As you dive into the world of investing, index funds are bound to pop up on your radar. With the help of these funds, you can build your portfolio in a relatively hands-off way.

But what exactly is an index fund? And why are so many investors fans of this type of investment vehicle? In this article, we’ll explore all of those questions and more. Let’s get started!

What Is An Index Fund?

An index fund is a type of investment that is designed to follow a particular benchmark of the stock market.

The fund itself can track any particular selection within the financial market. For example, the S&P 500 is a common index on which a wide range of funds are based. A few of the index funds that are based on the S&P 500 include Vanguard’s VFINX, Fidelity's FUSEX, and Schwab's SWPPX.

Index funds can be either an exchange-traded fund (ETF) or a type of mutual fund. As long as the fund is designed to follow a particular segment of the financial market, it's considered an index fund.

Pros And Cons Of Index Funds

As with all financial products, you’ll find that index funds have pros and cons. Here’s what you need to know.

Pros

Let’s start with the advantages of working with an index fund.

Cons

As with all financial products, there are some disadvantages to investing in an index fund. Here are some things to be aware of:

How Do Index Funds Compare To Active Funds?

An index fund is often considered a relatively hands-off investment. They simply serve as a mirror to a particular component of the market. With that, they're are all about the achieving the average for whatever benchmark they're following.

Actively managed mutual funds, meanwhile, don’t follow a particular index. Instead, they seek to outperform the market. So how do these two funds stack up against each other? Here’s a closer look at the performance and cost differences.

Performance

If you wanted to simply keep pace with the market, an index fund would suffice. But investors that choose actively managed funds are seeking overperformance. So is that what they get? It turns out that active funds don't come out ahead nearly as often as you might expect.

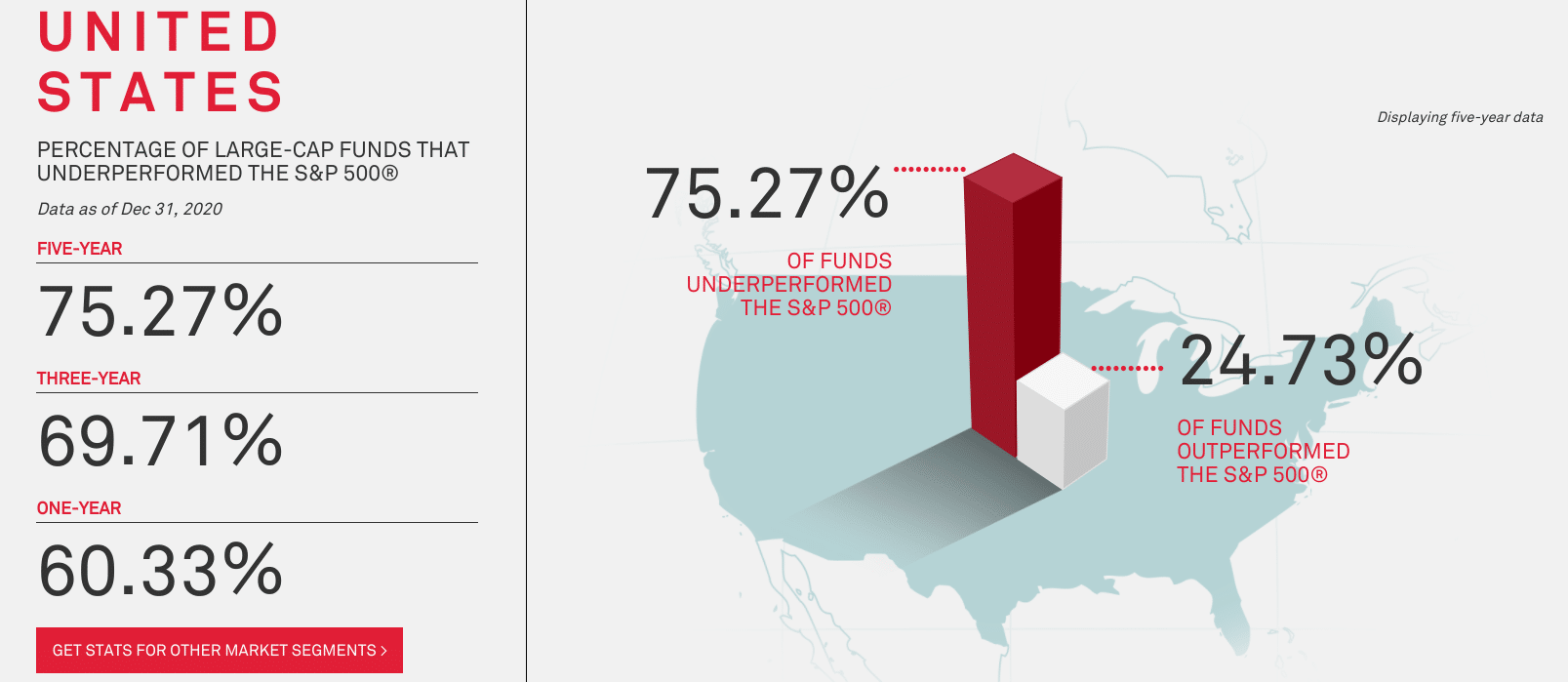

In 2020, 60.33% of actively managed large-cap funds underperformed the S&P 500 according to SPIVA. And that was in a year in which we saw massive volatility due to the pandemic-induced crash that took place in March.

Over three years, the percentage of actively managed funds that have lagged behind the overall market increases to 69.71%. And over the five-year period that ended December 31, 2020, a whopping 75.27% of active funds weren't able to keep pace with the S&P 500's performance.

Image by SPIVA

Obviously, some actively managed funds do fall in that 25% or so of funds that beat the market over the past five years. ARK Funds, for example, are highly popular due to their reputation for consistently outperforming the S&P 500. Still, the overall odds of this happening with just any active fund are not in your favor.

Costs

As you select funds for your growing investment portfolio, it’s important to consider the costs. After all, the goal of investing is to build wealth. You don’t want to overpay for fees that will create a strong headwind for your investments to fight against.

Actively managed funds are regularly monitored by fund managers that have to make choices about what to include in the fund. That might include hours of research, buying stocks, and selling stock. All of that effort comes at a price. The average expense ratio for an actively managed mutual fund runs between 0.5% to 1.0%.

On the flip side, index funds are relatively passive endeavors. The fund is designed to mirror a particular index, and the choices for buying and selling are limited to the constructs of the index. With that, they're less labor-intensive to manage and are typically a more affordable option, with average expense ratios of around 0.2%

When you take the lower cost and potential active management blunders, you may feel drawn towards investing in an index fund. And you wouldn’t be alone. In fact, investors have been pulling out of actively managed funds for years in favor of lower-cost passive funds that promise to keep pace with the market.

Final Thoughts

An index fund can be a useful tool to help you build a portfolio designed to reach your investment goals. If you're content to keep pace with the market instead of trying to beat the market, then an index fund is an easy choice.

Some of our favorite stock brokers for DIY index fund investing include Vanguard, Fidelity, and Charles Schwab. Or if you'd still like a little help with your investments, you might want to consider opening an account with one of our top robo-advisors, most of which build their portfolios on the bedrock of index ETFs.

Want to explore your other investment options? Take a look at our top ten ways to start investing with just $1,000.

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller