Embarking on the journey to higher education is a life-changing decision. One of the first and biggest challenges many prospective students encounter is whether to pursue a college education in-state or out-of-state.

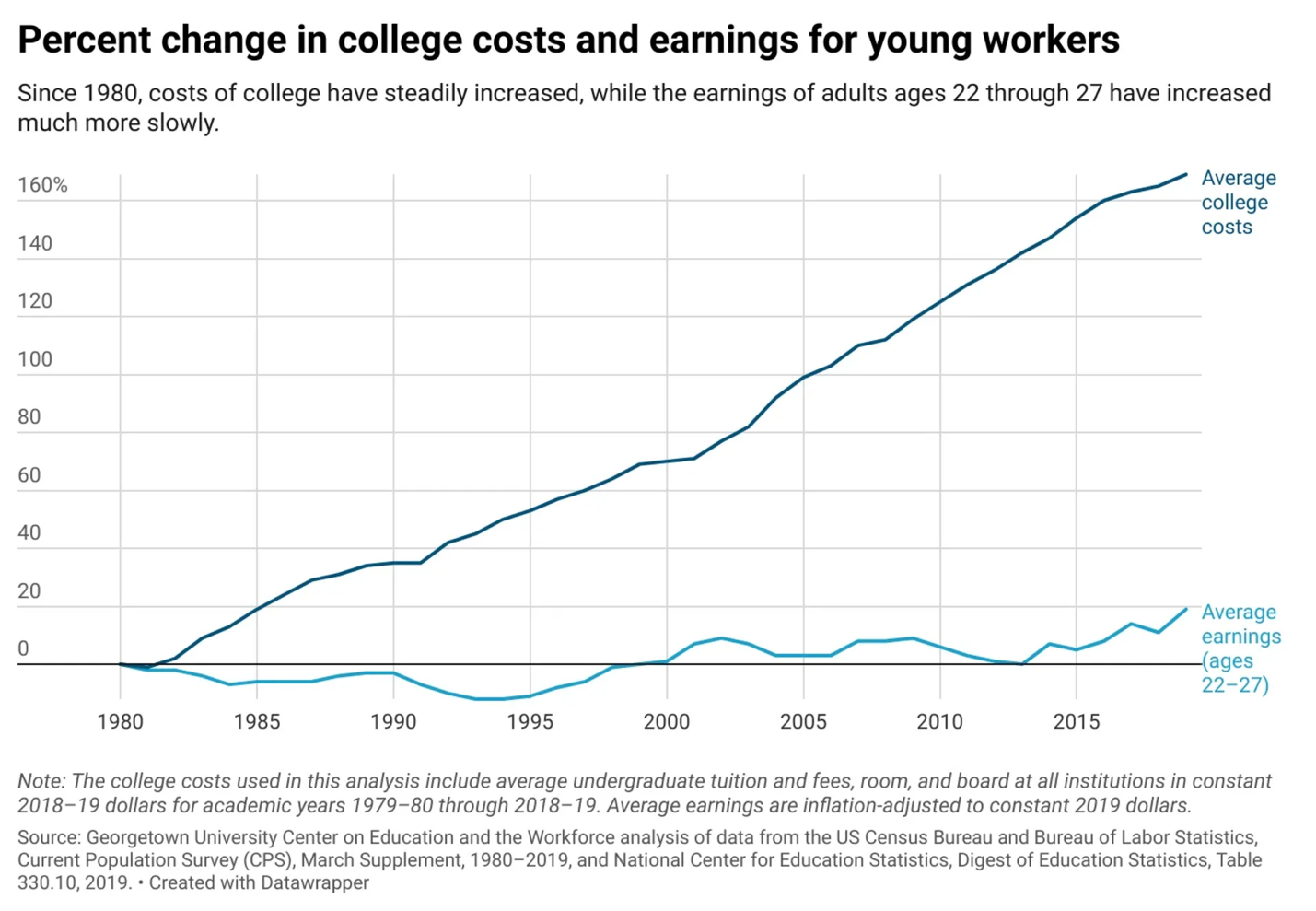

As you know, the average cost of tuition has been on an upward trajectory since sometime around the 1980s. College tuition at a public four-year university increased 9.24% between 2010 and 2022, averaging a 12% increase each year in that period.

Not only does higher tuition mean greater costs for education, but it also means greater likelihood of finding yourself graduating with larger student loans. This is particularly concerning when the average student loan debt of recent graduates is $33,500.

In this article, I’ll dive into the reasons why opting for an in-state college might prove to be a better long-term decision for you. From location and affordability to in-state benefits and quality of education, I aim to shed light on the advantages of keeping your educational investment in-state.

First, a quick overview of the pros and cons of staying in-state:

Pros of Applying to In-State Schools

- Lower tuition and fees

- Comparable education

- Increased opportunities for financial aid

- Geographical familiarity and comfort

- Known personal & professional network

- Keeps travel costs low

Cons of Apply to In-State Schools

- Limited diversity or exposure

- Staying in a familiar environment

- Limited program specialization

- Lack of personal independence

First Things First: What Should I Know?

Whether or not you’re the first person in your family to pursue a higher education, there are a few important things to keep in mind, beginning with common terms used when discussing the overall cost of attending postsecondary school.

Tuition: The cost of attending college classes. Some colleges charge one set tuition rate, while others charge per credit hour. Tuition is often different for resident vs. non-resident students.

Fees: There are almost always additional charges to cover the cost of your classes, such as additional course materials or a lab fee.

Direct Costs: These are costs paid directly to the university, such as tuition and fees, housing, and a meal plan.

Indirect Costs: These are educational costs not paid directly to the university, such as textbooks, transportation, and other personal expenses associated with your education.

Cost of Attendance: This is the maximum amount of money an academic institution costs to attend for one year, before any financial aid is applied. This includes both direct and indirect expenses.

Net Price: This is the amount you pay to attend an academic institution for one year, after any financial aid has been applied. Net price calculators are a useful feature where you can enter information about yourself to find out what similar students paid to attend the same university the previous year, after taking grants and scholarships into account.

Understanding the full cost of attendance at a university will help bring your financial picture into perspective, identifying how much financial aid is needed and the extent of any out-of-pocket expenses you face. Now that we’ve gotten basic terms out of the way, here’s a look at why knowing your costs is so important in the long-term.

To be clear, median earnings of early-career professionals with a bachelor’s degree or higher have been growing. However, we’re seeing the average cost of tuition increase almost 10 times faster than average earnings, and you don’t need a college degree to recognize the gross imbalance that creates. Rising tuition rates is one of the greatest contributing factors to the high student loan debt experienced in recent decades. It begs the question: How much debt are you willing to take on for your four-year degree?

Average Tuition Rates

The cost of education remains a significant financial challenge for most families, and the last thing you want to do is underestimate your dues. One way to fully understand the current weight of tuition is to look at the cost of attending the flagship school in each state. I guarantee if you compare in-state and out-of-state tuition at a handful of flagship schools across the country, you’ll start to notice a pattern. (This data was found at TuitionFit and IPEDS.)

Also, when researching tuition rates, I also noticed that some schools set different rates for lower-classmen vs. upper-classmen. Make sure to do your own research and ask around to uncover any hidden costs you’ll be hit with later.

Remember, your first year of college is also typically the least expensive year. Tuition and fees usually rise every year. You could be paying substantially more your last year of college than your first.

Let’s start by comparing average tuition across all four-year public universities in the U.S. with average tuition of only the flagship school in each state.

Header | Average In-State Tuition | Average Out-of-State Tuition |

|---|---|---|

U.S. Overall State Average, 2022-2023 | $11,103 | $27,715 |

U.S. Flagship-Only Average, 2022-2023 | $12,486 | $33,770 |

What does this tell us? Right away, you see that average out-of-state tuition is higher than in-state tuition, though what’s more telling is just how high out-of-state tuition is at a flagship university.

Average out-of-state tuition at a flagship university is more than $6,000 higher than average out-of-state tuition at a non-flagship university. This instantly tells me states are slapping on a “premium” for attending their flagship university.

Not convinced? Take a look at average annual tuition rates for 2022 -2023 across some of the most popular flagship schools in the U.S. and keep an eye on that premium I mentioned.

University | In-State Tuition | Out-of-State Tuition | Out-of-State Premium | Out-of-State Premium (as a percentage) |

|---|---|---|---|---|

U. of Alabama | $11,940 | $32,300 | $20,360 | 271% |

U. of Arizona | $13,260 | $39,560 | $26,300 | 298% |

UC Berkeley | $15,200 | $46,250 | $31,030 | 304% |

U. of Colorado at Boulder | $13,110 | $40,360 | $27,250 | 308% |

U. of Florida | $6,380 | $28,660 | $22,280 | 449% |

U. of Michigan - Ann Arbor | $16,740 | $55,330 | $38,590 | 331% |

UNC Chapel Hill | $9,000 | $37,560 | $28,560 | 417% |

Ohio State University | $12,490 | $36,720 | $24,230 | 294% |

U. of Texas at Austin | $10,860 | $38,650 | $27,790 | 356% |

U. of Virginia | $18,240 | $54,390 | $36,150 | 298% |

The out-of-state tuition rate at flagship schools is at least twice the in-state tuition rate and, in some cases, three or four times the in-state tuition rate.

According to Mark Salisbury of TuitionFit, "Flagship universities see out-of-state students as cash cows and don't feel any obligation at all to make themselves financially feasible for out-of-state students."

Average out-of-state tuition is already 172% more than in-state tuition among public institutions. Is it worth it? I’ll dive into that next.

Is This Data Helpful? Want To See How Your Financial Aid Award Compares With Others?

Submit your financial aid award to TuitionFit and see if you are getting a fair offer! And help others know the “real” numbers as well. Check out TuitionFit here >>

Why You Should Stay In-State

Cost and Affordability

Knowing how much higher out-of-state tuition and fees are compared to in-state rates, choosing to attend an out-of-state school instantly increases your financial burden, and you may find fewer opportunities for financial aid, grants, or scholarships.

TuitionFit data from students accepted by out-of-state public institutions shows that out-of-state students get proportionally smaller merit aid awards. Plus, you’ll need to factor in the cost of living in a new state, as well as the cost to travel back and forth to see family.

Quality of Education

Don’t quietly rule out in-state schools because of a myth that out-of-state schools offer a better education. In-state schools have comparable quality of education and academic offerings, and many are reputable enough to warrant your interest and research.

Location and Familiarity

Moving to a new place can be emotionally distressing – take it from someone who’s been there. Going out-of-state means removing yourself from your immediate support network, which can feel isolating at such an important time in your life. Staying in-state may make it easier to travel back home or to commute from your current residence.

Networking and Opportunities

Attending college in your home state can often provide easy access to networking opportunities, growing existing relationships and forging new ones as a result. Having strong connections can make a difference in the types of opportunities you receive, especially when you’re ready to start your career.

Cultural and Social Fit

Like being in a new location, adapting to a new culture or climate can be tough. There are many new things to see and do, but exploring a new environment can be scary. Be honest with what you value in your current community and whether you’ll be able to find those same aspects elsewhere.

When An Out-Of-State School Makes Sense

There are times when going out-of-state makes sense, but it’s often for very specific circumstances. That might include:

- Enrolling in a highly specialized academic program

- Wanting to work with specific professors, research facilities, or other technology

- Moving closer to other family members

- Moving to a location that is in better alignment with your personal or professional values

- Receiving an attractive financial aid package that makes attending an out-of-state school feasible.

There are also states that offer tuition reciprocity for universities located in neighboring states. For example, the Western Undergraduate Exchange can be used by students in Alaska, Arizona, California, Colorado, Hawaii, Idaho, Montana, Nevada, New Mexico, North Dakota, Oregon, South Dakota, Utah, Washington, and Wyoming. Check the regulations in your state.

Reasons To Keep Student Loan Debt Low

The importance of reasonable and manageable tuition really can’t be overstated because it directly influences your present and future wellbeing. Keeping tuition low not only prevents you from incurring excessive debt now, but it also minimizes your monthly minimum payments later – a time when you’ll have other costs to concern yourself with.

I’d be remiss if I didn’t at least briefly discuss the impacts of student loan debt here. While some student loan debt can actually be a good thing, here are a few points to consider before signing on the dotted line:

- Student loan debt can have a long-lasting impact on your financial well-being and force you to delay other life events such as purchasing a home or starting a family.

- Failing to make loan payments on time or defaulting on your loans can negatively affect your credit score, which further hurts your ability to buy a house or car.

- Making loan payments can keep you from building your savings or retirement portfolio.

- Loan-burdened graduates may feel the need to pursue higher-paying jobs over career satisfaction to meet the needs of their monthly payments.

- Student loan debt creates socioeconomic inequities for many graduates, which may limit your personal and professional growth overall.

Final Thoughts

As you can see, there are ample benefits to keeping your college education in-state. First and foremost, you save thousands of dollars. But you also maintain your geographical comfort, retain a network of support, and receive a quality education just a stone’s throw from home.

And while tuition at in-state school is much lower than what you’d owe at an out-of-state school, pursuing a four-year degree at any university is a costly endeavor, in general. So, my advice to you is to research the schools near home and find out what they offer.

Allison’s passion lies in decoding the ways of the world to help put others on a path to success. She likes to ask big questions, and it’s her goal to find answers to share with you. A self-acknowledged transplant to the Pacific Northwest, Allison likes to write about finance, policy, fitness, and anything else that sparks her curiosity.

Editor: Ashley Barnett Reviewed by: Robert Farrington