KuCoin is one of the largest cryptocurrency exchanges and trading platforms.

If you want to invest in cryptocurrency, you’re probably going to use a cryptocurrency exchange to buy various cryptos at some point.

And one of the most popular exchanges in the world is KuCoin, which states 25% of cryptocurrency holders worldwide use its platform. KuCoin offers a variety of ways to buy cryptocurrency and has additional trading features that cater to more experienced, active investors.

But using KuCoin if you live in the United States is a bit of a gray area. And it’s important to understand everything the platform offers before making it your exchange of choice.

Note: KuCoin recently updated their KYC and AML rules making many customers verify their identities to conduct trades on the platform.

KuCoin Details | |

|---|---|

Product Name | KuCoin |

Supported Currencies | 600+ |

Trading Fees | 0.10% |

Rewards | Lending, Staking, & Mining |

Promotions | Earn up to 500 USDT |

Who Is KuCoin?

KuCoin is a leading cryptocurrency exchange that began in 2017. The company was originally based in Singapore. Currently, KuCoin has its headquarters in Seychelles.

KuCoin is one of the most popular global cryptocurrency exchanges, with over 10 million registered users in over 200 countries. However, KuCoin isn’t licensed in the United States, so it’s a less popular choice for U.S. investors compared to exchanges like Coinbase and Gemini.

KuCoin is also focused on transparency of it's reserves (after events impacting other exchanges). You can view KuCoin's reserves here.

What Do They Offer?

With global coverage and support for over 600 cryptocurrencies and stablecoins, KuCoin lets people from around the world get started with crypto. KuCoin caters to beginner and experienced cryptocurrency investors alike, which is one of the reasons it’s so popular.

Additionally, the platform offers several features that are attractive for more active traders or anyone looking to lend or stake their holdings

Buy Cryptocurrency

Exchanges like Coinbase let you buy cryptocurrency with funds directly from your checking account or with a credit card. In contrast, KuCoin users can buy cryptocurrencies using three methods:

- 1Fast Buy: Buy Bitcoin, Ethereum, or USDT with Visa and Mastercard.

- 2P2P: Buy and sell cryptocurrencies on KuCoin’s peer-to-peer exchange with other users.

- 3Third-Party: Enter the cryptocurrency you want to buy, payment method, currency, and choose between third-party platforms Simplex or Banxa to complete your trade.

The third-party trading route provides the most flexibility, and you can purchase dozens of cryptocurrencies, including Bitcoin, Cardano, Ethereum, Shiba Inu, and Solana. This method also supports dozens of currencies, which is one reason KuCoin is popular globally.

In addition, KuCoin supports investors to deposit fiat currency like USD, AUD, CAD, GBP, and EUR to their KuCoin accounts using a credit card or debit card.

However, if you want to obtain a cryptocurrency that’s not available directly for purchase on KuCoin, you need to buy a cryptocurrency that’s available and then exchange it for your cryptocurrency of choice. So while KuCoin supports over 600 cryptocurrencies and stablecoins, it’s sometimes a two-step process to get the asset you’re looking for.

Advanced Trading Tools

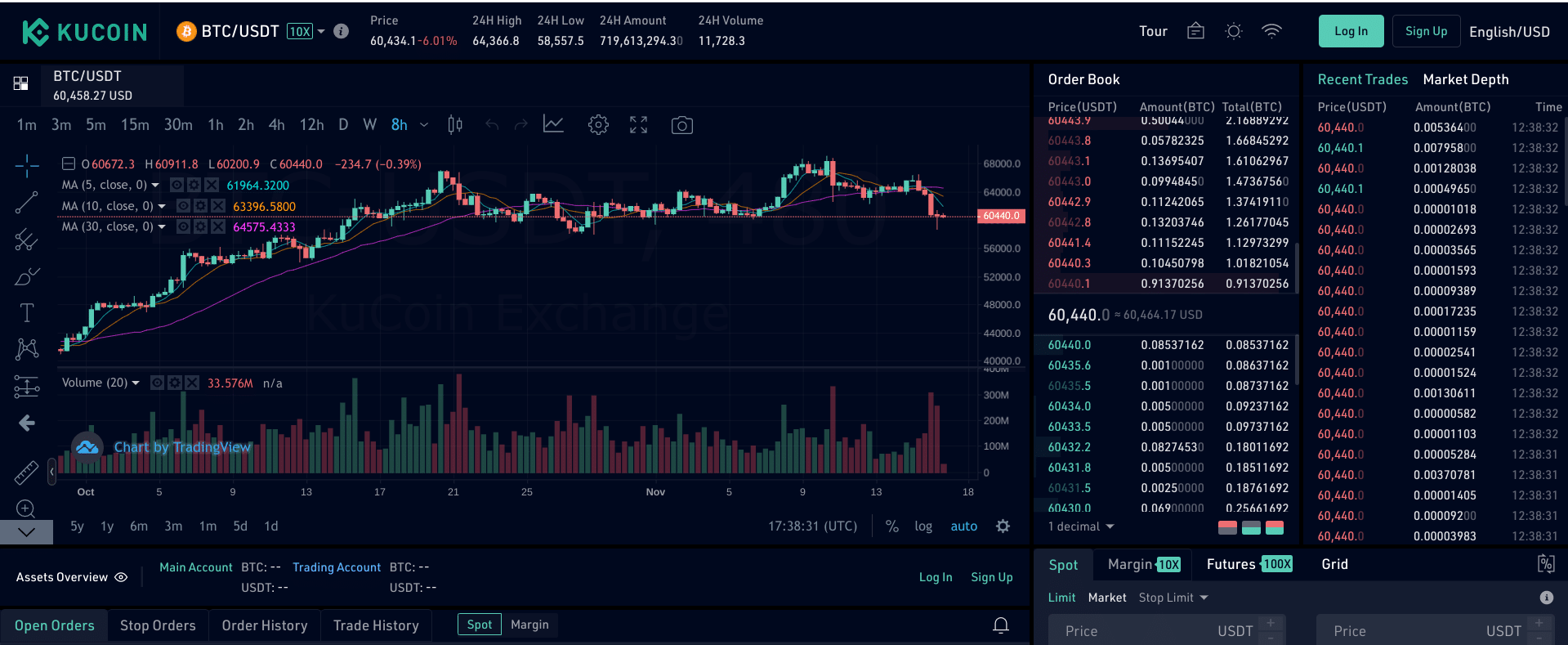

One of the main advantages of KuCoin is that you get a lot of trading tools right out of the box. For starters, spot trading lets you buy and sell various cryptocurrencies at live market rates.

However, it’s worth noting that most of your trading options are trading pairs, which involves trading one cryptocurrency for another. For example, if you use KuCoin to spot trade Bitcoin, you can trade BTC you hold for dozens of other cryptocurrencies.

If you want to take things a step further, KuCoin supports margin and futures trading. Margin trading offers up to 10x leverage and futures trading supports up to 100x leverage. This significantly increases your buying power, but is also especially risky if you’re new to trading and isn’t recommended for beginner crypto investors.

Finally, KuCoin Trading Bot is a free tool that can help users save time and energy while trading. It is equivalent to configuring a 24/7, all-round bot butler for your trading strategy. Currently, there are over 6 millions trading bots created to help investors trade.

KuCoin has various bot categories, including ones that aim to swing trade and bots that rebalance your portfolio and invest for the long-term. Using a bot isn’t a guarantee for profit, but this is one feature that differentiates KuCoin from many other exchanges.

Crypto Lending & Passive Income

KuCoin’s primary appeal is that it’s globally-friendly and has a variety of trading tools. But if you want to earn passive income by holding crypto, KuCoin also has several options.

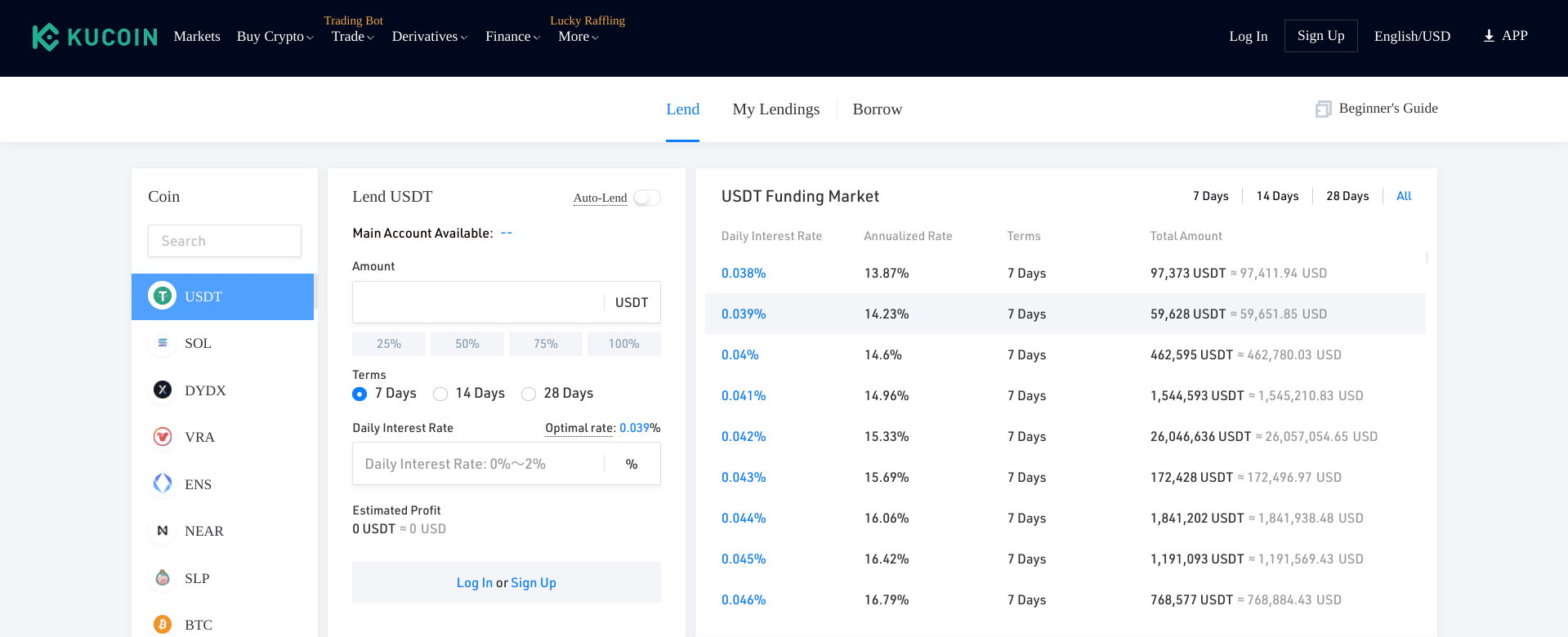

For example, KuCoin lets you lend out over 160+ cryptocurrencies and stablecoins to generate interest on your loan. This is similar to platforms like BlockFi and Celsius that let you deposit your crypto to earn interest.

KuCoin offers 7-, 14-, and 28-day loan terms. You select your required loan-to-value (LTV) ration as well and how much crypto you’re lending. KuCoin’s daily interest rate calculator displays how much you earn, and cryptocurrency lending returns can often surpass 10% or more depending on the asset you’re lending and overall loan risk.

If that wasn’t enough, KuCoin also lets you stake various Proof-of-Stake (PoS) cryptocurrencies like ADA, HYDRA, and DOT to earn rewards. Traditional staking involves locking up your crypto for a specific amount of time to help validate blockchain transactions. But KuCoin uses Soft Staking, which lets you deposit your cryptocurrency into staking pools and withdraw whenever you want.

That’s a lot of jargon. But in a nutshell, KuCoin staking lets you earn daily interest on various cryptocurrencies. Yields can also be quite impressive and easily reach over 10% annually.

Finally, KuCoin also has two mining pools for Bitcoin and Etherum. You'd have to create a mining account with KuCoin and mining is very energy-intensive overall. But this is a way to earn bonus Bitcoin and Ether for contributing hashrate to a KuCoin mining pool. Just make sure the energy costs and hardware strain on your machine don’t outweigh your rewards.

KCS Bonuses

KuCoin launched its own token, KuCoin Token (KCS) in 2017. This token is a method to reward stakeholders. And the more KCS you own, the more perks you get.

Benefits of holding KCS include:

- Daily Dividends: KCS holders split 50% of daily trading fees on KuCoin.

- Discounts: Get discounts on KuCoin trading fees.

- More Trading Options: KuCoin has additional trading pairs that utilize KCS.

Trading fee discounts are one of the main perks of holding KCS, and you get a 20% discount by paying trading fees with KCS.

Are There Any Fees?

One of the main advantages of using KuCoin over other exchanges is that KuCoin has some of the lowest fees out there.

KuCoin uses a maker/taker system and the base transaction fee is only 0.10% on trades. Additionally, you get lower trading fees the more you trade over a 30-day period.

Here’s how KuCoin’s fees breakdown as your trading volume increases:

KuCoin Trading Fee Structure | ||||

|---|---|---|---|---|

Tier | 30-Day Volume (USD) | KCS Balance | Maker Fee | Taker Fee |

1 | X < 50 | Y < 1000 | 0.10% | 0.10% |

2 | 50 ≤ X < 200 | 1000 ≤ Y < 10000 | 0.09% | 0.10% |

3 | 200 ≤ X < 400 | 10000 ≤ Y < 20000 | 0.07% | 0.09% |

4 | 500 ≤ X < 1000 | 20000 ≤ Y < 30000 | 0.05% | 0.08% |

5 | 1000 ≤ X < 2000 | 30000 ≤ Y < 40000 | 0.03% | 0.07% |

6 | 2000 ≤ X < 4000 | 40000 ≤ Y < 50000 | 0% | 0.07% |

7 | 4000 ≤ X < 8000 | 50000 ≤ Y < 60000 | 0% | 0.06% |

8 | 8000 ≤ X < 15000 | 60000 ≤ Y < 70000 | 0% | 0.05% |

9 | 15000 ≤ X < 20000 | 70000 ≤ Y < 80000 | -0.005% | 0.045% |

10 | 20000 ≤ X < 40000 | 80000 ≤ Y < 90000 | -0.005% | 0.04% |

11 | 40000 ≤ X < 60000 | 90000 ≤ Y < 100000 | -0.005% | 0.035% |

12 | 60000 ≤ X < 80000 | 100000 ≤ Y < 150000 | -0.005% | 0.03% |

13 | 80000 ≤ X | 150000 ≤ Y | -0.005% | 0.025% |

In short, KuCoin has some of the lowest trading fees out of any exchange. However, you can still pay fees depending on the payment method you use to purchase crypto on KuCoin. KuCoin doesn’t charge deposit fees itself, however.

As for withdrawal fees, KuCoin states it adjusts fees depending on market performance. Current withdrawal rates for several popular cryptocurrencies are as follows:

KuCoin Withdrawal Fees | ||

|---|---|---|

Cryptocurrency | Withdrawal Fee | Minimum Withdrawal |

0 - 100,000 | 0.0200% | 0.0500% |

100,001 - 1,000,000 | 0.0150% | 0.0400% |

1,000,001 - 5,000,000 | 0.0125% | 0.0300% |

5,000,001 - 10,000,000 | 0.0100% | 0.0250% |

10,000,001 - 20,000,000 | 0.0075% | 0.0200% |

20,000,001 - 50,000,000 | 0.0050% | 0.0150% |

50,000,001 - 100,000,000 | 0.0025% | 0.0125% |

100,000,001 + | 0.0000% | 0.0100% |

You can view a complete and live list of KuCoin trading and withdrawal fees on its website. But between potential KCS discounts and already low fees, KuCoin is one of the most affordable ways to buy and trade cryptocurrency.

How Does KuCoin Compare?

KuCoin is one of the most popular global cryptocurrency exchanges, but it’s not the only option. Additionally, U.S. investors should tread carefully with KuCoin due to its lack of know your customer (KYC) requirements.

Header |  |  | |

|---|---|---|---|

Rating | |||

Supported Cryptocurrencies | 600+ | 100+ | 40+ |

Reward Options | Lending, Staking, Mining | Staking | Lending |

KYC Verification | |||

Cell |

How Do I Open An Account?

KuCoin lets you sign up via email or with your phone number. Once you sign up, you can deposit, exchange, and even margin trade without meeting KYC requirements.

However, completing KYC verification increases your daily withdrawal limit, opens futures trading, and increases your overall daily trading limit. This is where U.S. investors run into a gray zone.

When you begin KYC verification, the United States isn’t an available country of residence. Because of this, it’s somewhat risky to use KuCoin as an unverified U.S. user. What if you suddenly want to withdraw your crypto balance but you have a low daily withdrawal limit?

This U.S. restriction ultimately means KuCoin is an excellent international exchange but not the best choice for U.S. residents. If you live in the United States, exchanges like Coinbase, Gemini, and Kraken are better choices.

Is KuCoin Safe?

KuCoin users have several security features to protect their accounts, including Google two-factor authentication, trading and withdrawal passwords, and mobile binding to keep your account secure if you use its app.

KuCoin also works with Onchain Custodian, a Singapore-based crypto custodian. Funds are backed by Lockton insurance against theft and hacks. KuCoin also stores a portion of funds in cold storage, which is a common security practice for exchanges. Finally, KuCoin has an ongoing bug bounty program which pays up to $10,000 worth of KCS to users who report bugs and security concerns.

Granted, KuCoin suffered a hack in September 2020 in which $285 million worth of assets were stolen. Approximately $240 million was eventually recovered and KuCoin covered remaining losses for impacted users. Ultimately, it’s a positive sign that KuCoin has insurance and was able to rectify damages from its hack. But the fact that $285 million worth of crypto was able to be stolen from the exchange in the first place (even if only temporarily), might still raise concerns about Kucoin's security protocols.

The bottom line is you should always take security into your own hands when investing in cryptocurrency. This means enabling security features like two-factor authentication. It also means using your own cryptocurrency wallet, like the Ledger hardwallet, to securely store your cryptocurrency instead of keeping it on an exchange.

How Do I Contact KuCoin?

As with other cryptocurrency exchanges, customer service is not a strong suit of KuCoin. While you can submit a request here or email tech support at tech-support@kucoin.com, there's no phone number to call. And they claim to be available 24/7, but it's all done via requests or email.

KuCoin's Trustpilot customer reviews are overwhelmingly negative and its currently rated 1.8/5 overall on the review platform. If you do run into any issues with KuCoin, you're best shot at solving them quickly is probably to troubleshoot them on your own using the company's Help Center.

Why Should You Trust Us?

We have been writing and researching cryptocurrency since 2016. We have been reviewing and testing all of the major cryptocurrency exchanges since 2017. Our team understands the crypto and NFT space, but also understands the intersection with TradFI (traditional finance). Our goal is to help bridge the gap between those in the cryptocurrency space, with those curious about it in the traditional finance space.

Furthermore, we have a compliance team that checks the accuracy of rates and service offerings regularly.

Who Is This For And Is KuCoin Worth It?

If you live in the United States, KuCoin’s lack of KYC verification is a red flag. You don’t want to be caught in a scenario where you have lower trading limits or can’t withdraw your cryptocurrency, so alternatives like Coinbase are a better option.

However, KuCoin is compelling for international users due to its low fees, trading tools, and reward options. The user-interface can be overwhelming for complete beginners. But KuCoin is a robust exchange that’s one of the best options for non-U.S. residents.

KuCoin Features

Product Type | Cryptocurrency exchange |

Supported Countries | 200+ |

Supported Coins | 600+ |

Trading Fees | Beginning at 0.10% |

Minimum Deposit | $0 |

Minimum Balance Requirement | $0 |

Reward Options |

|

Supported Payment Types |

|

Insurance | KuCoin works with Onchain Custodian and has insurance from theft and hacks through Lockton. After suffering a hack in 2020, KuCoin used this insurance policy to help refund impacted users. |

Security | KuCoin lets you enable two-factor authentication, trading passwords, and mobile phone number binding. |

Customer Support Options | Ticket form and a helpdesk FAQ |

Mobile App Availability | iOS and Android |

Web/Desktop Account Access | Yes |

Promotions | Earn up to 500 USDT for joining and trading. |

KuCoin Review

-

Liquidity

-

Fees

-

Products and Services

-

Supported Currencies

-

Security

-

Customer Service

Overall

Summary

KuCoin is a robust crypto exchange that supports many currencies and countries. But it isn’t currently licensed to operate in the U.S.

Pros

- Global support for 200+ countries

- Low trading and withdrawal fees

- Earn perks for holding KCS

- Earn crypto rewards through lending, staking, and mining

- Variety of tools for more active traders

Cons

- No KYC verification option for U.S. users

- Sheer number of options can be overwhelming for beginners

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Colin Graves