1040.com is a contender in the mid-tier tax software category. With a flat $25 price for all filers, 1040.com feels like a breath of fresh air when compared to other tax software with endless add-ons and upgrades. It also has an easy-to-use interface.

However, there’s no upgrade option to work with a pro or import your tax data, which could be a deal breaker for some filers.

It’s also not as easy to use as industry leaders TurboTax and H&R Block, which do charge more for a premium experience. 1040.com offers a decent service at a decent price, but it’s not the most compelling software on the market.

Here’s what you need to know about the 1040.com tax software this year. Also, find out how it stacks up in our annual list of the best tax software programs.

1040.com Details | |

|---|---|

Product Name | 1040.com |

Federal Price | $25 |

State Price | $0 |

Preparation Type | Self-Prepared |

Promotions | None |

1040.com - Is It Free?

Unlike some competitors, 1040.com does not offer a free version. All users pay the same $25 fee regardless of their tax-filing needs. The $25 cost includes federal taxes and as many states as you need. That’s much less than you would pay with premium competitors, who often charge more than $25 per state, let alone federal taxes.

The two add-ons are for services provided by third-party partners. An additional $24.95 cost allows you to pay your $25 fee with your refund, which is definitely not worth the cost as it doubles what you pay with no real benefits. You can also pay $29.95 for audit support should the IRS come back with questions.

What's New In 2024?

For the 2024 tax filing season, 1040.com provides a similar look and feel to previous years. If you’ve done taxes online before, you’ll find the layout and interface familiar and easy to navigate. And if you’ve used 1040.com, it will be mostly the same.

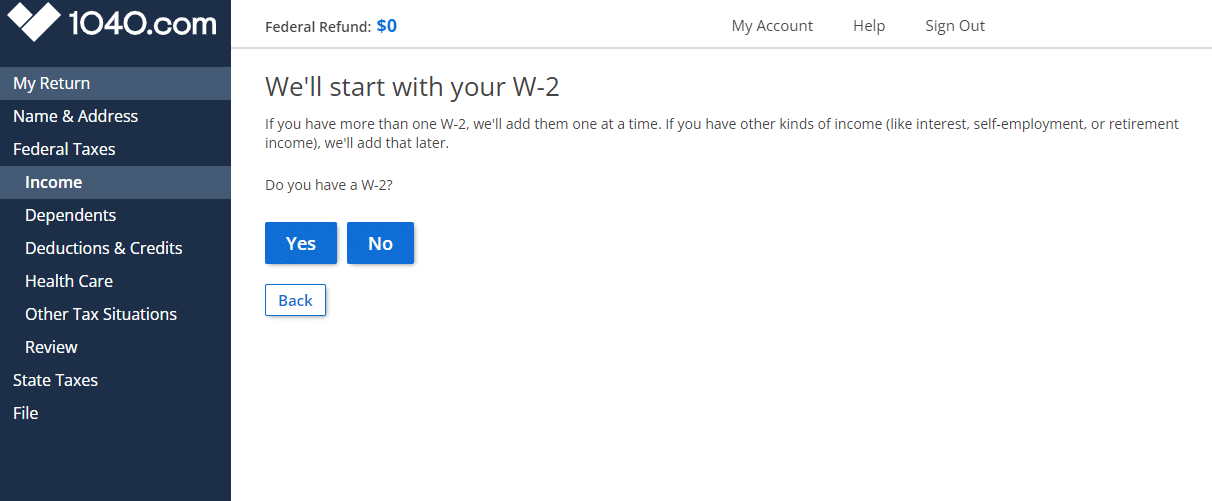

For this year, the company made the standard updates to keep up with IRS changes and made other minor updates. 1040.com calls its tax filing experience a “Walkthrough” where you answer questions or pick the forms you want to enter.

Option to choose between guidance and form selection

Does 1040.com Make Tax Filing Easy In 2024?

1040.com uses a “hybrid” navigation model. Users can decide whether to allow 1040.com to ask questions about their taxes using a left-hand navigation bar or jump around and choose the section to work on.

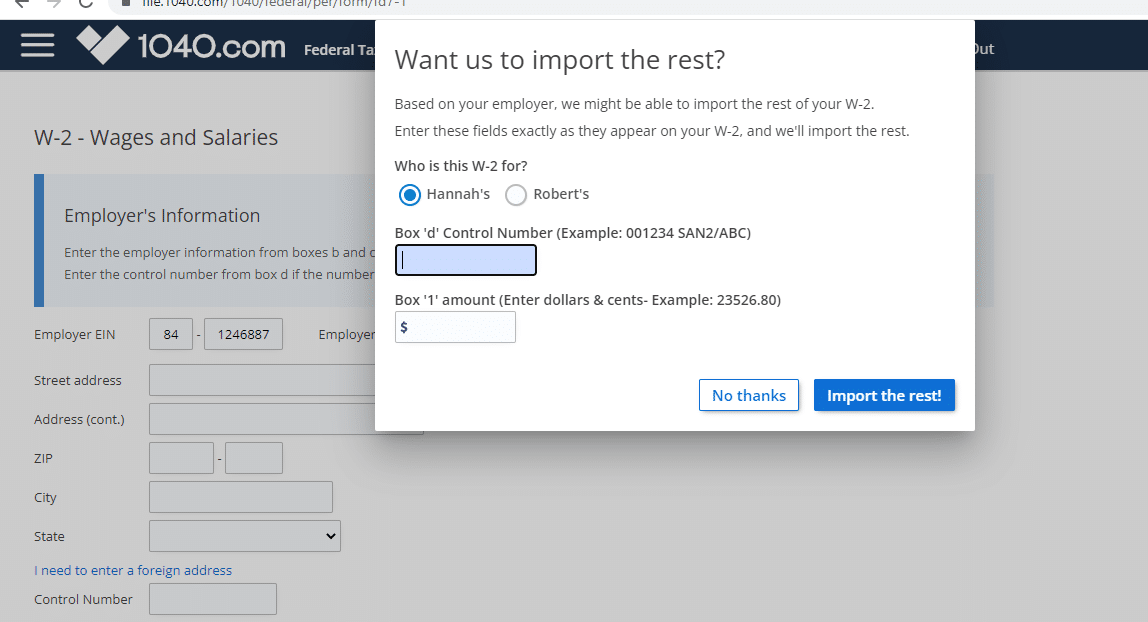

The interview-style navigation can be a bit tedious. One standout feature from mid-tier and low-cost competitors is the option to import your W-2 data if your employer is supported. All you have to do is enter your employer ID, and 1040.com will find and import your data if your employer participates.

W-2 Import

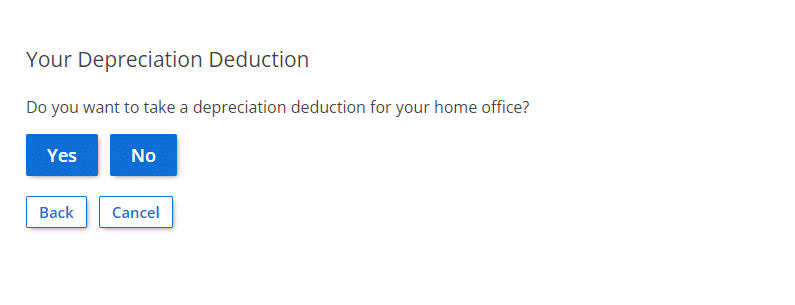

The software offers a decent experience for people who don’t have investments or for those who are dealing with self-employed business expenses. Filers who want to deduct depreciation for their rental properties must add a depreciation worksheet. This process can be confusing and unintuitive.

Interview for depreciation

To summarize, the software works well for people who have simple tax filing situations. If you’re an investor or a small-business owner with more than a simple side hustle, it could be worth paying more elsewhere.

1040.com Features

1040.com does the job of helping you file your taxes just fine, but it’s not the fastest or most intuitive experience. Here are some standout pros and cons to consider.

Flat Price For Federal And State Tax Filing

1040.com charges one price for federal tax filing and state filing. The $25 price tag allows filers to file in multiple states and includes all supported tax situations. When you're ready to checkout, there are no tiers or upgrades to deal with. One price fits all.

Guided Navigation or Choose Your Own Adventure

The 1040.com software offers a guided navigation option to help filers work through their returns. Users who opt to use the question-and-answer interface can find most of what they need during a single pass through the software.

The drawback to this is that the guided navigation only covers simple filing situations. Users with more complex incomes (such as investments, real estate, and self-employment) must select their income type from the menu before receiving guidance from the software.

If you don’t want to use the navigation, you can jump between sections and forms when you want to enter something specific.

Request to complete tax forms

Audit Support

1040.com users can pay for added audit support from ProtectionPlus, a 1040.com partner. The upgrade costs $29.95, more than the base $25 software cost and comes with a high price compared to other mid-tier priced software. By comparison, you can add audit support for $7.99 with TaxHawk and FreeTaxUSA.

1040.com Drawbacks

Let's take a closer look at a few areas where 1040.com left us underwhelmed in 2023.

Limited Import Options

1040.com supports W-2 imports when you work with a participating employer, which is great. However, it doesn’t allow users to import 1099 forms or spreadsheets. Users must manually copy information from their tax forms to complete tax filing. For people with stock or crypto trades, this can add a lot of cumbersome overhead to tax filing.

Harder To Use For Non-W2 Income Sources

Entering rental information and capital gains from investments is arduous. Users must know what they’re doing to complete filing if they have complex tax filing needs. It’s also fairly difficult if you need to depreciate an expense for your business.

No Section Summaries

1040.com doesn’t have section summaries displaying income, deductions, and other key details. This can make it difficult to determine whether you entered the information correctly and leaves you doing a lot of hunting if you suspect an error. 1040.com keeps a rolling summary of the refund you’re due, but this is insufficient for searching the details.

1040.com Pricing And Plans

1040.com uses a simplified pricing plan. All users pay $25. It's worth noting that the $25 price tag even applies to users who need to file multiple state returns.

This puts the software solidly in the middle-tier pricing category for tax software. It could make sense for some filers, including those who may "unexpectedly" get bumped into higher pricing tiers elsewhere. For example, those with tuition expenses, child care deductions, gambling winnings, health savings accounts (HSA), and other common forms could save money using 1040.com.

Plus, the fact that your flat $25 includes unlimited states can be very compelling. With many free tax software companies, you still have to pay for state filing, which often exceeds $25 each. If you moved last year or need to file in multiple states, that’s a bargain.

How Does 1040.com Compare?

1040.com is more affordable than the premium tax software platforms. We’ve compared it to other bargain software including Cash App Taxes (free) and TaxHawk.

We generally prefer competitors user experience to 1040.com. However, multi-state filers may appreciate that 1040.com includes unlimited state returns in the base price.

However, Cash App Taxes is free if you qualify, and TaxHawk is just $14.99 per state - so at one state you're saving money versus 1040.com.

Header |  |  | |

|---|---|---|---|

Rating | |||

Stimulus Credit | $25 | Free | Free |

Unemployment Income (1099-G) | $25 | Free | Free |

Student Loan Interest | $25 | Free | Free |

Import Last Year's Taxes | $25 | Free | Free |

Import W-2 | $25 | Not Supported | Not Supported |

Multiple States | $25 | Not Supported | $14.99 Per State |

Multiple W2s | $25 | Free | Free |

Earned Income Tax Credit | $25 | Free | Free |

Child Tax Credit | $25 | Free | Free |

HSAs | $25 | Free | Free |

Retirement Contributions | $25 | Free | Free |

Retirement Income (SS, Pension, etc.) | $25 | Free | Free |

Interest Income | $25 | Free | Free |

Itemize | $25 | Free | Free |

Dividend Income | $25 | Free | Free |

Capital Gains | $25 | Free | Free |

Rental Income | $25 | Free | Free |

Self-Employment Income | $25 | Free | Free |

Small Business Owner (Over $5k In Expenses) | $25 | Free | Free |

Audit Support | $29.95 Add-On | Free | Deluxe ($7.99) |

Advice From | Not available | Not available | Pro Support ($29.99) |

Pricing | $25 | $0 Fed & $0 State | $0 Fed & |

Cell |

How Do I Contact 1040.com?

You won't find a phone number published anywhere on 1040.com. If you want to get in touch with a live support representative, you'll need to create an account to access the company's chat support. Or you can submit general questions using the email contact form here.

Is It Safe And Secure?

1040.com employs a strong privacy policy and uses industry-standard encryption and multi-factor authentication to keep user information safe and secure. These precautions are standard for all tax filing companies.

Users can feel confident that 1040.com is as safe to use as most other tax software. Of course, using a strong, unique password and following other cybersecurity best practices is important to ensure the bad guys don’t get into your data.

Is 1040.com Worth It?

1040.com offers a fairly good user interface for people with straightforward filing situations. If you moved in the last year and you need to file taxes in multiple states, work across state lines, or earn income in multiple states for any other reason, it could be a good choice for you.

However, we don’t recommend 1040.com as a top choice for the typical tax filer. The software is too cumbersome to use for a $25 price point. Cash App Taxes and TaxHawk offer superior user experiences at lower price points.

If you want to dig into other options, we’re ready to help you find the best tax software for your situation.

Why You Should Trust Us

At the College Investor, we don’t play favorites. We have over a decade of experience reviewing tax filing programs, and we’ve used most of them ourselves over the last few years. Our goal is to help you find the right tax app at the right price. There’s no perfect way to file taxes for everyone, but there is likely a best option for you. We want to help you find the right fit for your unique needs.

1040.com FAQs

Here are the answers to a few of the most common questions that people ask about 1040.com:

Can 1040.com help me file my crypto investments?

Entering crypto trades into 1040.com is possible, but cumbersome. Users need to enter each transaction into the 1099-B/8949 form section manually. If you had a lot of trades, that could take hours.

Can 1040.com help me with state filing in multiple states?

Yes, this is one of the best reasons to pick 1040.com. The $25 price includes federal and unlimited state returns.

Does 1040.com offer refund advance loans?

1040.com does not offer refund advance loans. You’re able to pay for your 1040.com costs with your refund for an extra $24.95, but we don’t suggest this.

1040.com Features

Federal Cost | $25 |

State Cost | $0 |

Pay With Tax Refund | Yes, $24.95 extra cost |

Audit Support | Available as a $29.95 add-on |

Support From Tax Pros | Not available |

Full Service Tax Filing | Not available |

Printable Tax Return | Yes |

Import Tax Return From Other Providers | No |

Import Prior-Year Return For Returning Customers | Yes, prior-year returns are stored for up to three years |

Import W-2 With A Picture | No |

Stock Brokerage Integrations | None |

Crypto Exchange Integrations | None |

Self-Employment Income | Yes |

Itemize Deductions | Yes |

Deduct Charitable Donations | Yes |

Refund Anticipation Loans | Not offered |

Customer Support Options | Chat and contact form |

Customer Service Phone Number | None listed |

Web/Desktop Software | Yes |

Mobile Apps | No |

Promotions | None |

1040.com Review

-

Navigation

-

Ease Of Use

-

Features And Options

-

Customer Service

-

Plans And Pricing

Overall

Summary

1040.com doesn’t have many standout features in 2024. But it does include unlimited state returns at no extra cost.

Pros

- Simple $25 flat pricing for all users

- File multiple states for a single price

- Guided interface works well for “simple” filing situations

Cons

- Difficult to claim depreciation on rental property or other business assets

- The software contains a lot of text

- No section summaries

Eric Rosenberg is a financial writer, speaker, and consultant based in Ventura, California. He holds an undergraduate finance degree from the University of Colorado and an MBA in finance from the University of Denver. After working as a bank manager and then nearly a decade in corporate finance and accounting, Eric left the corporate world for full-time online self-employment.

His work has been featured in online publications including Business Insider, Nerdwallet, Investopedia, The Balance, Huffington Post, and other financial publications. When away from the computer, he enjoys spending time with his wife and three children, traveling the world, and tinkering with technology. Connect with him and learn more at EricRosenberg.com.

Editor: Colin Graves Reviewed by: Robert Farrington