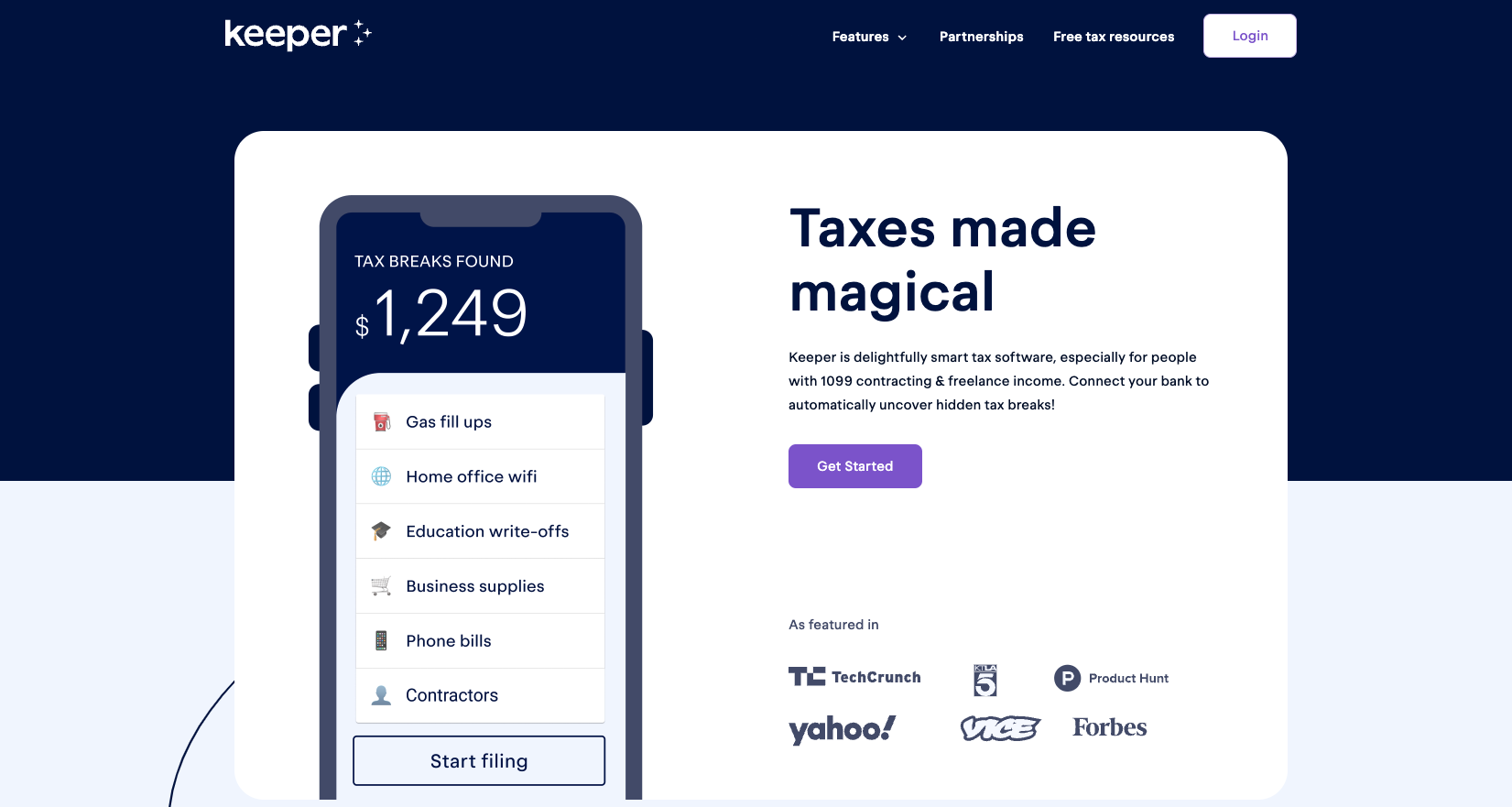

Keeper is an app that helps independent contractors, freelancers, and employees file their tax returns while keeping track of work-related expenses.

The app is available for both iOS and Android devices, or you can use a web-based desktop version.

Keeper could be a good fit if you want to stay organized come tax time. It’s important to consider pricing and features before signing up. Here’s a closer look at Keeper Tax and what you need to know if you’re looking for an app to track expenses and file taxes.

See how Keeper compares with our list of the best tax software here.

Keeper Details | |

|---|---|

Product Name | Keeper |

Monthly Subscription (Does Not Include Tax Filing) | $20/month |

Annual Subscription (Includes Tax Filing) | $192 per year |

Trial | 7-Day Free Trial |

What Is Keeper?

Keeper, formerly called Keeper Tax, is an app designed for expense tracking and tax filing for independent contractors and small business owners. Keeper can scan your bank and credit card statements to look for expenses to track and write off, aiming to lower your tax bill. It also handles your tax filing and offers tax professionals to provide answers to questions related to filing.

The company, founded in 2018 by Paul Koullick and David Kang, has rebranded from Keeper Tax to Keeper. The app is highly rated on both the App Store (4.8 out of 5) and Google Play (4.5 out of 5).

How Does Keeper Work?

Keeper is a mobile-first app that works online and on your phone. Users link bank and credit card accounts to the app to automatically scan purchases to look for potential write-offs.

After signing up with Keeper, you'll be asked a series of questions before you can move on to the next screen. For example, it asks if you’re a freelancer, an employee, or a business owner. It also asks if you use your vehicle or travel for work.

How Much Does Keeper Cost?

There’s a free seven-day trial with Keeper. Once that ends, here are your pricing options:

- Monthly subscription (expense tracking only): $20

- Annual subscription (expense tracking and taxes): $192

The monthly plan is $20 per month, which includes the expense-tracking features only. Keeper offers a yearly plan, which includes everything on the monthly plan, plus the option to file your taxes at no additional cost.

Notable Keeper Features

Let’s take a look at some key features from Keeper.

Tax Pro Help

When you use a platform to help you file your taxes, you may not have access to a live expert. Or, if you do, you’re required to upgrade to a higher tier. The nice thing about Keeper is that you have access to a tax expert who can answer questions for you. It may not be over the phone, but at least you can have someone help you with your specific issue.

Keeper prides itself on being a top educational content producer for those with 1099 taxes, so they may also be able to serve you with a video, article, or provide you with a calculator.

Audit Protection

Beyond an expert to answer your questions, you may want to know what would happen if you were to be audited by the IRS. Keeper provides audit protection, which means their team of tax assistants will help gather any necessary documents to send to the IRS if you’re subject of an audit. They will also provide you with access to CPAs and tax experts who can answer any questions.

Write-Off Detection

Keeper offers write-off detection, which scans your credit card and bank accounts and notifies you of expenses you can write off. Keeper looks at up to 18 months of transactions to automatically show which tax breaks may have been missed. Then, all of the deductions are categorized and automatically added to your tax return. Keeper also double-checks the deductions to make sure they won’t raise red flags with the IRS.

A few steps are involved before you can use this feature, including letting Keeper know what kind of work you do. Then you need to link your accounts to Keeper so it can scan your transactions.

Tax Bill Prediction

No one likes feeling surprised by a huge tax bill, which is why Keeper gives you year-round estimates on how much you will likely owe or lets you know how much your refund will be.

You must input your status, state, W-2, and 1099 income to calculate this number instantly. Their calculations include all federal and state taxes, including deductions and credits.

This is a helpful feature because you know how much to save or how much you’re getting back, so you can budget for taxes ahead of time.

Tax Filing

Since Keeper already scans your tax write-offs and gets you ready for tax season, filing your taxes with Keeper may make sense. It offers automatic tax form uploads and pre-fills documents for you. In general, it’s a very user-friendly experience for filers.

You can file your entire taxes using your smartphone. Keeper says, on average, it takes users 22 minutes to file their taxes. Once you submit, a tax professional reviews your documents before submitting to the IRS.

How Does Keeper Compare?

Even though Keeper is an easy-to-use platform that helps you with bookkeeping and filing, it has limited accounting features. You have to pay $192 for the year to manage your expenses but have no access the in-depth reports and features you get with QuickBooks, Xero, or other bookkeeping apps. It’s also on the pricier side, at $20 a month for expense tracking only.

For a cheaper option, you could check out Hurdlr, which is a similar accounting, bookkeeping, and income taxes app that is totally free with the option to upgrade to Premium at $8.34 per month (billed annually) or choose to go with their month-to-month option at $10 a month. Hurdlr has a similarly-priced tier, Pro, at $16.67 per month (billed annually).

Everlance helps freelancers track their business expenses and revenues. The app makes filling out a Schedule C for your taxes easy. Everlance offers a free 10-day Premium trial, but many of the features are available in their free version. Everlance Premium features special customer service access, PDF reports, and automatic trip tracking. Premium costs $8 per month or $12 per month for Premium Plus.

Header |  |  | |

|---|---|---|---|

Rating | |||

Free Plan? | No | Yes | Yes |

Pricing |

|

|

|

Cell |

If your taxes aren’t that complicated, you could file completely for free. Check out our favorite options to file your taxes for free.

Plenty of other less expensive options allow you to export your data without a $39 added cost. TurboTax tops The College Investor’s list as the best and easiest tax software to use (though it’s also a bit expensive). You can import PDFs and spreadsheets directly from your employer, financial institutions, and investment companies to download your tax data.

If you want a human to help guide you through the process, consider H&R Block, which has robust software with the ability to import most tax PDFs, like Turbotax, but also has the added benefit of thousands of physical locations across the country. Here’s our review of H&R Block.

Visit The College Investor’s Tax Center to learn more about the best tax software, resources, and tools, plus what to understand about your tax return.

To contact customer service, you can email support@keepertax.com. There is no phone number for customer service.

How To Sign Up

You’re asked for an email address and a phone number. Then, you’re given an option of whether you want to link your checking or credit card accounts to find eligible write-offs if you freelance, for example.

After answering the questions and inputting your email address, you’re asked to download the app through a QR code on your computer, or you can go directly to the App Store or Google Play to download the app.

Free Tax Resources And Customer Service

Keeper is big on educating you on what to know about your taxes to help you save money and reduce your taxable income. They do this through their Free Tax Resources page, which houses knowledge articles, free calculators, tools, articles, and FAQs on their website.

For more specific answers to customers’ questions, visit their help site.

Why Should You Trust Us?

The College Investor team spent years reviewing all of the top tax filing options, and our team has personal experience with the majority of tax software tools. I personally have been the lead tax software reviewer since 2022, and have compared most of the major companies on the marketplace.

Our editor-in-chief Robert Farrington has been trying and testing tax software tools since 2011, and has tested and tried almost every tax filing product. Furthermore, our team has created reviews and video walk-throughs of all of the major tax preparation companies which you can find on our YouTube channel.

We’re tax DIYers and want a good deal, just like you. We work hard to offer informed and honest opinions on every product we test.

Is Keeper Actually A Keeper?

Keeper is an impressive expense tracking plus tax filing combo. If you freelance, have 1099 income, and your finances are relatively straightforward (i.e., you file a Schedule C), you may appreciate the app. Keeper is easy to use, and the expense-tracking features may be worthy of the $20 monthly fee for some individuals.

However, if you have a more complicated work, income, and financial situation—for example, if you own rental real estate or buy and sell crypto regularly, you may consider a more robust software like TurboTax or H&R Block paired with an adequate bookkeeping software suite.

Keeper Features

Services |

|

Monthly Subscription Fee (Expense Tracking Only) | $20 |

Annual Subscription Fee (Includes Tax Filing) | $192 |

Ask A Tax Expert (Free service from Keeper) | |

Customer Service Email | support@keepertax.com |

Keeper Resources | |

Keeper Mobile App | |

Promotions | Free 7-day trial |

Keeper Review: An Expense-Tracking App For Freelancers

-

Navigation

-

Ease of Use

-

Features and Options

-

Customer Serivce

-

Plans and Pricing

Overall

Summary

Keeper is an app that helps independent contractors, freelancers, and employees file their tax returns while keeping track of expenses.

Pros

- Designed for freelancers to automate the tracking of potential tax write-offs.

- Has CPAs to help answer questions.

- Offers audit protection and can help in the event of an IRS audit.

Cons

- Pricey for expense-tracking.

- It is not ideal for those with complicated taxes or financial situations.

Eric Rosenberg is a financial writer, speaker, and consultant based in Ventura, California. He holds an undergraduate finance degree from the University of Colorado and an MBA in finance from the University of Denver. After working as a bank manager and then nearly a decade in corporate finance and accounting, Eric left the corporate world for full-time online self-employment.

His work has been featured in online publications including Business Insider, Nerdwallet, Investopedia, The Balance, Huffington Post, and other financial publications. When away from the computer, he enjoys spending time with his wife and three children, traveling the world, and tinkering with technology. Connect with him and learn more at EricRosenberg.com.

Editor: Colin Graves Reviewed by: Robert Farrington