Have you heard of the Rule of 72? Maybe if you go back to your college finance class? And even if you did remember it, you probably haven't thought about it since then - especially in an investing context. However, the Rule of 72 is a great tool that every investor should use - it helps you quickly understand how long it will take for money to double as a certain interest rate.

Yes, scientific and finance calculators, and spreadsheets can all do this - but nothing beats simple math sometimes. Let's look at how this works.

The Rule of 72

The Rule of 72 is a method for estimating how long it will take for money to double at a specific interest rate. The best way to highlight this is with an example. Let's say you have $1,000, and you want to know how long it will take to get to $2,000 at 2% interest.

Using the Rule of 72, you can estimate it will take 36 years. You simply take 72 and divide it by the interest rate. That is what makes this rule so amazing, and simple.

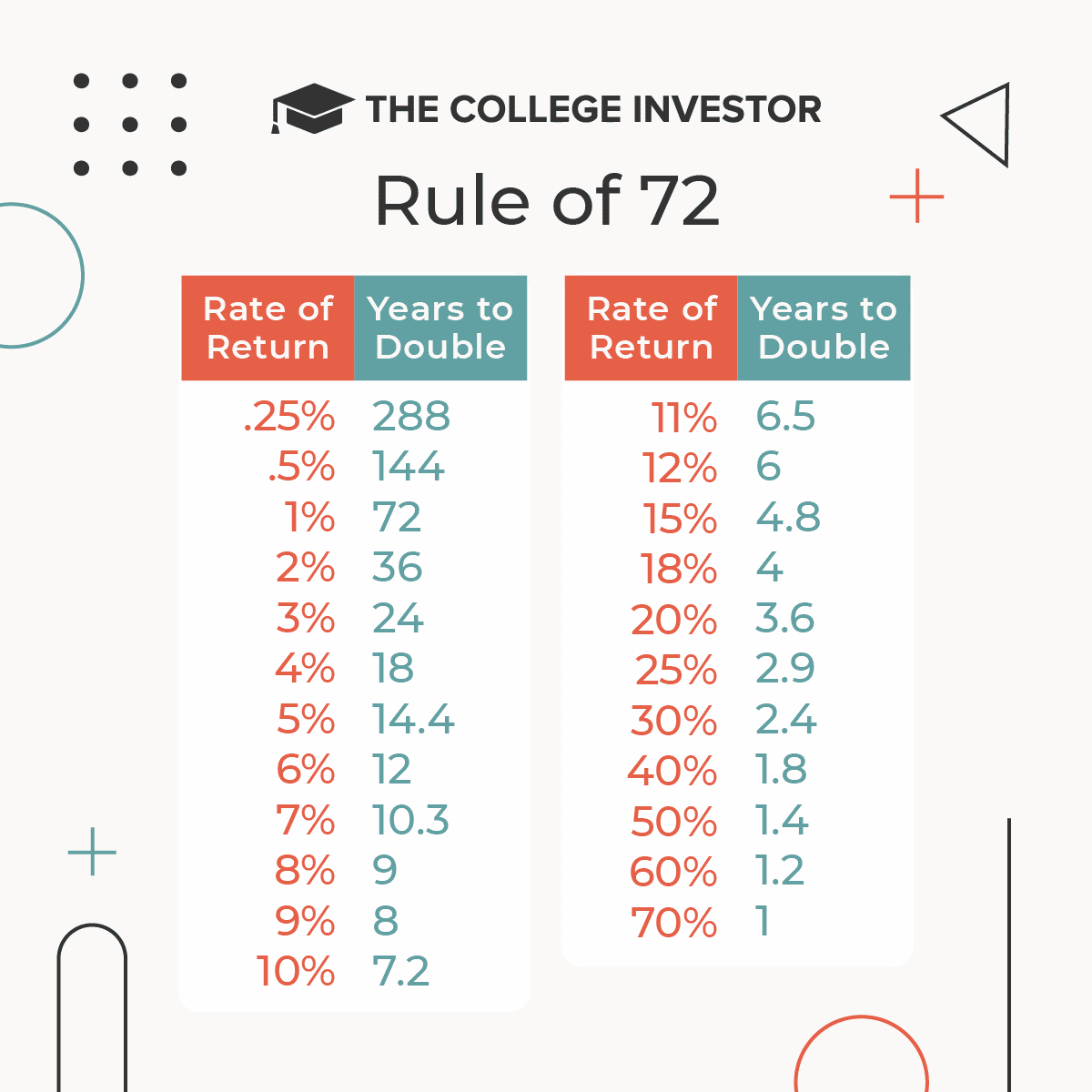

See the quick reference chart below:

The Rule of 72 Applied to Investing

Now that you know the basics of the Rule of 72, you might ask why you should care? I mean, how does that help with investing? We all want our money to double as quickly as possible.

I use the Rule of 72 in two scenarios when it comes to investing:

1. The Impact of Fees: If you want to know how much money your fees are going to take out of your investments, you can take the Rule 0f 72 and divide it by the fee rate. This will show you how many years it will take for fees to eat up half of your investments. For example, if you have a mutual fund that charges 2%, it will take 36 years for fees to reduce the principal by half if the money doesn't grow. How about that for scary?

2. The Impact of Inflation: You can also use the Rule of 72 to quickly estimate the impact of inflation on your portfolio (or better, the buying power of the earnings of your portfolio). For example, if inflation is 3%, it will take 24 years for the value of $1 to be worth $0.50. You can use this to help you plan your retirement spending. If you plan on retiring in 24 years, you're going to need about double your current expenses to live off of based on inflation.

Related: Would You Rather Have A Penny That Doubles Each Day Or $1,000,000?

The Other Rules

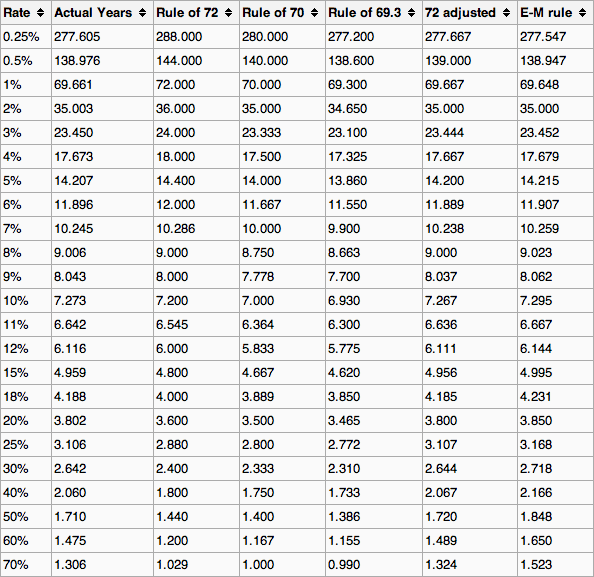

It's important to note that the Rule of 72 is only an estimate. In fact, using my 2% example from above, your money will actually double in 35.003 years. That is why some people prefer to use the Rule of 70 or Rule of 69. In fact, if you have continuous compounding, the Rule of 69 in the rule you want to use.

To make things easy, we found this great chart from Wikipedia that highlights the rules in action:

Have you used the Rule of 72 since college? Any other quick estimates that you do that uses the Rule of 72 for investing?

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller