FreeTax.com is a tax prep software owned by Liberty Tax, and historically it’s been one of the few companies that could legitimately claim free tax filing for all users.

However, the “Free” part of FreeTax.com is in jeopardy this year. While users can prepare their returns for free, they have to pay for e-filing. Given this wrinkle, most users can find better software at comparable price points.

Here’s what you need to know about FreeTax.com this year. Also, make sure you check our full list of the Best Tax Software.

Editors Note: FreeTax.com is no more. Parent company Liberty Tax has shut down its FreeTax.com brand for the 2023 tax year (2024). FreeTax.com was one of our lowest-rated tax filing solutions, so it won't be missed by many. If you are have used FreeTax.com in the past, we recommend visiting Liberty Tax instead, or even better, check out our list of the best tax software for 2024.

FreeTax.com- Is It Really Free?

FreeTax.com allows users to prepare and print their taxes for free. However, they charge $19.95 to E-File if you accept your refund on a prepaid debit card. Those who want their refund check another way will have to pay $39.95 to e-file.

What's New In 2023?

Last year, FreeTax.com, a brand owned by Liberty Tax relaunched it as a free tax site. The FreeTax.com site uses the same software as LibertyTax, eSmartTax, and several other major tax sites including 1040.com.

However, unlike past years, free contains an asterisk. The company supports free state and federal tax form preparation. Users can then print out their forms and mail them in. To e-file, users have to pay $19.95 (or $14.95 if they will accept their refund on a prepaid debit card).

Option to choose between guidance and form selection.

Does FreeTax Make Tax Filing Easy In 2023?

FreeTax.com works well for people with basic tax situations. It can easily handle W-2 income, interest, dividends, and major deductions and credits. Even people with basic self-employment can use the software successfully.

However, FreeTax.com is not designed for complex tax situations. Active stock or crypto traders could spend hours keying in each transaction manually.

Landlords have to use the search function to find depreciation worksheets.

As users work through the software, the software offers little feedback that can help users figure out whether they are entering their information correctly. A user who miskeys information could dramatically alter their tax information due to a simple and avoidable mistake.

Overall, FreeTax.com simplifies tax filing for some users, but people with more complex tax situations should avoid it.

FreeTax Features

While FreeTax.com doesn’t have outstanding software, there are a few features that make it compelling.

Prepare Tax Returns For Free

FreeTax.com allows users to prepare and print their state and federal tax returns for free.

Free Multi-State Filing

FreeTax.com allows users to file taxes in multiple states. It is the only free tax software that supports multi-state filing this year. This is a notable drawback from other free software like Cash App Taxes.

Guided Naviation

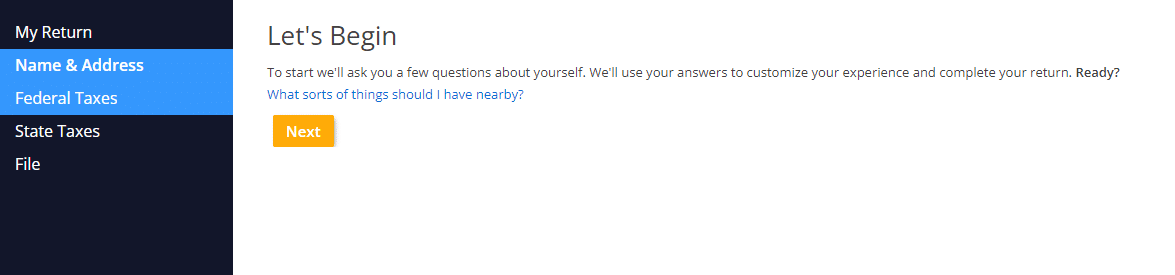

FreeTax.com users can easily find their way through the software by answering questions. Based on a user’s answers to the questions, the software leads users to enter information from relevant tax forms. However, users with more complex income (investments, real estate, self-employment) must select their income from the menu before receiving more guidance from the software.

Example of guided navigation.

FreeTax Drawbacks

These are a few areas where FreeTax.com fails to impress this year.

No Option To Import Forms

Users cannot import tax forms such as W-2 forms or 1099 forms. All tax information must be manually transferred to the FreeTax.com software. This increases the amount of time that users have to spend on tax prep. However, no bargain software offers import options this year.

Hard To Use For Complex Income Sources

Figuring out how to depreciate expenses is a huge pain in the software. It’s extremely difficult for landlords and self-employed people to use FreeTax.com to prepare their taxes.

No Section Summaries

Several companies offer section summaries that help users figure out whether they’ve entered all the necessary information. Without section summaries, FreeTax.com leaves users guessing about whether they are using the software correctly.

FreeTax.com Price And Plans

While all users can prepare their taxes for free, FreeTax.com charges for e-filing a return. The details of the e-filing costs are laid out below.

Plan | FREE | E-File | E-File+ |

|---|---|---|---|

Best For | Print and mail returns. | Taxable income less than $100,0000 | Taxable income more than $100,000 |

Federal Pricing | $0 | $19.95 | $39.95 |

State Pricing | $0 | $0 | $0 |

Total Cost | $0 | $19.95 | $39.95 |

How Does FreeTax Compare To The Competition?

FreeTax.com allows users to prepare and print their tax forms for free, but they have to pay for e-filing. The other companies include e-filing with the software.

To fairly compare FreeTax.com, we’ve included a special line to compare the cost of e-filing. We’ve compared it to other bargain software including Cash App Taxes (free) and TaxHawk. We also added 1040.com because it uses the same software under the hood. From a user experience standpoint, we prefer Cash App Taxes and TaxHawk over FreeTax.com

Header |  |  |  |  |

|---|---|---|---|---|

Rating | ||||

E-Filing | $19.95 | $25 | Free | Free |

Stimulus Credit | Free | $25 | Free | Free |

Unemployment Income | Free | $25 | Free | Free |

Student Loan Interest | Free | $25 | Free | Free |

Import Last Year's Taxes | Not Supported | Not Supported | Not Supported | Not Supported |

Snap Pic of W2 | Not Supported | Not Supported | Not Supported | Not Supported |

Multiple States | Free | $25 | Not Supported | $14.99 per additional state |

Multiple W2s | Free | $25 | Not Supported | Free |

Earned Income Tax Credit | Free | $25 | Free | Free |

Child Tax Credit | Free | $25 | Free | Free |

HSAs | Free | $25 | Free | Free |

Retirement Contributions | Free | $25 | Free | Free |

Retirement Income (SS, Pension, etc.) | Free | $25 | Free | Free |

Interest Income | Free | $25 | Free | Free |

Itemize | Free | $25 | Free | Free |

Dividend Income | Free | $25 | Free | Free |

Capital Gains | Free | $25 | Free | Free |

Rental Income | Free | $25 | Free | Free |

Self-Employment Income | Free | $25 | Free | Free |

Audit Support | Not Offered | Add-On | Free | Deluxe ($6.99) |

Support From A Tax Pro | Not Offered | Not Offered | Not Offered | Add-On |

Cell |

Is It Safe And Secure?

FreeTax.com uses both encryption and multi-factor authentication to keep user information safe. It holds up the industry standards that are standard for tax filing companies.

Although the software is free to use, users can feel confident that FreeTax.com and its parent company, Liberty Tax are likely to keep user information safe.

However, no company can guarantee information safety. Any information transmitted online could be hacked, so users should carefully evaluate the risks before moving forward with any tax filing company.

Final Thoughts

FreeTax.com is an acceptable software for filers with simple tax returns. It is not ideal for people with complex income such as stock or crypto trades or landlords. However, FreeTax.com isn’t really free in 2023. The cost of E-Filing makes it more expensive than bargain software like FreeTaxUSA or Cash App Taxes.

If you want to prepare and print your files, FreeTax.com could be a good option, but most others should overlook it this year. Plus, remember, if you print and mail your tax return, you could be waiting months for your tax refund.

FreeTax FAQ

Let's answer a few of the most common questions that people ask about FreeTax.com.

Can FreeTax.com help me file my crypto investments?

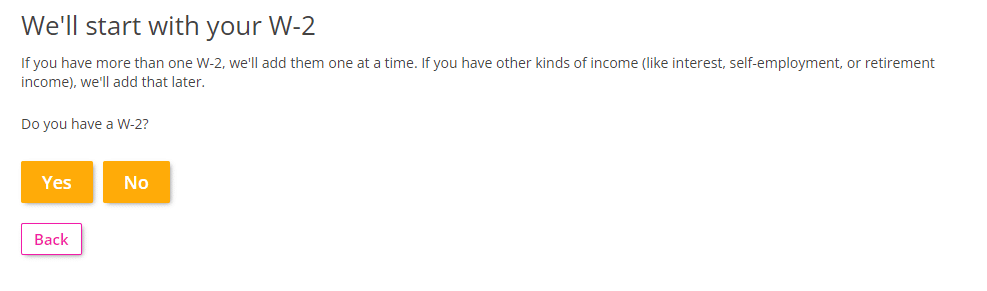

While FreeTax.com supports crypto investments, users will find the interface cumbersome. The software requires users to manually enter each transaction separately in a long, cumbersome form.

The first part of the stock and crypto trade form.

I didn’t receive the full amount for Advanced Child Tax Credit Payments, can FreeTax.com help me get the rest?

FreeTax.com guides users through questions that help them claim the correct amount for the child tax credit. Parents who didn't receive the advance payments will receive the balance of the credit in their refund.

Can FreeTax.com help me with state filing in multiple states?

FreeTax.com supports multi-state filing on all tiers. Users don’t have to pay extra for filing in multiple states.

Will FreeTax.com keep my information safe?

FreeTax.com has not suffered from security breaches in the past, and it has robust security in place to keep user information safe. However, the company is based online and it cannot guarantee the safety of user information. Users must evaluate their willingness to take on this risk before using the software.

Does FreeTax.com offer refund advance loans?

In 2023, FreeTax.com does not offer refund advance loans.

FreeTax.com Review

-

Navigation

-

Ease Of Use

-

Features And Options

-

Customer Service

-

Pricing And Plans

Overall

Summary

Freetax.com is a service offered by Liberty Tax that offer free tax prep as long as you print and mail your tax return.

Pros

- Prepare taxes for free, including multi-state filing.

- Relatively easy to use for simple tax returns.

Cons

- Only free if you print and mail your tax return, you have to pay for E-File.

- Difficult to claim depreciation on rental property or other business assets.

- No section summaries.

Hannah is a wife, mom, and described personal finance geek. She excels with spreadsheets (and puns)! She regularly explores in-depth financial topics and enjoys looking at the latest tools and trends with money.

Editor: Clint Proctor