Among the top leaders in online tax software, TaxAct stands out as a great choice for business owners as the only place you can complete some important tax forms online.

It’s also slightly cheaper than its larger competitors, making it a bit more friendly on your budget.

While TaxAct is the cheapest option of the three biggest tax software companies, it isn’t the cheapest. It has made huge software improvements to keep up with the likes of TurboTax, but still lags in integrations compared to the larger rival. And companies like TaxSlayer are really making in-roads into what TaxAct has built.

Keeping reading our full TaxAct review below to learn why. You can also see how TaxAct compares in our list of the best tax software.

TaxAct Details | |

|---|---|

Product Name | TaxAct |

Federal Price | Starts at $0 |

State Price | Starts at $39.99 per state filed |

Preparation Type | Self-prepared, Xpert advice, and Full-Service |

Promotions | None |

TaxAct - Is It Really Free?

On the TaxAct homepage, there’s a version that’s “Free,” but only if you meet a limited set of qualifications and live in a state where you don’t have to file a tax return. For most people, the minimum is $39.99 for a state return and no cost for a Federal return if you have simple filing needs.

As a result, most people using TaxAct will pay anywhere from around $25 to $65 for federal returns and $45 for state returns. That makes it a little cheaper than the bigger guys, but not by much. And not free.

The only truly free option for TaxAct is through the IRS Free File program, available to a limited number of households earning $65,000 per year or less or people with simple taxes who don’t need to file a state return. If you qualify for the free tier and don’t need access to tax help, consider these TaxAct alternatives.

What's New In 2024?

For 2024, TaxAct supports new tax provisions, such as the updated 1099-K reporting requirements and updated tax brackets, credits, deductions, and other limits adjusted for inflation.

Xpert Assist, a tool to get help from a tax professional, was complementary with past versions of TaxAct. Starting in 2024, it costs $39.95 to add Xpert Assist for all TaxAct tiers.

Not a change, but something good to know, is that TaxAct is the only online filing software for many small businesses, including S Corps, to do their taxes without downloading a Windows-only application. Business and personal bundles cost up to $199.95 for 2024.

Does TaxAct Make Tax Filing Easy In 2024?

TaxAct is in the middle of the pack when it comes to usability. It includes imports of PDF versions of form W-2 and 1099-B, but investors and those with many bank accounts will find the lack of support for importing 1099-INT, 1099-DIV, and 1099-NEC frustrating.

The navigation and interface are similar to major competitors like H&R Block and TurboTax. However, there are still some areas where you won’t find clear explanations of what you need to enter and will have to either use the help feature or your favorite search engine to find the answer.

Given the price, it would be good to see expanded help resources and explanations for where to find information in future editions and more broad support for importing all types of 1099 forms. If it could add automatic downloading for tax information from banks and investment companies, it could even jump ahead of our second favorite tax program from H&R Block.

TaxAct Top Features

TaxAct is a well-known software ranking among the top three tax software options. These are a few features that enhance the filing experience for TaxAct users.

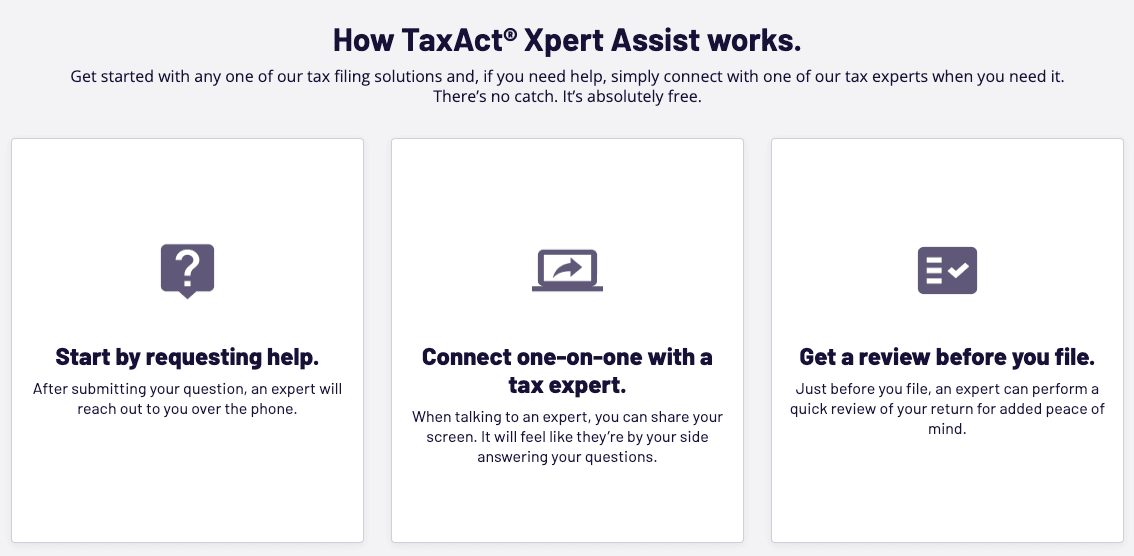

Xpert Assist (Human Tax Support)

A top reason to pick TaxAct is the included access to a human tax expert for your tax questions. While others give you limited technical support for no extra charge, you usually have to pay a hefty added fee for help from a human with questions about your tax filing. Xpert Assist costs $39.95 for the 2024 tax filing season.

Question And Answer Guidance

TaxAct uses questions and answers to guide users through the software. Filers can skip around in the software, but it guides them back to the questions and answers to ensure everything is completed. If you miss anything, you’re brought back to complete it with a warning message before filing.

Tax Imports

TaxAct supports prior-year PDF tax imports, W-2 imports, and 1099-B imports from multiple brokerages. When users upload these documents, TaxAct inputs the information on behalf of the filer. This functionality reduces the chance for error and the time spent on tax filing.

Note: When we tested TaxAct, we had difficulty getting our W-2 to upload. You can see this in our walkthrough video.

Import CSV Files From Brokerages

In addition to W-2 imports, TaxAct has the ability to import 1099-B forms and CSV files from brokers. If you have stock market investments, this functionality could save you significant time on your tax filing.

TaxAct is one of the few online tax prep firms that allow you to attach Form 8949 for your crypto transactions. Learn more here.

S-Corp And Trust Taxes Online

TaxAct is noteworthy as the only major tax software provider that allows you to do your taxes for an S Corp or Trust yourself online. Some others sell downloadable versions for Windows, leaving Mac users stuck. Regardless of your computer, TaxAct allows you to complete Form 1120S and state filings for an S Corp or Trust online. That’s something you can’t find anywhere else.

TaxAct Drawbacks

TaxAct is a robust software without doesn't have many missing features. However, the few drawbacks that it does have could be deal-breakers for some filers.

Errors Only Highlighted At The End

TaxAct has helpful built-in calculators. However, it only highlights errors once a user completes a section. This can be useful for trying to “get into the flow,” but it can also make filing a challenge when you’re unsure about how details fit into the big picture and requires going back to fix things, making for more back and forth.

Extremely Limited Free Filing (State Not Included)

TaxAct limits its free filing to filers with very simple filing situations. Side hustlers, people with HSAs, and those who contribute to retirement accounts will not qualify for the Free tier. And even those who qualify for free federal filing still have to pay for state filing unless they qualify for the limited Free File program from the IRS.

High Cost Given The Functionality

TaxAct is a little less expensive than H&R Block and TurboTax, but it falls behind its larger rivals when comparing user-friendliness. In fact, its experience more closely mirrors several discount tax apps like TaxSlayer and FreeTaxUSA.

Whereas FreeTaxUSA prices its products in line with bargain tax software, TaxAct prices its products near the top of the market.

TaxAct 2024 Pricing And Plans

TaxAct aligns its pricing with the complexity of a filers situation. Filers who don’t think of themselves as “complex” may be surprised to find that they'll need to use the Deluxe edition.

Plan | Free | Deluxe | Premier | Self Employed |

|---|---|---|---|---|

Best For | W-2 income, unemployment income, Earned Income Tax Credit (EIC) and child tax credits. | Itemizers, HSA contributions, People with child care expenses, student loan interest payments. | Landlords, investors | Self-employed people (including gig workers) |

Federal Pricing | $0 | $24.99 | $34.99 | $64.99 |

State Pricing | $39.99 | $44.99 per state | $44.99 per state | $44.99 per state |

Xpert Assist | $0 | $0 | $0 | $0 |

Note: TaxAct tends to adjust prices throughout the tax season. December and January are the best time to lock in low rates.

How Does TaxAct Compare?

TaxAct positions itself as a premium product, but its performance is comparable to budget tax software. It certainly gets the job done, but the pricing leaves much to be desired. We compared TaxAct to FreeTaxUSA and TaxSlayer for a head-to-head feature review.

Header | |||

|---|---|---|---|

Rating | |||

Stimulus Credit | Free+ | Free | Free+ |

Unemployment Income | Deluxe+ | Free | Classic+ |

Student Loan Interest | Deluxe+ | Free | Free+ |

Import Last Year's Taxes | Free+ | Free | Free+ |

Snap Pic of W2 | Free+ | N/A | N/A |

Multiple States | Not advertised | $14.95 per state | Classic+ |

Multiple W2s | Free+ | Free | Free+ |

Earned Income Tax Credit | Free+ | Free | Free+ |

Child Tax Credit | Free+ | Free | Classic+ |

Dependent Care Deductions | Deluxe+ | Free | Classic+ |

HSAs | Deluxe+ | Free | Classic+ |

Retirement Contributions | Free+ | Free | Free+ |

Retirement Income (SS, Pension, etc.) | Free+ | Free | Free+ |

Interest Income | Deluxe+ | Free | Classic+ |

Itemize | Deluxe+ | Free | Classic+ |

Dividend Income | Deluxe+ | Free | Classic+ |

Capital Gains | Premier+ | Free | Classic+ |

Rental Income | Premier+ | Free | Classic+ |

Free Tier Price | $0 Fed, | $0 Fed, | $0 Fed, |

Deluxe Tier Price | $24.99 Fed, | $7.99 Fed, | $34.95 Fed, |

Premier Tier Price | $34.99 Fed, | N/A | $54.95 Fed, |

Self-Employed Tier Price | $64.99 Fed, | N/A | $64.95 Fed, |

Cell |

Is It Safe And Secure?

TaxAct follows industry-standard security practices and commits never to sell personal information. Despite strong precautions, the company experienced a security breach in 2016. Since then, it has increased its security measures, including stronger encryption. However, the past incident is still a concern.

TaxAct requires multi-factor authentication the first time a user logs in each year and has complex password requirements. With TaxAct and any other financial-related login, following password and online security best practices is critical to keep your information safe.

How Do I Contact TaxAct Support?

TaxAct's general customer service phone number is (319) 373-3600. Operating hours are Monday - Friday, 8 a.m. to 5 p.m.

Tax filers get access to Xpert Assist for $39.95 when using TaxAct. Users can receive advice from a tax professional to ensure they're filing their returns correctly and maximizing deductions and credits without the significantly higher costs of a traditional accountant.

TaxAct also features TaxAct Xpert Full Service, available during busy tax filing months. If you pay for this product, a tax pro will complete your entire return for you from start to finish. This service requires a higher fee than the free Xpert Assist while doing your taxes yourself.

Why Should You Trust Us?

The College Investor team spent years reviewing all of the top tax filing options, and our team has personal experience with the majority of tax software tools. I personally have been the lead tax software reviewer since 2022, and have compared most of the major companies on the marketplace.

Our editor-in-chief Robert Farrington has been trying and testing tax software tools since 2011, and has tested and tried almost every tax filing product. Furthermore, our team has created reviews and video walk-throughs of all of the major tax preparation companies which you can find on our YouTube channel.

We’re tax DIYers and want a good deal, just like you. We work hard to offer informed and honest opinions on every product we test.

How Was This Product Tested?

In our original tests, we went through TaxAct and completed a real-life tax return that included W2 income, self-employment income, rental property income, and investment income. We tried to enter every piece of data and use every feature available. We then compared the result to all the other products we've tested, as well as a tax return prepared by a tax professional.

This year, we went back through and re-checked all the features we originally tested, as well as any new features. We also validated the pricing options.

Is It Worth It?

Despite performance improvements, TaxAct isn’t competitively priced for what it offers. Charging for state returns on the free tier isn’t consumer-friendly in our opinion. Even for the paid tiers, TaxAct isn’t a great deal in 2024, as others offer better features with a slightly higher cost or similar features at a lower price point.

It's somewhat less expensive than H&R Block. But H&R Block massively outperforms TaxAct, especially with imports and other convenience features. And tax software options TaxSlayer and TaxHawk offer comparable experiences with a lower price tag.

It’s also the best (and only) pick for S Corp and Trust taxes online, which is a big draw for many small business owners looking for DIY business taxes.

TaxAct FAQs

Let's answer a few of the most common questions that filers ask about TaxAct:

Can TaxAct help me file my crypto investments?

TaxAct supports crypto filing and allows users to import .csv files from a brokerage account. Filers who pay for a .csv from CoinLedger or another crypto accounting service can import their files into the software.

Can TaxAct help me with state filing in multiple states?

TaxAct supports multi-state filing. Users must pay the state filing fee for each state they file in.

Do I have to use the self-employed tier for my side hustle?

Yes, side hustlers who earned cash or a 1099-NEC will have to use the Self-Employed tier to file their taxes.

DoesTaxAct offer refund advance loans?

No, refund advance loans aren't being advertised by TaxAct this year.

Does TaxAct offer any deals on refunds?

No, TaxAct isn’t currently advertising any refund deals.

TaxAct Features By Tier

Here are the features you can expect for each version of TaxAct.

Free | Deluxe | Premier | Self-Employed | |

|---|---|---|---|---|

W-2 Income: Simple Returns | ||||

Unemployment Income | ||||

Retirement Income | ||||

Child Tax Credits | ||||

Earned Income Tax Credits | ||||

Stimulus Credits | ||||

Itemize Deductions | ||||

Deduct Student Loan Interest | ||||

Deduct Mortgage Interest | ||||

HSAs | ||||

Stock And Crypto Investments | ||||

Rental Properties | ||||

Home Sale | ||||

Foreign Financial Accounts | ||||

1099 Income | ||||

Deduct Small Biz Expenses | ||||

Small Biz Asset Depreciation |

TaxAct 2024 Review

-

Ease Of Use

-

Features And Options

-

Customer Service

-

Plans And Pricing

Overall

Summary

For 2024, TaxAct supports new tax provisions, such as the new 1099-K reporting changes and inflation adjustments to tax brackets and limits for credits and deductions. These changes are standard across all tax providers.

Pros

- Prior year returns and W-2 form imports

- Import stock information from brokers

- Navigation is mostly easy to follow

Cons

- Expensive for the software quality

- Updated pricing of $39.99 for help from a tax professional

Eric Rosenberg is a financial writer, speaker, and consultant based in Ventura, California. He holds an undergraduate finance degree from the University of Colorado and an MBA in finance from the University of Denver. After working as a bank manager and then nearly a decade in corporate finance and accounting, Eric left the corporate world for full-time online self-employment.

His work has been featured in online publications including Business Insider, Nerdwallet, Investopedia, The Balance, Huffington Post, and other financial publications. When away from the computer, he enjoys spending time with his wife and three children, traveling the world, and tinkering with technology. Connect with him and learn more at EricRosenberg.com.

Editor: Claire Tak Reviewed by: Robert Farrington