If you’re wealthy, you may wan to look at life insurance as a way to pass your wealth on. Tax laws favor life insurance: policy holders with estates of up to $13.61 million (individual, more for married couples) in 2024 are exempt from estate taxes when leaving this amount to a beneficiary. Consult a tax professional to discuss your options.

Seniors (60s & Up)

If you don’t have a life insurance policy by this phase of life, you should definitely consider talking to someone about your options. Depending on your age and health, you may find fewer options, and you’ll almost certainly incur higher premiums, hence the benefit of starting early. If your main concern is covering the cost of a funeral or memorial, then you may only need a “final expense” policy. Designed just for older policy holders, this type of policy doesn’t require a medical exam with the application.

What if I’m retired? A lot changes in retirement. If you had group coverage through work, it was terminated either on or shortly after the date you retired. If you have supplemental coverage, you’ll want to consider either extending your term policy or converting it to a permanent policy to cover your expenses after you pass.

What if I already have a pension? Federal pension law requires that private pension plans continue to provide a pension to a former employee’s surviving spouse if the employee earned a benefit. However, there are situations when your spouse or other dependent is unable to receive your pension after your death. Because life insurance is meant to cover lost income, check the fine print of your pension benefits, and consider a supplemental life insurance policy to cover any gaps in your retirement income.

Related: How Does A Life Insurance Payout Actually Work If You Die?

The Takeaway: Do You Need Life Insurance?

There are a lot of benefits to having a life insurance policy that is well balanced between what you need and what you can afford. And, ultimately, how well do you want your loved ones cared for when you’re gone?

The only situation in which you might not need life insurance is if you have zero plans to ever have dependents (children or a partner) or obtain a mortgage, and your estate can be settled with the assets in your name at your death. But still, unless you’ve unlocked some hidden talent, no one can see the future. Why not prepare now in the event that something changes down the road?

Allison’s passion lies in decoding the ways of the world to help put others on a path to success. She likes to ask big questions, and it’s her goal to find answers to share with you. A self-acknowledged transplant to the Pacific Northwest, Allison likes to write about finance, policy, fitness, and anything else that sparks her curiosity.

Editor: Ashley Barnett Reviewed by: Chris Huntley